Bringing about a more financially free future through financial literacy

Financial literacy is vital for the stability of any economy. And for an emerging country like the Philippines, there needs to be a more concrete solution to make everyone aware of the importance of being financially educated. For Filipinos to make wiser financial decisions to protect and grow their hard-earned money, more inclusive financial education programs are key.

When surveyed on basic financial literacy questions, only 2 in 10 Filipinos gained perfect scores, while 7 in 10 correctly answered at least half of the questions. Only 42 % of adults correctly identified inflation’s effect on purchasing power in 2021, and the World Bank found that only 25% of adult Filipinos are knowledgeable on basic financial concepts.

Sun Life Financial-Philippines Foundation, Inc. (Sun Life Foundation) is committed to help educate and uplift the lives of marginalized Filipinos so they could achieve a sustainable future. Through holistic and transformative community-based initiatives, the Sun Life Foundation has long helped public school teachers, fisherfolks, and its scholars, among others, through programs focused on its pillars including health and wellness, environment, and education/financial education.

At the helm of the Sun Life Foundation is Executive Director Kristine Dianne C. Millete, who is also the Sustainability Champion for Uplifting Communities for Sun Life Philippines. A development executive with years of experience in leading projects that drive social impact, she is responsible for steering the Foundation’s strategies, operations, programs, and transformation, oversees daily operations, and implements the appropriate resources to ensure that they are gearing toward their mission.

Sun Life Foundation’s Executive Director, Kristine Dianne C. Millete

Most of the Foundation’s projects are community-based and are directly interlocked with Sun Life’s dream of creating a brighter Philippines. “Our mission is to be a committed corporate foundation, successful in community transformation initiatives. So, it’s really all about transforming communities in the field of health, education–including financial education, and the environment,” Millete shared.

The Foundation’s flagship projects

With Sun Life Foundation being the philanthropic arm of a financial services company, it is no surprise that many of its initiatives are focused on promoting financial literacy. In fact, one of its flagship programs is the award-winning behavioral financial management program Sun Pera-Aralan. Millete is extremely proud of Sun Pera-Aralan because it has helped public school teachers secure their finances address indebtedness and develop positive money habits.

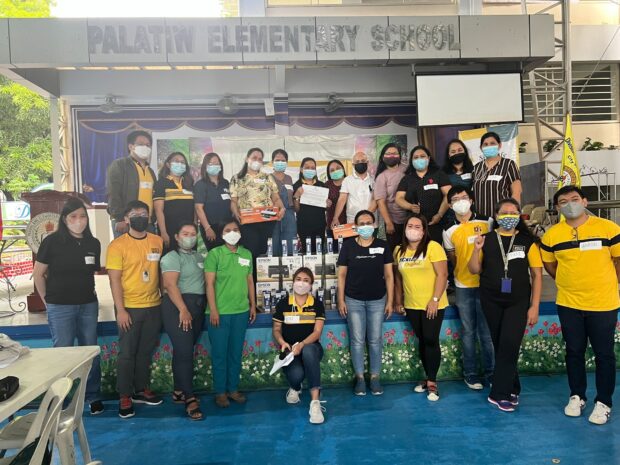

Sun Pera-Aralan Program with Palatiw Elementary School Public School Teachers

“We partnered with AHA! Behavioral Design, sat down with the teachers, did focus group discussions, shared money management tips to help them save up, and strove to really understand their financial journey because changing their mindset and behavior about money was very challenging to begin with. We came up with a money envelope, which we called the “Peso Sobre Tool”, Sun Pera-Aralan’s budgeting system designed to aid in the proper allocation of one’s monthly salary,” Millete shared. “Now, they have money reserved as an emergency fund, for livelihood, or even travel. And I could say that was one of the proudest moments of my journey with Sun Life.”

Sun Pera-Aralan Public School Teacher-Beneficiaries (1)

Meanwhile, the Foundation also aimed to promote financial literacy among fisherfolk. The Philippines is home to a large fishing industry, but small-scale fishers are among the country’s poorest and most marginalized people, earning only an average of P178 daily, which is not sufficient to sustain their family’s basic needs. As a result, the fisherfolk have minimal to no savings to protect their households from unforeseen financial challenges such as natural disasters, illness, and variations in fish yields.

To support them, the Sun Life Foundation partnered with Rare, a global leader in program development for people and nature, to bring Rare’s Fish Forever program, a financial literacy-focused initiative for fisherfolks.

The collaboration started with an innovative pilot project in the Negros Oriental Province. “We helped them establish a savings club, and financial literacy training. During the pandemic, this became a lifeline for them,” Millete said. “All these helped them kickstart their own financial goals and build good financial habits so that they can use their savings to buy items such as fishing gear, electronic devices for their children’s virtual classes, or establish an alternative livelihood for their spouses.”

