On a quest to make health care ‘smarter’

When tech-savvy Jaeger Tanco took the helm of Philhealthcare Inc. (PhilCare) six years ago, he knew he had to work hard to prove himself while navigating the highly competitive health and maintenance organization (HMO) industry.

He had never worked outside the family business. Right after earning his entrepreneurial management degree from the University of Asia and the Pacific, he joined STI Education and pursued his Master of Business Administration degree at the Ateneo de Manila University.

After seven years of handling schools and business development at STI, the only son of businessman Eusebio Tanco was tasked to fill the leadership vacuum at PhilCare—at a time when the pioneering HMO wasn’t at its most enviable footing.

But these days, the 42-year-old Tanco has gained all the confidence of a seasoned and discerning president and CEO.

He has led PhilCare, whose tagline is “health care made smarter,” to harness technology to improve sales and customer experience and innovate to make health care inclusive. He has also unlocked the potential of partnerships to enhance PhilCare’s ecosystem.

Article continues after this advertisementIn 2022, PhilCare’s premium breached the P3-billion mark from just P950 million in 2009 when the Tanco group bought the former Philam Care following the Wall Street-epicentered global financial crunch that had ravaged AIG.

Article continues after this advertisementMembership base has doubled to 400,000 from about 200,000 since then. Net profit last year was estimated at P141 million. PhilCare maintained profitability even when the COVID-19 pandemic erupted. Total assets are now nearing the P4-billion mark.Tanco has also taken on leadership roles at other insurance companies within the group: CEO of Philippine Life Financial Assurance Corp., chair of PhilPlans First and director of PhilsFirst Insurance Corp.

He founded several firms: Comm&Sense, an award-winning public relations agency and its sister company, Roar Agile Communicators, as well as technology firm Stitch Tech Solutions, which offers cloud, enterprise resource planning and other tech solutions.Filipino-focused

He brings his affinity for tech to flesh out PhilCare’s mission to design health-care plans that anticipate the needs of Filipinos. It is a tricky business, after all, not one that can be put on auto-pilot mode. The aggressiveness to grow market share has been tempered a bit, Tanco says in an interview with Sunday Biz.

“The HMO business is so competitive that in a lot of ways, it becomes a price war. And in health insurance, when you bag a new business, it’s not [automatic] that you get an income. When your [members’] utilization is high, you could lose money. If you try to get market share, it will drain your income,” he explains.

As such, he says, it’s important for PhilCare to generate new business from high-quality corporate accounts while growing its retail segment.

“Starting 2017, we’ve tried to go more tech-savvy in terms of sales and servicing existing clients,” Tanco says. PhilCare thus developed Hey Phil app, which uses artificial intelligence to help members find a doctor and hospital, create letter of authorization for utilization of services, queue automatically and consult digitally.

“The vision is to create an ecosystem. From the time you get sick, use the app to have your telemedicine consult, buy teleconsult [service] through our prepaid card, get a prescription, eventually buy your medicine and have it delivered to you,” he says.To date, PhilCare is affiliated with more than 48,000 physicians and 1,600 hospitals and clinics nationwide.

‘Sachet’ plan

The Philippines is a prepaid market in telecommunications but will the same sachet solution work in health care?

Tanco has been overseeing the PhilCare Wellness Index, the first and only nationwide study on the health and well-being of Filipinos since its inception in 2014. The study has led to a suite of innovations, including the first prepaid health cards and mental health programs for employees in the country.

“It’s challenging but we try to target a different market,” Tanco says.

Initially, PhilCare’s prepaid cards focused on preventive services, like annual physical examinations and other medical checkups. Now, they include medical treatment and accident benefits. For instance, there’s a P599 “Dengue Assist” plan and a P1,999 “Dengue RX Plus for family.” For P3,750, there’s “Health Vantage 40 for Adults,” a multiple-use health care card that provides coverage of up to P40,000 for emergency care and hospitalization for viral and bacterial illnesses, treatment of injuries resulting from accidents (except for stroke) in accredited hospitals.

