Asia stocks rise on earnings hopes; keep wary eye on Mideast tensions

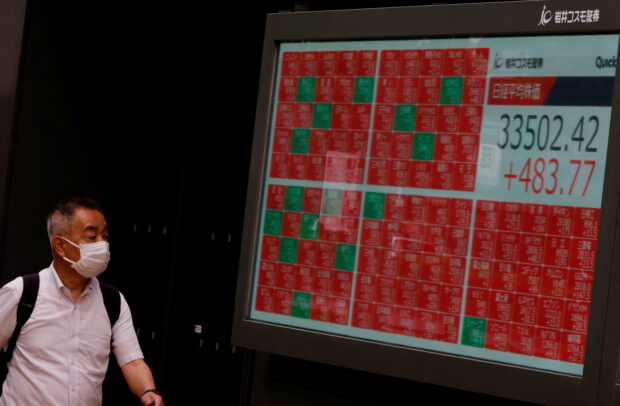

A man looks at an electric board displaying the Nikkei stock average outside a brokerage in Tokyo, Japan June 14, 2023. REUTERS/Kim Kyung-Hoon/File photo

HONG KONG – Asian stocks made some cautious gains on Tuesday, with investors choosing to focus on corporate earnings prospects and the resilience of the U.S. economy ahead of tensions in the Middle East.

MSCI’s broadest index of Asia-Pacific shares outside Japan advanced 0.58 percent. Tokyo’s Nikkei rose 0.89 percent.

Overnight the S&P 500 had climbed 1 percent, while oil prices and the U.S. dollar had fallen.

A host of “favorable” signs from the strength of the U.S. consumer, economic growth, and interest rates supporting bank profits, gave reasons for hope, said Kerry Craig, a global market strategist at J.P. Morgan Asset Management.

Quarterly results from Goldman Sachs and Bank of America are due on Tuesday, with Morgan Stanley, pharmaceutical giant Johnson & Johnson, Tesla and Netflix due later in the week.

A recent shift in tone from Federal Reserve officials – hinting that interest rate hikes might be over – has also cheered investors and bond markets lately.

READ: US interest rates in ‘good place,’ for now: Fed officials

Benchmark 10-year Treasury yields are about 15 basis points off 16-year highs, though they crept higher in Asia trade Tuesday to 4.7542 percent.

Investors are also trying to assess risks that a wider conflict breaks out in the Middle East which remains a “very fluid situation”, Craig said.

U.S. President Joe Biden will visit Israel on Wednesday as the country prepares to escalate an offensive against Hamas militants that has set off a humanitarian crisis in Gaza and raised fears of a broader conflict with Iran.

Iran’s Foreign Minister said Israel would not be allowed to act in Gaza without consequences, warning of “preemptive action” by the “resistance front” in the coming hours.

Israel’s shekel weakened beyond 4-to-the-dollar for the first time since 2015 on Monday, as it bears some of the brunt of worry and uncertainty about the Gaza situation.

In other developments, Russian President Vladimir Putin on Tuesday arrived in Beijing to meet with Chinese President Xi Jinping even as the war in Ukraine raged on.

The widely watched trip is aimed at showcasing the trust and “no-limits” partnership between the two countries, as Beijing is moving to strengthen ties with counties for its infrastructure-focused Belt and Road initiative.

In currency markets the Australian dollar ticked up a little to $0.6352 as minutes from the most recent central bank meeting struck a surprisingly hawkish tone, while the U.S. dollar steadied elsewhere.

A slowdown in New Zealand inflation to a two-year low dented bets on any further interest rate hikes and the kiwi, which extended earlier losses to be down 0.54 percent at $0.5906.

READ: New Zealand consumer inflation falls, still exceeds bank target

The euro traded at $1.0525 and the yen hovered just short of the 150-per-dollar mark at 149.6.

China’s property sector, meanwhile, edged toward deeper trouble with Tuesday marking the end of a 30-day grace period on a late payment from developer Country Garden. If investors don’t receive the coupon payment, all of Country Garden’s offshore debts will be deemed in default.

The property sector was flat while the Hang Seng rose 0.7 percent on Tuesday. A mainland real estate index fell 0.77 percent.

Gold edged away from Friday’s three-week high and was last at $1,914.3 an ounce. Brent crude futures had dropped more than $1 a barrel on Monday on hopes for an agreement that the U.S. will ease sanctions on Venezuelan oil.

Brent futures retrieved earlier losses of 0.25 percent to stand back at $89.66 a barrel on Tuesday.

Bitcoin had leapt on Monday before giving up gains after BlackRock denied a report that it had won approval for a bitcoin exchange traded fund.

It was last at $28,161 after trading as high as $29.900 on Monday.