Investors await relief from market turbulence

MANILA -The stock market slump could linger for longer as risk aversion persists due to stubborn inflation and violent clashes caused by the Israel-Hamas war.

Nevertheless, some of the country’s top experts have maintained their year-end targets showing modest upside for the benchmark Philippine Stock Exchange index (PSEi).

“Investors are likely to trade cautiously in the coming weeks amid continued concerns over sticky inflation, higher-for-longer interest rates and their dragging impact to economic growth,” says Abigail Chiw, head of research at BDO Securities.

“However, there are still opportunities to pick up quality stocks that are trading at bargain valuations, especially for investors who have a long-term view and the risk appetite to stomach market volatility,” she adds.

Chiw notes that inflation accelerated for a second straight month in September, mainly due to rising food and energy costs.

READ: Experts predict reversal of stock market downtrend

Thus, the PSEi would likely end the year at their “bear case” scenario of 6,900. This is based on their full-year corporate earnings growth forecast of 24 percent and a price to earnings multiple of 13 times.

Year-end target

The year-end target implies a 10-percent increase from the PSEi’s current level. However, it is important to note the PSEi is currently down about 4.6 percent since the start of 2023.

Gabryle Aguila, head of equity research at stock brokerage house Unicapital Securities Inc., says the challenging environment for 2023 could also cap year-end gains at the 6,900 level.

“Amid September inflation figures being faster-than-expected, another potential rate hike from the [Bangko Sentral ng Pilipinas], and inflationary expectations going into [fourth quarter of 2023],” he tells the Inquirer.

READ: PH inflation rose to 6.1% in Sept as food prices, transport cost soared

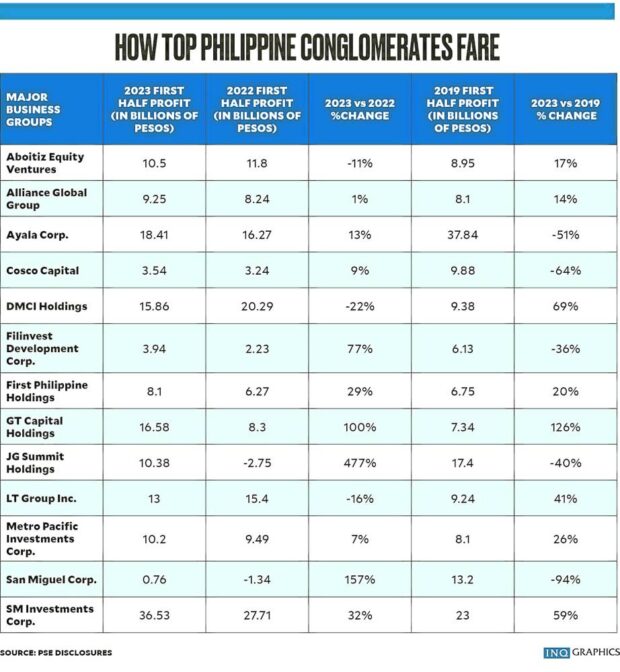

He estimates 2023 corporate earnings growth at 15 percent. Indeed, first semester 2023 data show that while most of country’s top conglomerates eked out growth over the previous year, many have yet to match their prepandemic profits.

Michael Ricafort, chief economist at the Rizal Commercial Banking Corp., says another risk factor is the Israel-Hamas war, which could further stoke inflation if the conflict escalates.

“If dragged directly into the conflict amid the proxy war, Iran could potentially use as a threat the blockage of the Strait of Hormuz, an important passage for international oil tankers, in retaliation to any action against it,” he says.

While investors continue to stay risk-averse, Aguila says there are early signs the market would do better in 2024.

“While there are upward inflationary pressures, overall, inflation has slowed compared to 2022 and this has improved prospects of rate cuts in 2024,” he says.

“The higher-for-longer interest rate view may challenge the Philippines’ [economic] performance in [first half 2024] but would otherwise spur a resurgence of investor confidence when inflation slows to target 2 to 4 percent levels and once rate cut prospects begin to materialize in 2024,” he adds.

Source: Philippine Stock Exchange data

Luring back investors

Successful efforts to stabilize inflation could also lure back investors and attract new initial public offerings (IPOs), many of which were postponed in 2023. Issuers include Enrique Razon Jr.’s Prime Infrastructure Capital Inc., Edgar Saavedra’s Citicore Renewable Energy Corp. and the real estate investment trust of the Sy family’s SM Prime Holdings.

Chiw adds, “2024 may possibly be a better year for capital raising, if market conditions improve. We think corporates will have more confidence in pursuing expansion plans once inflation and interest rates have stabilized at lower levels.”

Capital raised at the PSE in the first nine months reached nearly P92 billion, about 60 percent of the bourse’s full-year target.

The three IPOs this year were those of renewable power firm Alternergy Holdings, computer gadgets retailer Upson International Corp. and hydro-power focused Repower Energy Development Corp.

Stock experts also welcome the PSE’s Oct. 23 launch of short selling, which will allow investors to bet and profit from a drop in the share price and whose implementation has been delayed since the mid 1990s. INQ