China ramps up internationalization of yuan under Belt and Road Initiative

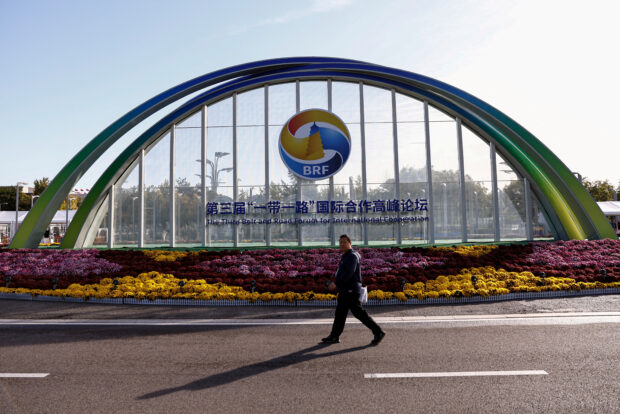

A person walks past a sign of the Third Belt and Road Forum ahead of its opening ceremony, at the media centre in Beijing, China, Oct 18, 2023. REUTERS/Tingshu Wang

SHANGHAI/SINGAPORE – China is using loans agreed through its Belt and Road Initiative (BRI) to promote the yuan internationally, having already boosted the yuan’s share of global payments to record levels.

During the Belt and Road Forum in Beijing that ended on Wednesday, China’s policy banks signed a series of yuan-denominated loan contracts with foreign lenders.

Many of the 130 countries that attended the forum belonged to the Global South, while most Western nations stayed away, and the presence of Russia’s President Vladimir Putin lent support to Chinese President Xi Jinping’s ambition for a new, multi-polar world order.

“You can see that the countries that are basically using the RMB for trade settlements are mostly countries that have visited Beijing or have come up with strategic agreements with Beijing, Russia being the most obvious one,” said Alicia Garcia Herrero, Asia Pacific chief economist at Natixis.

Geostrategic tensions and high U.S. interest rates have helped Beijing increase the yuan’s acceptability with some countries.

In September, the yuan – also called the RMB – accounted for 3.71 percent of global payments by value, hitting a record high, and almost doubling from 1.91 percent in January, according to SWIFT data released on Wednesday. Still, the yuan’s share is negligible compared with the dollar’s 46.6 percent.

READ: Bolivia is latest South American nation to use China’s yuan for trade

Rising Sino-U.S. competition and the Russia-Ukraine war, both pushed Beijing to persuade more countries to use yuan for settlement, despite the currency’s depreciation against the dollar.

And funding BRI projects has helped China revitalize the once-stalled process of yuan internationalization. It is 10 years since Xi launched his signature BRI strategy, aimed at building global infrastructure and energy networks connecting Asia with Africa and Europe.

“Amid rising currency volatility globally, the BRI provides a good opportunity to expand the RMB’s international clout,” China International Capital Corp (CICC) wrote.

The China Development Bank, a state policy lender, signed yuan-denominated loan contracts with Malaysia’s Maybank, Egypt’s central bank, and BBVA Peru to support BRI projects.

Another policy bank, the Export-Import Bank of China, signed a yuan-based loan agreement with Saudi National Bank, while Bank of China helped Egypt issue Africa’s first yuan-denominated Panda bonds.

Beijing also allocated an additional 80 billion yuan ($10.94 billion) to its Silk Road Fund for BRI projects.

A major driving force behind the rise in yuan financing has been the sharp increase in U.S. interest rates.

READ: The end of King Dollar? The forces at play in de-dollarization

As a result of the “increasingly high borrowing cost of the dollar… many debtors have turned to the RMB for financing or refinancing,” Natixis economist Haoxin Mu said, while also citing “the weaponization of the dollar” in the wake of the Ukraine war as a factor behind the increased use of the yuan.

Natixis’ Garcia Herrero said the yuan is still a long way from challenging the dollar’s dominance, citing its tiny share in the oil trade, and foreigners slashing holdings in Chinese stocks and bonds. She also cautioned that a currency favored by a bloc has less chance of being accepted as a reserve currency.

“A reserve currency is never a currency of a group of countries,” Garcia Herrero said. “Can you do this in a targeted way with MOUs with all BRI countries? Maybe. But it will not become a truly global international currency.”

($1 = 7.3157 Chinese yuan renminbi)