Asia shares on tenterhooks for Fed, ECB and BOJ

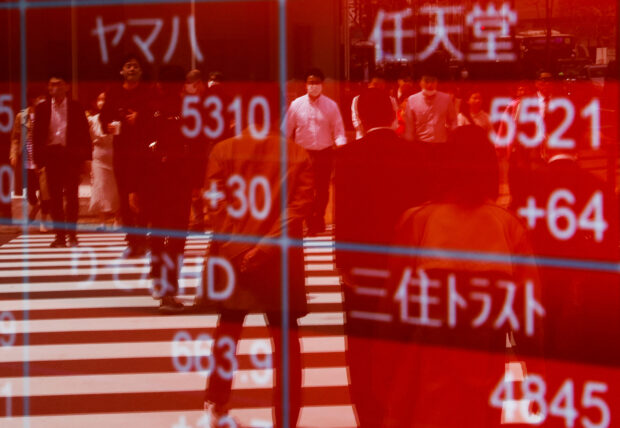

Passersby are reflected on an electric stock quotation board outside a brokerage in Tokyo, Japan April 18, 2023. REUTERS/Issei Kato/File photo

SYDNEY – Asian shares marked time on Monday ahead of an action packed week of earnings and central bank meetings that will likely see higher rates in Europe and the United States, and possibly the end of the tightening cycle in both.

Markets are fully priced for quarter point hikes from the Federal Reserve and European Central Bank, so the focus will be on what Fed Chair Jerome Powell and ECB President Christine Lagarde say about the future.

“For both, we expect this to mark the last hike in the cycle, though neither Lagarde or Powell is likely to signal that the peak is in, instead retaining hawkish tones and remaining data-dependent,” said John Briggs, an analyst at NatWest Markets.

“But activity and inflation data in both regions have softened enough, and likely to soften further, to justify an end of the tightening cycle.”

The odd man out will be the Bank of Japan which meets on Friday and is thought likely to keep its super-loose policy intact, but some western banks are speculating on a tweak to its yield curve control stance.

Article continues after this advertisementReuters reported last week that BOJ policymakers prefer to scrutinize more data to ensure wages and inflation keep rising before changing policy, though the decision could still be a close call.

Article continues after this advertisementThe report slugged the yen and gave Japan’s Nikkei an early 1.1 percent gain, while MSCI’s broadest index of Asia-Pacific shares outside Japan was barely changed.

China’s Politburo meeting this week could see more stimulus announced, though investors have so far been underwhelmed by Beijing’s actions.

Host of earnings

S&P 500 futures and Nasdaq futures were little changed ahead of a wave of earnings this week.

A who’s who of major companies are reporting including Alphabet, Meta, Intel, Microsoft, GE, AT&T, Boeing, Exxon Mobil, McDonald’s, Coca Cola, Ford and GM.

The results will have to be good to justify the S&P 500’s earning multiple of 20 and its gains of 19% year-to-date.

“We believe recent valuation expansion despite higher rates is reasonable considering the longer-term relationship between rates and equities, the improvement in expected growth, and the high market concentration in stocks benefiting from AI optimism,” wrote analysts at Goldman Sachs.

“While our baseline forecast assumes a slight contraction in the S&P 500 P/E multiple to 19x by year-end, we believe risks to valuations are tilted to the upside if the multiples of laggards ‘catch up’ or yields fall.”

Yields on 10-year Treasuries were steady at 3.85 percent, still below the recent spike high of 4.094 percent.

The dollar held firm at 141.75 yen, having jumped 1.3 percent on Friday following the report on the BOJ. The gains lifted the dollar across the board and left the euro at $1.1128 and off its recent top of $1.1276.

There was no obvious reaction to news Spain was heading for a hung parliament, though its debt might come under pressure when local markets open.

The rise in the dollar pulled gold back to $1,961 an ounce and away from last week’s peak of $1,987.

Oil prices ran into profit taking early on Monday having climbed for four straight weeks amid tightening supplies.

Brent fell 47 cents to $80.60 a barrel, while U.S. crude lost 39 cents to $76.68.