The Maharlika Investment Fund and its promise

The Philippines now has its own sovereign wealth fund, the Maharlika Investment Fund (MIF).

Recent reports have noted that the seed capital of the MIF has been deposited by Landbank of the Philippines and Development Bank of the Philippines, with P50 billion and P25 billion, respectively, as their contribution.

Around the world, there are about 100 sovereign wealth funds holding about $11 trillion in assets under management. The top 5 of which are the China Investment Corp with $1.35 trillion; Norges Bank Investment Management, $ 1.14 trillion; Abu Dhabi Investment Authority, $993 billion; State Administration of Foreign Exchanges, $980 billion, and Kuwait Investment Authority with $769 billion. (www.statista.com)

Among the funds, Norges Bank Investment Management of Norway is the best performer with a return on investment of 14.5 percent for 2021. It is said that the fund holds about $244,000 for every Norwegian man, woman and child. (www.reuters.com)

The declared policy of the MIF is to generate, preserve and grow national wealth, create jobs, promote trade and investments, foster technological transformation, strengthen connectivity, expand infrastructure, and achieve energy, water and food security. (Sec. 2 of Republic Act No. 11954)

Maharlika Investment Corp (MIC), which will administer the fund, has an authorized capital stock of P500 billion, out of which P125 billion is to be initially subscribed and paid in by government financial institutions. (Sec. 6, RA 11954)

While this amount might be considered small compared to other sovereign wealth funds, the law allows the MIC to issue bonds, debentures, and other securities. This means that the fund can significantly increase its total assets and investible funds. (Sec. 10, RA 11954)

The law has specified areas of investments which are:

a. Cash, foreign currencies, metals, and other tradeable commodities

b. Fixed income instruments issued by sovereigns, quasi-sovereigns and supranationals

c. Corporate bonds

d. Equities

e. Islamic investments

f. Joint ventures or co-investments, mergers and acquisitions

g. Mutual and exchange-traded funds

h. Certain real estate and infrastructure projects

i. Programs and projects on health, education, research and innovation, and other such investments that contribute to sustainable development

j. Loans and guarantees to, or participation into joint ventures or consortiums in industrial, mining, agricultural, housing, energy, and other enterprises, which related to economic development of the country, or important to the public interest

k. Other investments with sustainable and developmental impact

l. Investments in real estate, including agro-industrial estates and economic zones, estates infrastructure and other development projects, whether alone or in partnership with other corporate entities, shall be limited to high-impact projects as approved by the appropriate approving body, to ensure that these are in line with the socioeconomic development program of the government.

(Sec. 14, RA 11954)

The MIF, if utilized properly, can make an effective and positive contribution to the Philippine economy and gross domestic product. In 2019, the Philippine GDP was higher than that of Malaysia and Vietnam. In 2022, Malaysia and Vietnam have overtaken the Philippines.

(Source: www.statista.com/statistics/796245/gdp-of-the-asean-countries/)

Part of our work as lawyers involves dealing with clients from small to large enterprises, both local and foreign. Here are some inputs and observations from clients where the MIC may deploy and utilize the resources of the MIF to improve the Philippine economy:

1. Power/ electricity

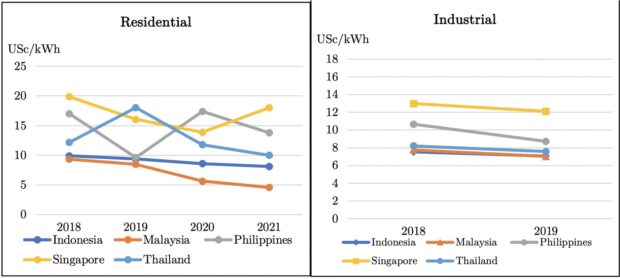

A study reveals that the Philippines has one of the highest electricity prices among our Asean neighbors.

Philippine residential electricity rates in 2021 was 13.81 US cents/kWh compared to 10 cents/kWh in Thailand, 8.12 cents/kWh in Indonesia, and 4.58 cents/kWh in Malaysia.

For the same period, our rates for industrial electricity was one of the highest in Asean and second only to Singapore.

(Source: The Nature and Causes of High Philippine Electricity Price and Potential Remedies, Majah-Leah V. Ravago, Ateneo de Manila Department of Economics, Ateneo Center for Research and Economic Development, Jan 19, 2022)

Our higher electricity cost means higher cost of operating a business which then deters investments.

Accordingly, investments directed at power generation, transmission and distribution resulting in lower electricity rates will not only incentivize businesses to locate their operations in the Philippines but also benefit existing businesses operating in the country.

2. Infrastructure

Another area that may benefit from deployment of the MIF resources is Infrastructure.

Metro Manila is plagued by severe congestion, primarily because it serves as the centralized hub for business and activity. While there is effort to decentralize commerce and industry to surrounding areas in the north, south and other provinces, enhancing accessibility to, from and within these regions is paramount. Accessibility does not only refer to the road or highway network but may also involve other forms of transportation such as ferry/ boat and railroad as well as connectivity like reliable telephone and internet signals.

Decentralizing away from Metro Manila is expected to yield positive outcomes in terms of addressing housing shortages, reducing crime rates and mitigating pollution levels.

3. Agriculture

Recently, the media has been reporting on the issue of the government-imposed price ceiling for rice. Prior to that, several issues regarding the high prices of onions, sugar and other commodities have been raised. One area in need of significant investment, and one where the MIF can play a vital role, is the agricultural sector of the country. Across the globe, advancements in technology and efficiency are continuously occurring, all of which demand substantial capital and training.

4. Skills training

Last but not the least, we must invest in our people. Many of our clients have expressed concerns about the skill levels of our workforce. For instance, one of our clients, a multinational company specializing in consumer goods, frequently participates in “pop-up” exhibits, whether at trade shows or in malls. They used to have their exhibit booths locally fabricated. However, starting 2023, they have opted to have this done in another Asian country due to quality issues with local suppliers. Another client engaged the services of a local software company to create their commerce website but found the local company could not properly deliver the product. This prompted the company to enlist the services of a Vietnamese software company to deliver the website.

Foreign investors and companies are in agreement that one of the strengths and advantages of the Philippines is its people. Most Filipinos speak English, the population is relatively young providing a strong work force and consumer base, and Filipinos have good communication and interpersonal skills. It would be regrettable if we fail to enhance and cultivate the skills of our workforce to enable Filipinos to remain competitive.

In conclusion, the MIF holds great promise and, hopefully, it will be deployed in the most efficient and effective manner to benefit the Philippines.

(The author, Atty. John Philip C. Siao, is a practicing lawyer and founding Partner of Tiongco Siao Bello & Associates Law Offices, an Arbitrator of the Construction Industry Arbitration Commission of the Philippines, and teaches law at the De La Salle University Tañada-Diokno School of Law. He may be contacted at jcs@tiongcosiaobellolaw.com. The views expressed in this article belong to the author alone.)