Trends redefining the residential market

Colliers is seeing several trends in the residential market, both in the pre-selling and secondary segments.

As I highlighted in my previous columns, the residential sector is starting to recover, with rents and prices likely to rise by about 2 to 3 percent annually from 2023 to 2025.

We are now seeing the return of more expatriates, signaling a recovery of the leasing market. In the pre-selling segment, take-up as of H1 2023 improved by 52 percent year-on-year, while launches rose by 70 percent. Interest from local investors is picking up, as reflected by improving consumer and business sentiments. Housing summits are back, indicating that developers are starting to test the market’s overall appetite for new residential projects.

My colleague, Gigi Limguangco, shared some interesting insights on the residential market, the trends likely to redefine the sector beyond 2023, and what will likely help lift demand over the near to medium term. Gigi, who is the head of Colliers Philippines’ residential services, is a licensed real estate broker with more than 20 years of experience in residential sales and leasing.

Capture rising demand from expatriates

The leasing market has gradually picked up in 2022 and we attribute this to the easing of pandemic-induced restrictions.

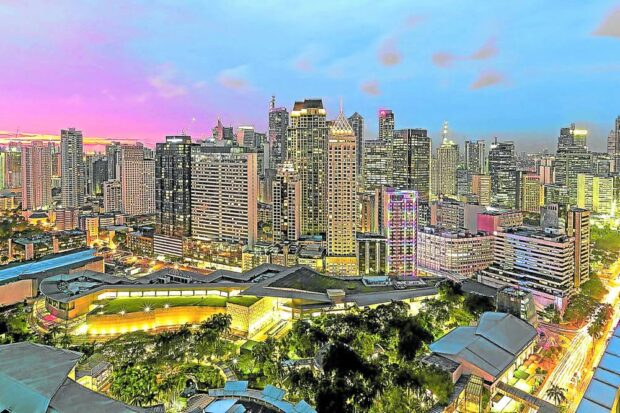

In our view, expats are now more inclined to return to the Philippines. Colliers has seen Fort Bonifacio as one of the most preferred locations among expats due to the presence of schools as well as retail and leisure establishments. Other popular options include Makati central business district and Rockwell Center.

We have been getting more queries from large business process outsourcing (BPO) companies, manufacturing firms, and even multilateral lending agencies that are planning to welcome more expatriates.

In our view, the upkeep of residential units should remain a priority if investors want to attract renters, including discerning expats. Providing high-end appliances is definitely a plus.

Continue offering attractive leasing, pricing schemes for RFOs

Vacancy in the secondary residential market continues to hover above 17 percent.

With a substantial inventory in the secondary market, developers should be proactive in offering leasing and early move-in promos for ready-for-occupancy (RFO) projects. We are already seeing some developers remaining aggressive in offering early move-in and rent-to-own schemes for their RFO units. A couple of developers are even allowing buyers to move in with a down payment as low as 5 percent, and discounts of as much as 20 percent on total contract prices (TCPs) for spot cash buyers.

Attractive RFO schemes should be implemented especially in business districts such as the Bay Area, where there will be substantial completion from 2023 to 2025.

Highlight features that cater to buyers’ postpandemic preferences

The results of our Q3 2022 Residential Survey show that 83 percent of our respondents prefer condominium projects that offer good ventilation as well as green and open spaces. Developers should thus consider incorporating more facilities that will allow residents to work from home or multi-task, such as coworking spaces, and business amenities including function rooms and business lounges, as well as smart home systems.

More than 90 percent of respondents also believe that having sustainable features is important in a residential development. We encourage developers to consider integrating features such as water recycling and treatment facilities, sensor lighting, solar panels and pocket gardens to capture the demand from discerning buyers looking for innovative and sustainable features.

Secure green building certifications for residential towers

Colliers encourages developers to consider securing green building certifications such as Leadership in Energy and Environmental Design (LEED) or Building for Ecologically Responsive Design Excellence (BERDE) for their condominium and horizontal projects.

In our view, adopting green and sustainable features will play a crucial role in future-proofing not only office towers but also residential developments within and outside Metro Manila postpandemic.

Explore JVs for upscale to luxury projects

We recommend that property firms seize opportunities in the market by partnering with foreign developers for the development of more luxury projects. In our view, these joint ventures (JVs) should help local players differentiate their projects in the market.

Developers should also emphasize the JV projects’ upscale amenities, integrated development features, topnotch concierge services, and strong potential for capital appreciation, which are important considerations for discerning investors and end-users.

From cities to suburbs

More and more investors and end-users are wiling to gravitate from the cities to the suburbs. We have seen people who own condominium units in Metro Manila expressing interest to purchase horizontal units outside CBDs, particularly in Central and South Luzon.

Since the start pf the pandemic we have seen a spike in demand for resort or leisure-themed horizontal projects. We see this trend persisting beyond 2023 as more Filipinos choose to feel the suburban vibe. With this trend, we see the demand for resort-oriented residential projects outside of Metro Manila thriving.

As a result, developers have aggressively launched new house-and-lot and lot-only projects outside Metro Manila as they seize this growing demand from end-users. Expect more masterplanned communities in the fringes as connectivity in key regions improves.