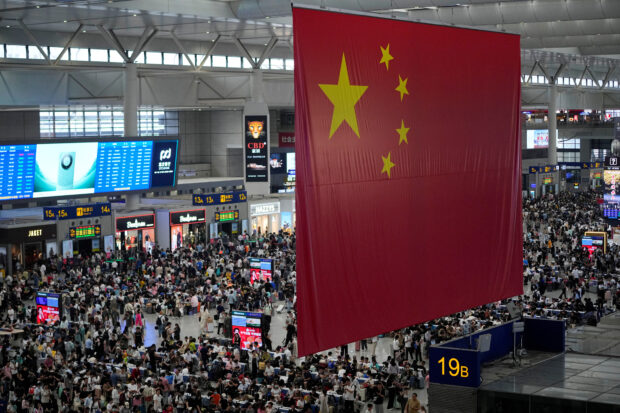

People wait to board trains at the Shanghai Hongqiao railway station ahead of the National Day holiday, in Shanghai, China September 28, 2023. REUTERS/Aly Song/File Photo

BEIJING – The International Monetary Fund on Tuesday upgraded its 2023 gross domestic product growth forecast for China to 5.4 percent from 5 percent, citing a “strong” post-COVID-19 recovery, but said the fund still expected the Chinese economy to slow next year.

GDP growth could slow to 4.6 percent in 2024 because of continued weakness in China’s property sector and subdued external demand, the IMF said in a press release, albeit better than its October expectation of 4.2 percent in the IMF’s World Economic Outlook (WEO).

The upward revision followed a decision by China to approve a 1 trillion yuan ($137 billion) sovereign bond issue and allow local governments to frontload part of their 2024 bond quotas, in a move to support the economy.

READ: China to accelerate issuance of gov’t bonds, says finance minister

“These projections reflect upward revisions of 0.4 percentage points in both 2023 and 2024 relative to October WEO projections due to a stronger-than-expected third-quarter outturn and recent policy announcements,” said IMF’s First Deputy Managing Director Gita Gopinath in the statement.

Over the medium term, growth is projected to gradually slow to about 3.5 percent by 2028 amid headwinds from weak productivity and population aging, according to Gopinath.

READ: China’s property slump worsens, clouding recovery prospects

China has introduced numerous measures to support the property market, but more is needed to secure a quicker recovery and lower economic costs during the transition, she said.

A comprehensive policy package should include measures to accelerate the exit of nonviable property developers, remove impediments to housing price adjustment, allocate additional central government funding for housing completion, and assist viable developers to repair balance sheets and adapt to a smaller property market, Gopinath said.