Pride Month and beyond, GCash remains an essential tool for Filipinos to achieve financial independence

GCash shows its support for the LGBTQIA+ community with the latest GCash Stories film released in celebration of Pride Month featuring Drag Queen, Breadwinner, and GCash User Turing Quinto and her story of grit, hard work, and unwavering passion.

As an inclusive e-wallet, GCash strongly pursues its vision of financial opportunities made available for all. GCash continues to provide products that help make this possible, so that the road to success can be accessed by anyone, anytime. Pride Month or not, GCash remains an essential tool for Filipinos as they work to achieve financial independence.

Dream Businesses & Passion Projects Made Possible with GLoan

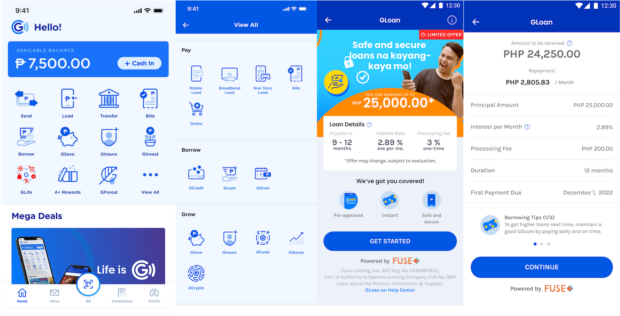

GCash makes it easier to borrow funds for your dream business with GLoan: one of the financial borrowing services that can be accessed through the GCash app.

Get easy approval with zero additional documents and no collateral needed for up to P125K instant cash. Your loan limit is based on your GScore, which is a score that reflects how active you are in using GCash’s products and features.

GLoan also lets you enjoy low interest rates as low as 1.59% per month or as low as P266 per month, and you can pay your installments in 5, 6, 9, or 12 months. Once approved, the loan will be sent to your GCash wallet within minutes so you can immediately use it.

To learn if you are eligible, head to the GCash app and tap “Borrow” on the homepage to see the GLoan icon. Eligible users will be able to view their maximum loan limit, interest rate, and one-time processing fees.

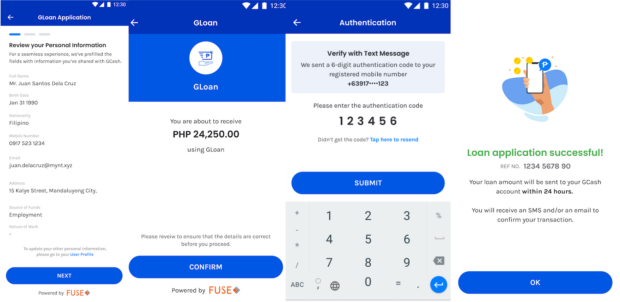

HOW TO APPLY FOR A GLOAN

STEP 1: Click “Borrow” on the GCash main page

STEP 2: Click on “GLoan” to proceed

STEP 3: View your loan limit, interest rate and processing fee in the GLoan homepage

STEP 4: Review your loan amount and details, click continue to proceed with transaction

STEP 5: Review your personal details for GLoan application processing

STEP 6: GCash to redirect user to the final loan amount page confirmation

STEP 7: GCash user to receive OTP for final GLoan confirmation

STEP 8 : Enjoy instant disbursement to your GCash wallet

Seamless Payments & Smoother Business Operations with Scan-To-Pay

GCash Scan-To-Pay allows entrepreneurs and businesses to offer cashless transactions through a generated QR Code. This innovation in digital payments allows business owners to receive payments through cashless transactions, allowing for more efficient day-to-day operations.

GCash Scan-To-Pay offers a frictionless experience for these business owners as merchants receive real-time texts on their smartphones when payments are made. They are also able to monitor transactions in their merchant portal, accept unlimited transactions daily, and even have the option to offer GGives and GCredit to their customers.

One can easily apply to become a GCash Merchant and have their very own GCash In-Store QR by filling up this form. Only businesses that are registered with DTI, BIR, or SEC are eligible to apply.

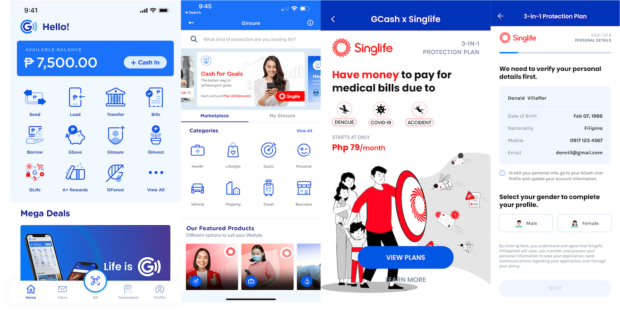

All Kinds of Protection For The People & Things That Matter Most with GInsure

GInsure is your one-stop-shop for insurance policies ranging from life, health, car, income loss, and more, that can be accessed through GCash so you can manage and keep track of everything from right inside the app.

With GInsure, protecting yourself and what matters to you is made more convenient with clear benefits, easy to understand terms and conditions, and one of the lowest insurance premiums in the Philippine Market for as low as Php 10 monthly so you can focus on working with pride and doing what you love knowing you and your loved ones are covered for the unexpected.

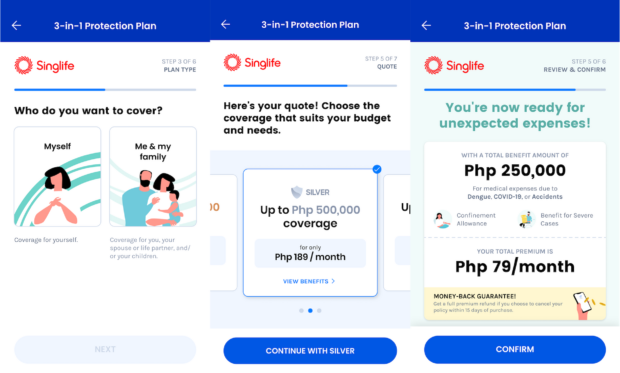

HOW TO AVAIL OF GINSURE

STEP 1: Click “GInsure” on the GCash main page

STEP 2: Click on “Featured Products” → “Singlife 3-in-1”

STEP 3: Tap “View Plans”

STEP 4: Verify personal details

STEP 5: You may choose coverage for yourself or for your loved ones

STEP 6: Choose coverage plan – bronze, silver or gold

STEP 7: Check out your selected plan, review final details and click confirm

Making Funding, Loans, and Security Equally Accessible with GLoan, Scan-To-Pay, and GInsure

As part of its “Werk With Pride” campaign, GCash highlights these three products that serve to encourage hustling entrepreneurs, budding business owners, young families, and the like by enabling them to access funding and loans services through the app.

Download the GCash app now and #WerkWithPride everyday with the help of these easily accessible and inclusive financial products and services..