“What we wanted to do was [to have] no underwriting, because it’s where the process takes long. You must get a physical exam etc,” he says.

But how does PhilCare manage its risks if the process of establishing pricing for insurable risk is waived? There are certain safeguards, according to Tanco, like the waiting periods for treatment as well as clear-cut exclusions.

Theirs is an asset-light business model. “HMOs usually want to put up their own clinic, but in our case, we just partner with ones that already have clinics,” he says.

New alliances

Parent firm Maestro Holdings recently teamed up with Reliance United, a subsidiary of Unilab, to give PhilCare members access to the latter’s full-service HealthFirst Clinic.“It further reflects our commitment to not just provide quality and smarter health care to our members, but to also make it more accessible in terms of costs and location,” he says.

HealthFirst Clinic has branches in Mandaluyong, Cubao, Cebu, Alabang, Eastwood and BGC.

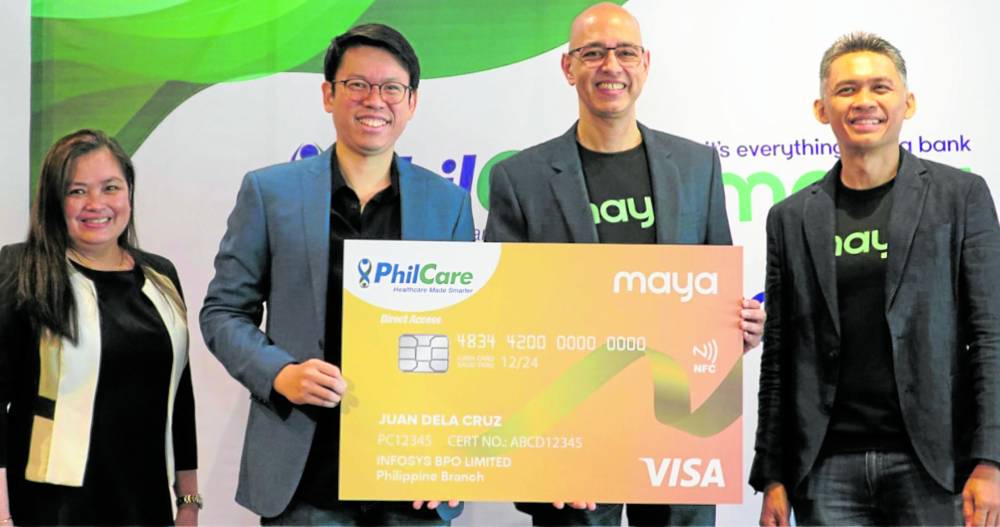

ALL-IN-ONE CARD (From left) PhilCare vice president for operations Eilyn Ayuste, Jaeger Tanco, Maya Group president Shailesh Baidwan and Maya Bank president Angelo Madrid -contributed photo

PhilCare has also partnered with digital bank Maya to launch an innovative all-in-one card that combines health-care and digital financial services. As an HMO ID, the PhilCare-Maya card gives its members access to more than 1,700 accredited medical providers throughout the country. The card also allows members to complete medical reimbursements from any ATM. At the same time, it serves as a lifestyle payment card for purchases and as a privilege card for rewards and vouchers from affiliated merchants. By linking the card to the Maya app, users can enjoy the full suite of Maya services, including high-interest savings, e-wallet, credit and investments solutions.

“Partnering with Maya will surely push us to the next level of digital service,” he adds.

Inclusive

In the future, Tanco says PhilCare wants to put therapeutic packages in its HMO. “Maintenance medicine is currently not included. What we want is to include it in the package. Some people, for instance, already know they have high blood, but they can’t buy medicine.”

If the recent string of merger and acquisition deals in this sector is any indication, the HMO space has become more interesting these days, especially after more than two years of lockdowns as the world battled the COVID-19 public health crisis. Tanco says PhilCare is open to taking in equity partners “as long as they have the same vision.”