Southeast Asian PE deals slowed in 2022 but macro fundamentals robust

Southeast Asia’s private equity (PE) market saw a slowdown in deal activity in 2022 given a natural reaction to the global macro climate. Increasing interest rates, a softening economic environment and general uncertainty over the future have all made it more challenging to get deals done. However, the region’s long-term macro fundamentals remain strong and will be an attractive place to deploy capital, according to Bain & Company’s Southeast Asia Private Equity Report 2023.

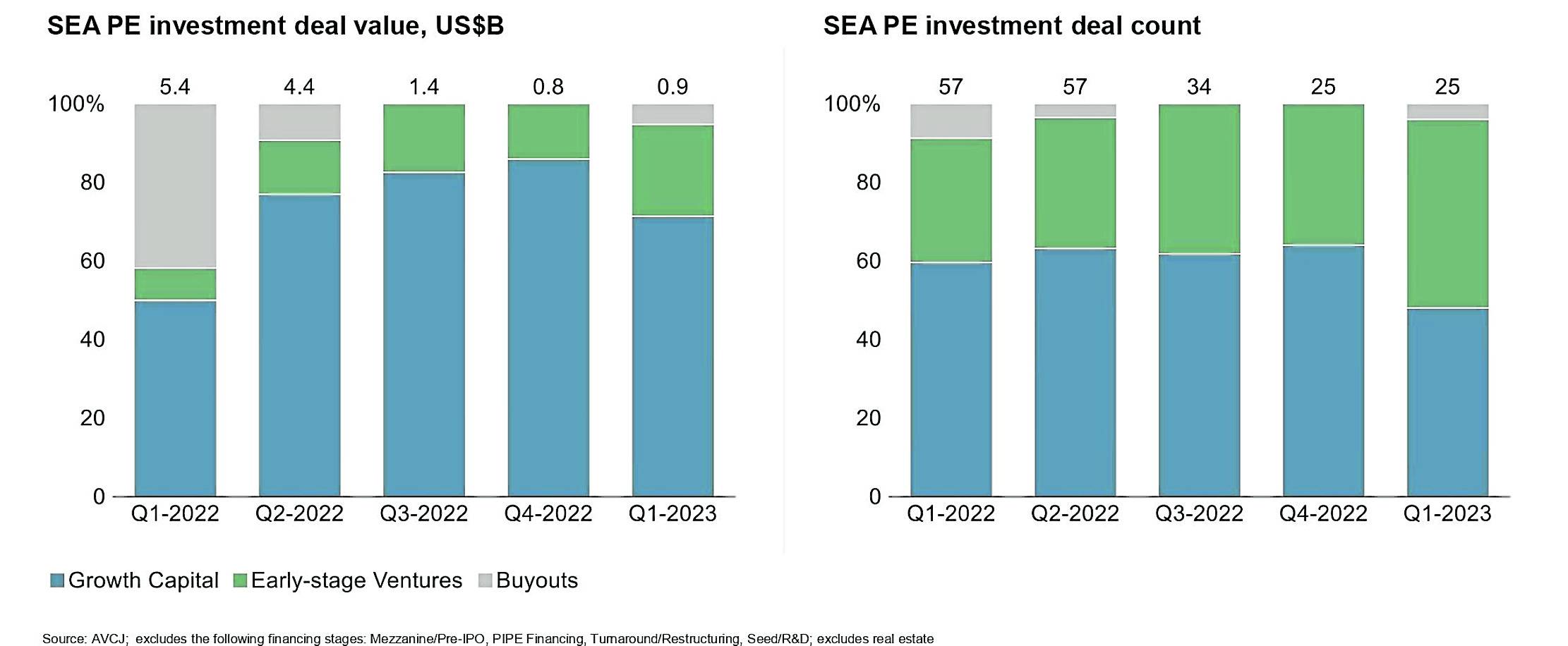

Deal value in Southeast Asia saw a fall of 52 percent in 2022 compared with the previous year, with deal count also declining 15 percent. Activity in the region was strong through the first half 2022 and matched 2021 activity levels before falling by mid-year, owing to an economic slowdown, which collided with mounting global and regional uncertainties to produce a perfect storm for investors. Growth deals continued to account for majority of activity in the region in 2022, with the largest relative declines occurring in the buyout sector.

