MANILA, Philippines—The local stock market barometer sprang back Tuesday to the 4,600 level to approximate the recent record high as risk appetite was boosted by an orderly bond sale by France in the aftermath of sovereign credit rating downgrades in the European Union.

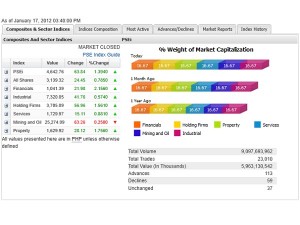

Ending a two-day pullback, the Philippine Stock Exchange index recouped 63.84 points, or 1.4 percent, to close at 4,642.76. The index is now nearing the all-time high finish of 4,648.11 posted last Thursday.

The day’s upswing was led by the financial, holding firms and property counters, which surged by 2.16 percent, 1.56 percent and 1.75 percent, respectively. Only the mining/oil firm counter closed in the red.

Dealers reported that foreign investors were loading up on large-cap stocks, boosting turnover to P5.96 billion from the previous day’s P3.9 billion.

The prices of 113 stocks went up against 59 that showed declines, while 37 were unchanged.

The index was led higher by Metrobank, BDO, PLDT, Megaworld, URC, AGI, BPI, Semirara, SM Investments, Manila Water and Philex. There was likewise strong appetite for Security Bank.

On the other hand, the PSEi’s gains were pared down by the decline of AP, SMC, DMCI and RLC. Shares of Lepanto A (open only to locals) and B also declined.

“Sentiment recovered overnight, as the French bill auctions were carried out smoothly after the rating downgrade. Markets are shrugging off the credit downgrades, including the latest on the EFSF (the EU rescue fund),” said Frances Cheung, senior strategist for emerging Asia at Credit Agricole CIB.