Western firms shift investment from China to India as worries mount

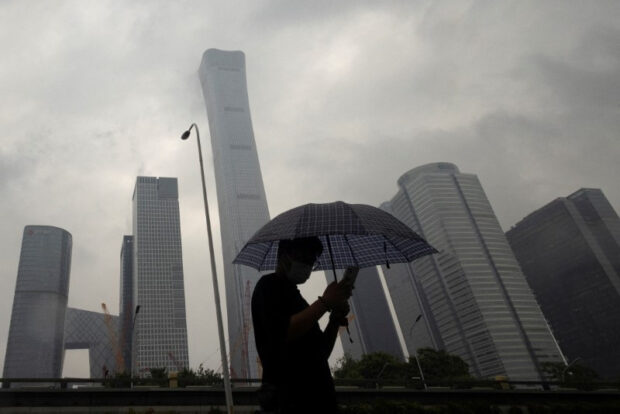

A man walks in the Central Business District on a rainy day, in Beijing, China, July 12, 2023. REUTERS/Thomas Peter/File photo

BEIJING – U.S. and European firms are shifting investment away from China to other developing markets, a report from Rhodium Group showed, with India receiving the vast majority of this redirected foreign capital, followed by Mexico, Vietnam and Malaysia.

These companies are turning their backs on the world’s second-largest economy even as its share of global growth continues to increase, highlighting how concerns over China‘s business environment, economic recovery and politics weigh heavy on the minds of foreign investors.

The value of announced U.S. and European greenfield investment into India shot up by some $65 billion or 400 percent between 2021 and 2022, Wednesday’s report said, while investment into China dropped to less than $20 billion last year, from a peak of $120 billion in 2018.

“Diversification is well underway,” the research organization said, but acknowledging: “it will take years for advanced economies to achieve the objectives behind their ‘de-risking’ policies,” as China is so central to global supply chains.

Low production costs and the prospect of a massive middle class drew the first foreign firms to China in the late 1980s, as the country abandoned its Maoist economic model. But with consumers now tightening their purse strings and production costs continuing to rise, the market is losing its sheen.

Article continues after this advertisementThe shift comes as Chinese local authorities struggle to revive foreign investment after an economically bruising pandemic and property crisis depleted their coffers.

Article continues after this advertisementWestern companies are stepping up greenfield investment in these markets to give them options when sourcing assembled goods and geopolitically sensitive commodities, such as semiconductors, as well as to reduce their dependence on China in their supply chains, the report said.

But the authors cautioned that diversification is unlikely to result in a rapid decline in exposure to China because the markets foreign firms are investing in are heavily reliant on trade and investment with the Asian giant themselves.

As a result: “it would not be surprising to see China‘s overall share of global exports, manufacturing and supply chains continue to rise, even as diversification away from China accelerates.”