During the pandemic, the Sun Life Foundation also launched its very own children’s storybook called “Ayla Saves for a Brighter Day”, which not only promotes financial literacy among children but was also written to help them process the extraordinary experiences they had amid the pandemic. This was distributed in communities and to public school teachers.

The Foundation shows no signs of slowing down as it continues to strengthen its initiatives. “We are very much committed to our flagship programs and are determined to see them through. And with Sun Life Philippines celebrating its 130th year in 2025, I am sure we will have another gift for the community so there’s a lot more in store,” Millete revealed.

Are Filipinos ready for financial literacy?

Millete believes that being financially literate means knowing how money works. “It’s very important to know how money works and to have a good relationship with it. You have to understand how your finances can work for you and use those skills to effectively make better money decisions and be empowered to meet your needs and reach your goals. At the same time, financial literacy serves as our protection because it can keep us from falling for get-rich-quick scams,” Millete explained. “It can be overwhelming, but it is not a journey we need to go through alone. There are experts we can consult with, and often for free. We can be given advice and learn about the products that suit our goal. We just have to make sure that we are asking the right people–ones who have the expertise and have our best interests at heart.”

Sun Pera-Aralan Breaktime Kwentuhan

Millete noted that the Filipinos’ interest in financial literacy heightened after the pandemic, as they began asking about insurance and investments and are eager to strengthen their financial portfolio after the pandemic revealed their vulnerabilities. “Hopefully, after learning about how they can protect themselves financially, more Filipinos will find the courage to consult experts, secure the right products, and commit to their financial empowerment.

There are many factors that hinder Filipinos from achieving financial literacy. “Culturally, we don’t have a separate pocket for insurance and investments, and sometimes, it’s hard to think long-term when you need to provide the needs of the present. We also don’t like talking about death, much less preparing for it. But we’re seeing a shift in this mindset. We have seen this work in the communities,” Millete mused. “In every program we support, we try to integrate a financial literacy component because we believe in its power to change lives. The interest is there, and we hope to nurture this so more may get on the right path in their financial journey.”

Mindful money management

Sun Life Foundation aims to help change the mindset of Filipinos by teaching them simple, doable, and long-term money management decisions—something that they can pass on to their children so that the future generation can be more financially prepared. In every program it launches, its goal is to become obsolete in the community by enabling the community to become self-sustaining. The true gauge of a project’s success is when the community it has transformed becomes so self-reliant that it will have no need of Sun Life Foundation any longer.

Luis Y. Ferrer Jr. SHS Public School Teacher-Beneficiaries of Sun Pera-Aralan

“More impact will be made if we focus on long-term projects. We also must be mindful about the alignment of advocacies of each organization we support. It should transcend through generations. And as more Filipinos become more equipped with better financial habits, they also become more empowered to take control of their finances. They can also be more informed in their financial decisions and start dreaming of bigger things like sending their kids to college, building their own home, having their own livelihood,” Millete said.

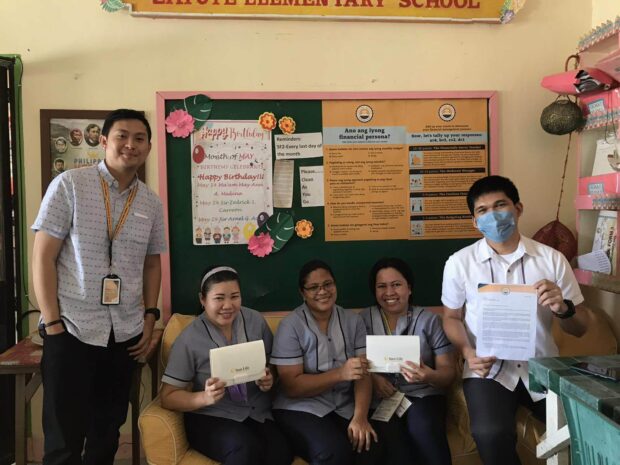

Zapote Elementary School Public School Teacher-Beneficiaries of Sun Pera-Aralan

Looking towards the future, Millete has also developed a strategic platform for the Sun Life Foundation for the next decade, so it may be more focused and deliberate in selecting projects that are long-term, sustainable, and focused on its core track of holistic health.

“There’s a quote from American journalist and songwriter Jana Stanfield that goes, ‘I cannot do all the good that the world needs, but the world needs all the good that I can do’. That’s our favorite quote in Sun Life Foundation, as it speaks volumes of our focus and the impact that we aim to achieve. We can’t do everything but with the power of collaboration, partners, and volunteers, we are able to do so much more for the community. It’s really been a most inspiring journey, especially knowing how we can help our beneficiaries, who we call partners, look forward to a brighter future.”

Sun Life Financial-Philippines Foundation, Inc. is the philanthropic arm of Sun Life Philippines. To know more about its projects, sunlife.com.ph and follow @SunLifePH on Facebook, Instagram, TikTok, YouTube, and Twitter.

INQUIRER.net BrandRoom/JC