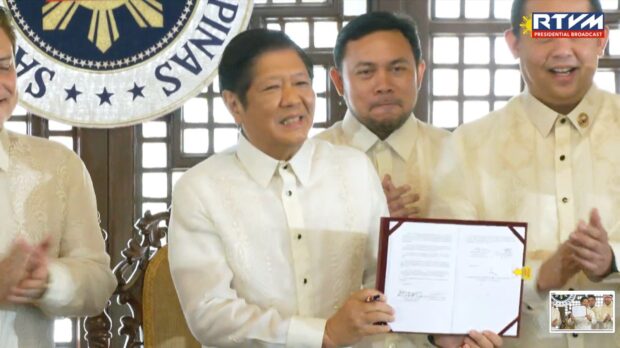

President Ferdinand Marcos Jr. signs the Maharlika Investment Fund bill into law on Tuesday, July 18, 2023. (Photo from RTV Malacañang)

MANILA, Philippines — Efforts to promote the Maharlika Investment Fund (MIF) overseas are not gaining as much traction as expected, mainly because there is not enough information being conveyed, according to the managing director of HSBC.

Frederic Neumann, HSBC’s chief Asia economist, said in a briefing with journalists that while the Marcos administration’s ongoing international roadshow to promote investment opportunities in the Philippines has been very helpful overall, there was more to be desired about the MIF.

“[Global] investors are very interested in the Philippines because, you will be surprised to know, they know very little about this country,” said Neumann, who is visiting to take part in an economic forum organized by HSBC.

Golden opportunities

“So this roadshow presents golden opportunities in terms of helping educate investors (about the Philippines),” he said.

As for the MIF, Neuman said there was far less information coming out overseas compared to how the fund is being talked about within the country.

“Investors are quite receptive to the idea because it’s [launching a sovereign fund] something that occurred in Indonesia and or other countries, too,” Neumann said.

“But there are questions: what’s the institutional setup? What are the investor safeguards? What’s the transparency [mechanism]—a lot of these questions (posed) in order to get a clearer picture of what the strategy is,” he said.

Even then, Neumann added that the unraveling of the answers to such important questions would be an ongoing process instead of a one-off explanation. That means investors would learn about the MIF as the investment fund is revealed through its actual operation.

Operational soon

According to Finance Secretary Benjamin Diokno, the Maharlika Investment Corp. (MIC)—which would manage the MIF—is expected to be operational before 2023 ends.

READ: Search on for Maharlika fund managers as IRR issued

The MIF advisory body which is composed of the budget secretary, secretary of the National Economic and Development Authority and the national treasurer, is expected on Sept. 29 to present to President Marcos a list of their recommendations for the MIC board appointees.

These include the president and CEO, two regular board members and three independent board members.

These six would complete the nine-seat board, adding to the finance secretary as chair and the respective presidents and CEOs of Land Bank of the Philippines and Development Bank of the Philippines.