Global investors no longer extremely bearish, BofA survey shows

Investors across the world are no longer extremely bearish but are still far from turning bullish as global growth risks persist, based on the September global fund manager survey of Bank of America (BofA).

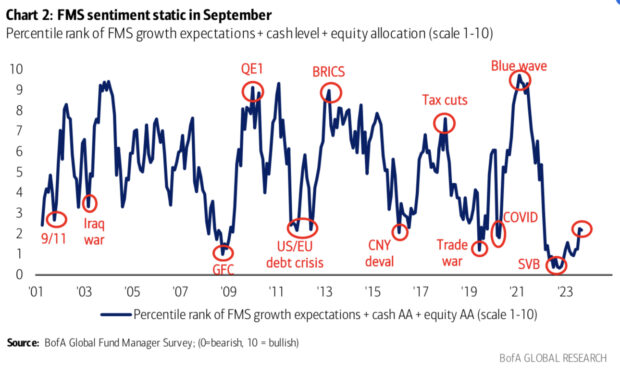

BofA’s fund manager survey conducted from Sept. 1 to 7 showed that the broadest measure of sentiment — based on cash positions, equity allocation and economic growth expectations — fell slightly to 2.2 from 2.3, “indicating that investors are still bearish, albeit no longer extreme bears.”

The BofA research note explaining the survey dated Sept.12 said fund managers’ cash levels as a percentage of assets under management (AUM) had gone up slightly from 4.8 percent to 4.9 percent in September.

READ: Investors pile into stocks and bonds, shed cash – BofA

Cash levels are now at the upper end of the normal 4 percent to 5 percent range but are now well below the maximum bear level of 6.3 percent last seen in October last year.

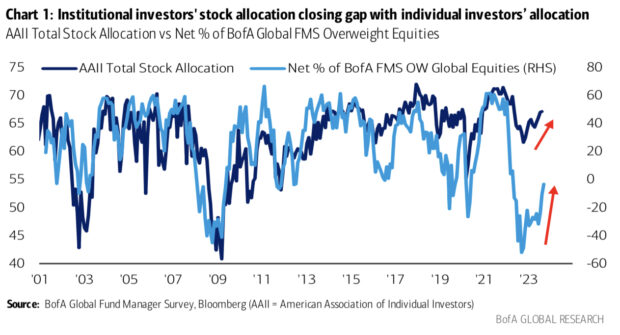

This month also saw a record jump in global fund managers’ equity allocation with a shift to US equities and out of emerging market (EM) equities.

Allocation for US equities rose 29 percentage points (ppt) from the past month’s 22 percent “underweight” position to net 7 percent “overweight”. These investors have turned overweight on US stocks for the first time since August 2022.

Underweight refers to a position to reduce allocation relative to the benchmark index while overweight is the exact opposite.

But while investors are scrambling for US equities, they are exiting their EM positions. The same survey showed that EM equity allocation in September had fallen by 25 ppt from the previous month’s net 34 percent overweight to net 9 percent overweight. This marked the smallest overweight allocation since November 2022.

Weaker global growth, dovish Fed

Meanwhile, the consensus is that the global economy will weaken in the next 12 months as China growth optimism slumped back to COVID-19 lockdown lows.

READ: IMF chief: Prospects for medium-term global growth weak

Some 53 percent of fund managers remained pessimistic about global growth, up from 45 percent in August who expected a weaker economy in the next 12 months.

Three out of fund managers expect either a soft landing (64 percent) or “no landing” (11 percent) at all versus 21 percent who expect a “hard landing.”

The research noted the ongoing disconnect between fund managers’ growth expectation and the S&P 500 upswing, “suggesting that equity optimism is driven by rate cuts.”

It cited a “big conviction” among investors that the US Federal Reserve would cut its targeted rates.

Six out of 10 surveyed investors believe that the Fed is “done” hiking rates. The percentage has gone up from just 47 percent in August and 88 percent in July.

Most of the investors expect the first Fed rate cut to happen between April and December 2024. Some 38 percent say it would occur by the second half of next year, while 36 percent say it could happen as early as the second quarter.

Biggest risks

The September survey also identified the biggest tail risks that keep global investors awake at night:

1. High inflation that keeps central banks hawkish (40 percent)

2. Geopolitics may worsen (14 percent)

3. There may be a systemic credit event, whether government or corporate

4. Bank credit crunch and global recession may happen (13 percent)

5. There could be an artificial intelligence/tech bubble (10 percent)

6. China’s real estate could be busted (8 percent).