REIT Revolution: Transforming the Philippine real estate investment scene

Real estate has always been the Filipino’s central mode of investment and capital preservation. Decades worth of this real estate investment culture has sustained a booming real estate market with many Filipinos and their families benefitting from life-changing value multiples over their lifetimes.

This very same success, however, has also become one of its main challenges. The high cost of entry to real estate assets—especially in relation to our GDP per capita—has now made it difficult for the average Filipino to buy real estate.

Enter: REITs

A Real Estate Investment Trust, commonly known as REIT, is a publicly-listed and traded corporation that owns and operates income-generating real estate. These include office buildings, residential complexes, malls, hotels, hospitals, and infrastructure projects.

When you buy into a REIT, you are essentially buying shares of the real estate assets in the REIT’s portfolio, which usually consists of high-quality assets in core markets. This offers investors a compelling opportunity to participate without the high engagement and capital requirements typically associated with property ownership.

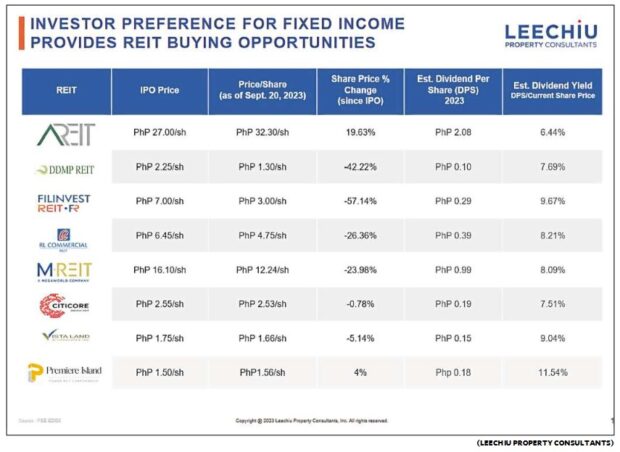

In 2020, Ayala Land made history by listing the country’s first REIT on the Philippine Stock Exchange (PSE). Seven other REITs have listed since. Currently, the PSE has a total of eight REITs with a combined market capitalization of P211.72 billion across 4.25 million sqm, with more companies exploring to make their own REITs available going forward.

REITs are not without their fair share of peaks and troughs, though. From the time REITs listed on the PSE, we witnessed values soar up to as high as 90 percent while some declined by as much as 50 percent from their IPO prices. Despite this, REITs remain an attractive option for investors as they offer some unique key advantages:

1. Hassle-free investing

While most Filipinos aspire to buy, sell, and manage their own properties, ownership of real estate comes with difficulties. High initial investment costs, maintenance expenses, property taxes, and the need for active management can be overwhelming. REITs offer an accessible way to participate in the market without the hassles and financial commitments associated with traditional property ownership but with all the benefits of a professionally managed, centrally located portfolio.

2. Capital appreciation

REITs have the tendency to move in the same trajectory as inflation, distinguishing them from conventional stocks. As the value of the assets appreciate, REIT prices tend to follow suit. Although investors are only buying a share of the assets, they benefit from the appreciation of the assets in the right market conditions.

3. Cash flow from dividends

REITs are required to distribute at least 90 percent of their annual income as dividends to the company’s shareholders. This provides REIT investors with a stable recurring income in place of rental income from a traditional real estate position.

4. Liquidity

One of the inherent advantages of a REIT is its liquidity. Selling shares can be accomplished in seconds. By comparison, buying and selling traditional real estate can take several months or even years. In this market environment that requires you to be quick on your feet, liquidity is key.

REITs are revolutionizing the way we see and approach real estate investments. They offer plenty of the upsides inherent in real estate, but with a lower barrier to entry and higher liquidity. Every Filipino now has one more entry point into the world of real estate investment—one that happens to be far from daunting. If we can embrace this new mode of owning real estate, then we stand to benefit from the developer giants that built these vast and towering portfolios. The author is the Director of the Investment Sales Team at Leechiu Property Consultants, Inc.