Getting your first home: Where your budget can take you

How do you know if it’s the right time to purchase a home?

A house is likely the biggest financial investment and obligation that people can make in their lifetime. It’s therefore a must to put in all your efforts to do a research and a deep personal assessment and consideration before making that commitment. Especially for first-time homebuyers, this will likely be a significant decision that needs careful consideration of various factors.

Decision process

To guide you through the process, ask yourself some basic questions such as: Are you financially capable? Can you afford it? Consider factors like your income, existing debts, downpayment and monthly amortizations, too. Have you saved enough for an emergency fund? And on top of this emergency fund, do you have the source or savings for a downpayment? Will your parents or family assist in making that downpayment?

And where is your preferred location? Is it near your place of work? Research different neighborhoods and consider factors such as safety, accessibility and transportation, access to basic support services and amenities, proximity to family, friends as well as potential for future growth.

What type of property suits your lifestyle? Remember that each type of dwelling comes with its own advantages and considerations. Decide whether you want a single-family home, a condo, a townhouse, or another type of property.

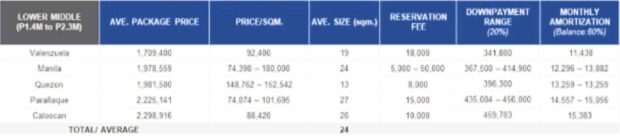

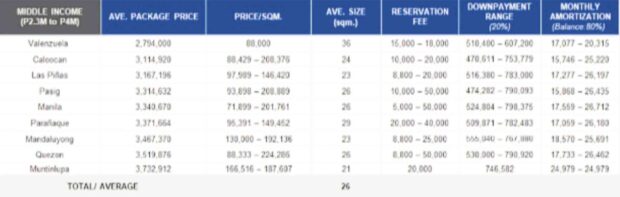

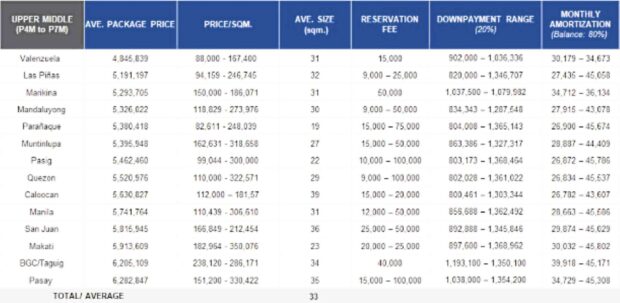

To help you think through the financial considerations, Leechiu Property Consultants compiled prices of Metro Manila condominiums, the downpayments required, and a rough mortgage calculation based on a 20-year bank loan term at 8 percent interest rate. This can help address your assessment of financial capability and your purchasing power.

P1.4M to P2.3M condo unit

To be able to purchase a condominium unit priced at P1.4 million to P2.3 million in Metro Manila, a person or household should have a monthly salary of P31,000 to P51,000. Of this monthly salary, about 30 percent is to be allocated for home or shelter expenses. Thus, financial institutions such as banks or Pag-IBIG Fund will be looking at a monthly amortization from P11,400 to P15,300 per month.

P2.4M to P4M condo unit

To be able to purchase a condominium unit priced at P2.3 million to P4 million in Metro Manila, a person or household should have a monthly salary of P53,000 to P89,000.

P4.1M to P7M condo unit

To be able to purchase a condominium unit priced at P4.1 million to P7 million in Metro Manila, a person or household should have a monthly salary of P102,000 to P175,000.

Essentially, the affordability of a unit depends on the household’s monthly income, the amount of savings and emergency funds, and the responsibility that comes with owning your first home.

All these data and questions are meant to help guide you throughout your homebuying process. What’s good now is that with the help of technology, homebuyers get to ask more probing questions, inquire with more than one developer, and ensure that they are able to choose a developer that has a good track record, is reliable and responsible, and whose projects have future asset value appreciation. All these will help them make sound decisions.

While this does not serve as a financial advice, it is always prudent to move slowly and choose what you can afford based on your lifestyle and capacity. It’s often a good idea to consult with experienced professionals and seek advice from family and friends who have gone through the process themselves.

The author is the associate director and head of consultancy at Leechiu Property Consultants Inc., the country’s premier real estate advisory firm