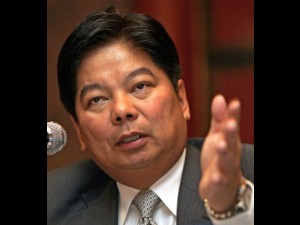

AMANDO TETANGCO JR.: Lower interest rates will help convince businesses to invest lower interest. AFP PHOTO/TED ALJIBE

The Bangko Sentral ng Pilipinas is expected to cut key rates in Thursday’s policy rate-setting meeting of the Monetary Board, citing the need to cushion the adverse impact of the crisis in the eurozone on the domestic economy.

BSP Governor Amando Tetangco Jr. said lower interest rates would help convince businesses to invest and counter the effects of anemic global demand for the country’s exports due to the crisis.

“We can be accommodative at this time given the manageable inflation outlook and the uncertainties coming from the debt crisis in the eurozone,” Tetangco told reporters Wednesday.

Market players are anticipating a cut of 25 basis points. This will bring the central bank’s overnight borrowing and lending rates, which influence commercial lending rates, to 4.25 and 6.25 percent, respectively.

Lower interest rates are expected to further boost demand for loans even as credit growth already grew at a double-digit pace last year. A faster increase in loans is, in turn, expected to help beef up consumption and investments.

Reduced borrowing costs help spur spending, but also has the tendency to push consumer prices higher.

Tetangco said this should not be a problem because inflation remained low and any upward pressure was not expected to cause it to breach the target of between 3 and 5 percent for 2012.

“Inflation is still seen to fall below the midpoint of the target,” Tetangco said.

The desire to cut key policy rates came following the Philippines’ decelerated growth last year.

The economy, measured in terms of gross domestic product, posted a slower-than-expected growth of 3.6 percent in the first three quarters of 2011. Government officials admitted that the growth rate as of end-September made the official, full-year growth target of 4.5 to 5.5 percent practically unattainable.

The poor economic performance in the first three quarters of 2011 was blamed both on the drop in government spending and a decline in the country’s export earnings.

Reduced export income came on the back of sluggish growth of the United States and countries in the eurozone, the country’s biggest export markets.