Easing food prices tamed inflation in October to 4.9%

MANILA -Inflation significantly eased in October on the back of slower increase in prices of key food items, with rice posting a milder price growth after being the main driver of resurgent inflation back in September.

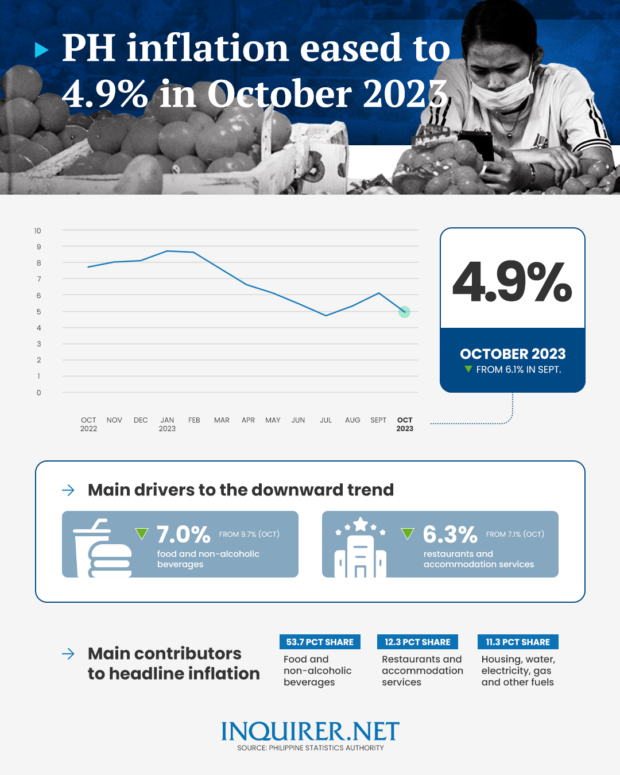

Inflation, as measured by the Consumer Price Index (CPI), cooled for the first time in three months to 4.9 percent year-on-year in October, from 6.1 percent in September, the Philippine Statistics Authority (PSA) reported on Tuesday.

Data showed the slowdown was enough to trim the 10-month average to 6.4 percent, albeit still far above the Bangko Sentral ng Pilipinas’ (BSP) 2 to 4 percent annual target. The latest reading was also better than the BSP’s own forecast that pegged the figure at between 5.1 and 5.9 percent.

The October data provided relief for Filipino consumers who have been trying to further stretch their paychecks amid rising costs of living. But National Statistician Claire Dennis Mapa offered the most hopeful news: barring any price shocks, inflation would likely go on a downtrend for the remaining months of 2023.

Socioeconomic Planning Secretary Arsenio Balisacan agreed with Mapa, adding that inflation would likely return to target “early next year” if the current pace of deceleration is maintained. But he remains wary of the seasonal surge in demand during the Christmas shopping season and damage from the El Niño dry spell.

Article continues after this advertisement“If we can get another 1.2 percentage point reduction, that’s now within the bound. But still we want to see progress in the reduction,” Balisacan told reporters in an interview after the data release.

Article continues after this advertisementFigures showed the October CPI was mainly pulled down by softer food inflation, which moderated to 7 percent from 9.7 percent in the previous month.

Harvest Season

Broken down, the onset of harvest season and arrival of imported supply tempered rice price inflation to 13.2 percent in October, from the 14-year high of 17.9 percent back in September. Figures showed vegetables also posted a milder uptick in prices last month at 11.9 percent versus September’s 29.6 percent.

READ: Agri officials see stable rice prices

But because the October print was compared with a year ago—when inflation was at a high of 7.7 percent—PSA’s Mapa said the significant decline in CPI last month was magnified by the so-called “base effects”. Still, Balisacan believes most of the slowdown in price growth in October was “real” and not mathematical.

“It’s true that there may be some of the base effects, but I think it’s (decline) quite substantial,” he said.

The October inflation figure would be a key data point for a central bank that has yet to decide whether it would tighten monetary policy further at its November 16 meeting, or slam the brakes on rate increases. This, following an out-of-schedule decision in late October to lift the key rate by 25 basis points to 6.50 percent, a fresh 16-year high.

READ: Rate hike pause seen likely in November

Banks typically use the BSP’s benchmark rate as a guide when charging interest rates on loans. By making borrowing costs more expensive, the central bank wants to rein in strong demand for commodities with limited supply, thereby tempering inflation. But this could also slow an economy that historically gets 70 percent of its juice from consumer spending.

For now, there are streaks of data that could ease the pressure on the BSP to hike further. Core inflation, which strips out volatile energy and food items to provide a clearer reading of underlying price trends, retreated to 5.3 percent in October from the previous month’s 5.9 percent. This indicates the previous tightening actions have started taming demand-side price pressures.

“The latest headline print, continuous downtrend of core inflation, and PSA’s confidence that inflation is on a downward trajectory (sans other shocks), likely points to the end of the BSP’s hiking cycle,” Domini Velasquez, chief economist at China Banking Corp., said.

“This latest development is positive for the country’s consumption outlook, and will likely provide some lift to economic growth in the fourth quarter,” she added.

Inflation in the Philippines may indeed continue to soften in November and December but might pick up yet again in early 2024, especially if temporary measures intended to bring down the cost of key food imports are not extended further after they expire at yearend.

Lower tariffs extension

HSBC economist Aries Dacanay said in a commentary that the rate of increase in the prices of goods and services that the average Filipino household commonly buys would flare up again in the first half of next year as tariff rates increase due to the expiration of Executive Order No. 10.

READ: Keep lower tariffs on key agri products, coal, gov’t urged

EO 10 temporarily reduced the tariff rates for rice, corn, coal, and pork until Dec. 31.

“We estimate its expiration to add 1.4 -percentage-point to the inflation outlook,” Dacanay said. “That said, the discussion of whether (EO) 10 will be extended or not will be key.”

He said it would be useful to monitor the view on this matter of newly minted Agriculture Secretary Francisco Tiu Laurel Jr., which will be a gauge of what the inflation outlook will be for 2024.

In October, food items especially rice continued to be the top contributor to headline inflation, although the pace of rising prices was tempered.

Diwa Guinigundo, former BSP Deputy Governor and now Philippine analyst for New York-based GlobalSource Partners, said lowered tariffs under EO 10 should be extended.

“The government should provide support to infrastructure aimed at strengthening the supply side of the economy including the extension of an executive order to reduce the tariff rates on such commodities as rice, corn and some meat products,” Guinigundo said.

In Addition, the research team at Goldman Sachs noted that minimum wage hikes, electricity tariff increases and another potential increase in transportation fares are keeping upward pressure on inflation.