Worst is over but brace for bumpy ride ahead, stock experts say

MANILA -The postpandemic period is seen to remain bumpy for stock market investors but emerging macroeconomic tailwinds may provide opportunities for those with appetite for risk.

Analysts interviewed by the Inquirer said soaring inflation would moderate in the coming months, prompting central banks across the globe to begin slowing the pace of interest rate hikes.

These factors, coupled with the easing of supply chain bottlenecks and the continued strength of domestic consumer spending, are expected to boost Philippine corporate earnings in 2023.

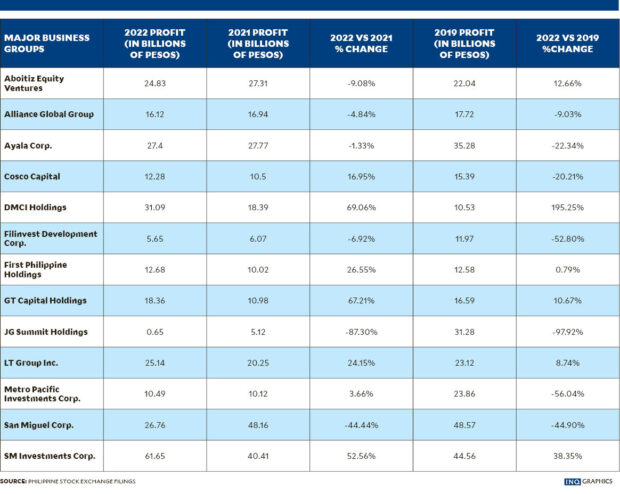

This also comes as the country’s biggest business groups and family-owned conglomerates posted mixed results last year, while roughly half have yet to recover to their prepandemic earnings level, data compiled by the Inquirer showed.

Nevertheless, market experts from AB Capital Securities, Bank of the Philippine Islands (BPI), Maybank Securities and Security Bank expected the benchmark Philippine Stock Exchange Index (PSEi) to rise from last year’s finish of 6,566.39.

Article continues after this advertisement“Barring any ‘Black swan’ events, we think the worst is largely behind us. We just do not expect markets to rise in a straight line,” BPI Trade president and CEO Haj Narvaez said in an email.

Article continues after this advertisementBlack swans are extremely rare events with severe consequences for the market.

Double-digit earnings growth

Narvaez said BPI Trade’s yearend forecast for the PSEi was at 7,900, supported by corporate earnings growth of 15 percent in 2023.

“We see inflation decelerating in the next three to six months given the recent correction in oil prices, base effects and more normalized supply chains. All things equal, it would appear that interest rates may stabilize in the near-term as well,” he said.

“More importantly for markets, we believe the [US Federal Reserve] will likely dial down the pace of rate hikes that we have seen in the past 12 months,” he added.

Jacqui De Jesus, head of equity research at Maybank Securities, also sees inflation trending lower to eventually return to the Bangko Sentral ng Pilipinas’ 2 to 4 percent target range by the fourth quarter.

This would help drive a corporate earnings growth of 13 percent, which would help push up the PSEi to their yearend target of 7,800, she said.

“The resilience of domestic consumption, which should further improve with increasing mobility, raises the earnings growth quality and longevity of consumption and mobility-based stocks in the current inflationary environment,” De Jesus said in an email.

Risks ahead

Jep Tang, vice president for equity sales at AB Capital Securities Inc., shared a more tempered outlook for the year given concerns on the impact of higher interest rates and inflation.

“Companies will report strong earnings for [the first quarter of 2023], as sales will have been bolstered by revenge spending and residual cash balances from last year’s election. This will start to weaken in [the second quarter], as high inflation and borrowing costs begin to bite,” he said in an email.

“In this kind of environment, companies will be hard-pressed to recover margins lost from last year’s cost increases. Lower commodity prices will help, but the second-round effects of inflation, such as wage increases and higher transport costs, are mostly irreversible,” he added.

Tang said the PSEi could close the year flat or chalk up a maximum gain of 5 percent.

“We remain overweight on the larger banks, select power generators, the casinos and mining companies,” he said.

“We are neutral on consumer stocks and still bearish on property. In general, we like companies that enjoy pricing power, either through market forces or regulation, and possess strong balance sheets,” he added.

Security Bank chief economist Dan Roces, who also sees inflation moderating this year, is wary of other downside risks such as a potential earnings downgrade from a US recession and the uncertain outlook for smaller US lenders.

Also on the horizon was geopolitical risk escalation between China and US and the Russian invasion of Ukraine that was launched in 2022, Roces said in an email.

“Corporate earnings will remain uneven, with consumer-retail and banking likely better earners with momentum from a healthy capital base from last year,” Roces said.

While he expects the PSEi to end the year at 7,500-7,800, there might be room for “downward adjustment as we assess the full impact of inflation to consumption and the [gross domestic product] figures of the first quarter.”

Opportunities

Still, there are opportunities for investors since some sectors traditionally fare better than others in a post high-inflation cycle.

“These include infrastructure, energy, manufacturing. Of course, banks, consumer-retail [sector] will perform even better as business and consumer sentiment improves, barring further black swan events,” Roces said.

Narvaez gave similar advice, noting that he favored power and consumer stocks.

Like Roces, he said external factors would play a key role in determining the market’s direction.

Maybank Securities, on the other hand, is “positive on the banking, property, transport and gaming sectors, as well as some select conglomerates,” said De Jesus.

“As an equity investor, I would pay close attention to labor supply tightness in the US and interest rates, particularly US monetary policy,” Narvaez said.

“I believe the latter will play an outsized role in driving interest in and flows into the Philippine equity markets. On the back of a more stable rate environment, we believe the market may enjoy more interest and flows especially in [the fourth quarter of 2023],” he added.