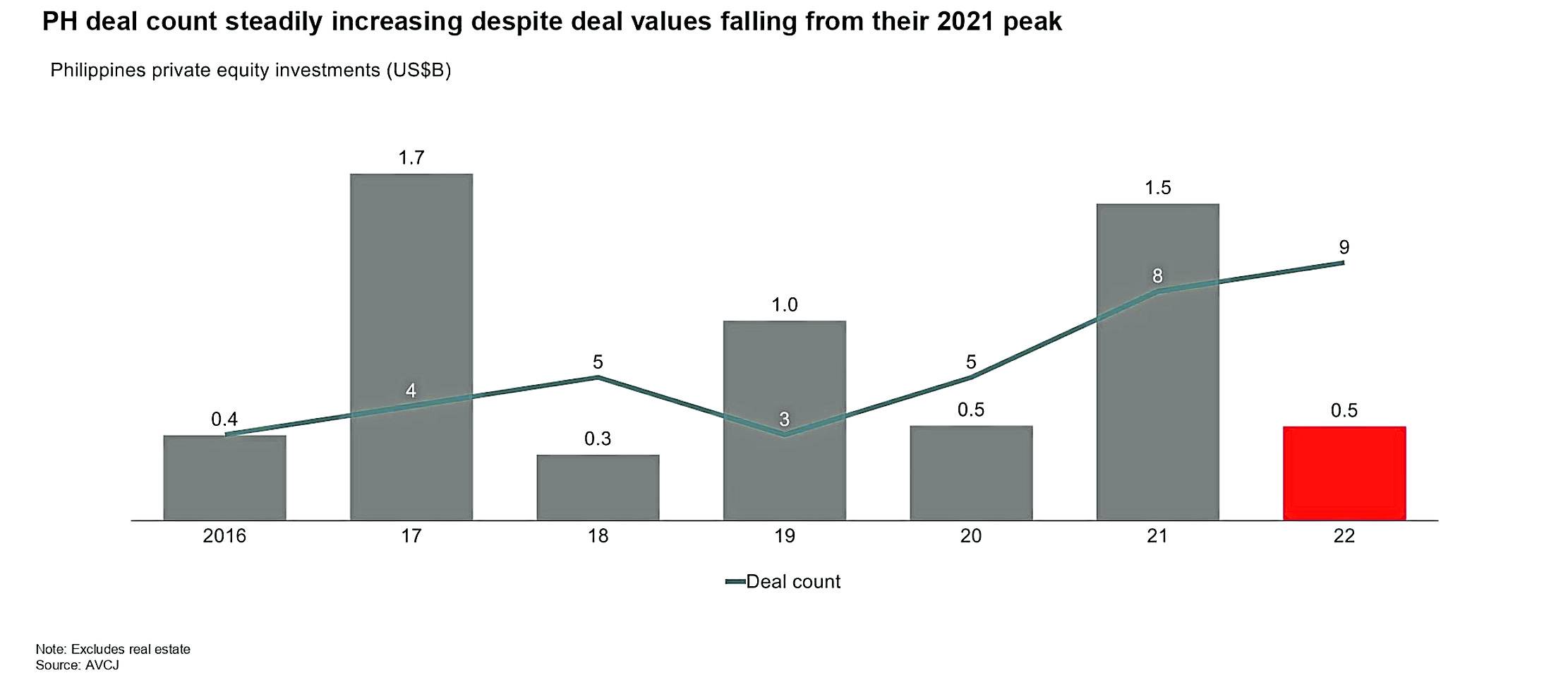

PH PE deal activity relatively modest

PE deal activity in the Philippines was relatively modest in 2022; deal count saw a steady increase despite deal values falling from their 2021 peak.

Singapore and Indonesia continued to attract the bulk of investment capital in Southeast Asia in 2022, accounting for over 80 percent of the region’s deal value and deal count, but activity across all regions declined during the year. Internet and tech continued to lead as the primary investor sector in each country, with health-care and financial services positioned as the second and third largest sectors across geographies.

Exit value in the region also fell 46 percent year-on-year as investors struggled with the re-rating of public market valuations, deteriorating portfolio performance and fewer avenues for exits given the decline in initial public offerings.

Article continues after this advertisementSector perspectives

The internet and tech sector saw fewer large-ticket investments and lower overall activity levels in 2022 versus 2021 but still accounted for the largest share of deals done in the region, accounting for 55 percent of total deal volume in the region in 2022. Most of the deals done in the Philippines have been internet and tech-related, followed by financial services.

Article continues after this advertisementBeyond the internet and tech sector, several other areas continued to attract capital in Southeast Asia. One to highlight is health care, which has seen continued investor interest on the back of clear secular trends (e.g., aging populations and rising affluence) and innovation across the value chain (e.g., emerging models outside of the hospital and new digital health tools).

Bain also sees opportunities in the broader energy transition space and generative artificial intelligence (AI). For Southeast Asian countries to meet their long-term carbon reduction goals, there needs to be investment across sub-sectors such as energy production, agriculture and waste management. Private equity and financial investors should also anticipate the impact of generative AI to be far-reaching, and leading players will be those that leverage on generative AI to drive returns. It will be critical for investors to get ahead of threats and opportunities to existing portfolio companies and potential investments that might be impacted in varying ways.

Outlook

Despite near-term uncertainty, the long-term outlook for private capital investment in Southeast Asia remains positive. Bain’s analysis showed that macroeconomic conditions in the region have been more resilient than the rest of Asia Pacific. Real gross domestic product growth continued to be strong while inflation-related indices remained moderate. In addition, ongoing geopolitical tensions between the US and China will continue to create opportunities for Southeast Asian businesses.

As always, the challenge for investors will be on doing the basics well—sourcing good deals and driving value in their portfolio companies. Most investors we spoke to in Bain’s annual survey do not think that multiple expansions will remain a key driver of sustainable returns due to high interest rates and pressure on asset valuations in both public and private markets. Under today’s volatile macroeconomic environment, investors have begun taking steps to shift their value creation emphasis to cost-focused efforts to create meaningful value. —CONTRIBUTED

Singapore-based Usman Akhtar is a senior partner and head of the Bain’s Southeast Asia Private Equity practice.