Oil slips on demand fears, market awaits Fed decision

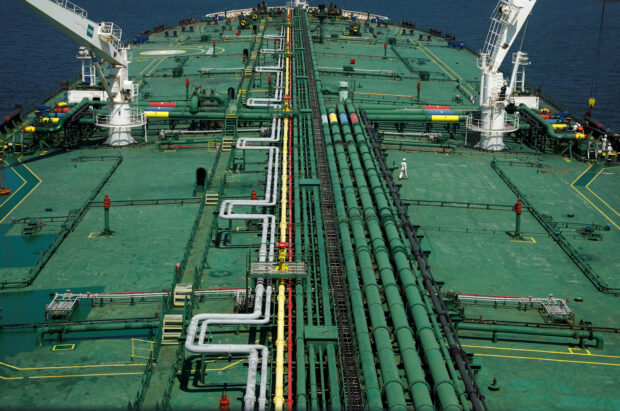

Pipelines run down the deck of Hin Leong’s Pu Tuo San VLCC supertanker in the waters off Jurong Island in Singapore July 11, 2019. REUTERS/Edgar Su

LONDON -Oil prices edged lower on Wednesday following fresh indications of weak demand, and as the market awaited a crucial interest rate decision by the U.S. Federal Reserve.

Brent crude futures , which have risen by almost 3 percent this week, were down 30 cents, or 0.40 percent, at $75.02 a barrel at 1026 GMT. U.S. West Texas Intermediate (WTI) crude futures were down 29 cents, or 0.42 percent, at $69.38.

Data from the American Petroleum Institute on Tuesday called demand into question after it showed an unexpected rise in U.S. crude inventories last week, sources said, defying analyst estimates of a decline.

Official data from the Energy Information Administration, the statistical arm of the U.S. Department of Energy, is due at 10:30 a.m. (1430 GMT) on Wednesday.

Further price weakness followed an unexpected rise in UK inflation in February, raising fears of further interest rate hikes a day before the Bank of England announces its latest interest rate decision.

The market will be seeking direction from the U.S. Fed’s Federal Open Market Committee (FOMC), which announces its decision on interest rates at 1800 GMT.

The expected rate hike of 25 basis points is a turnaround from the steep 50 basis point rate rise anticipated before the recent banking turmoil, triggered by the collapse of two regional banks.

“It would be a big shock if the Fed reverted back to larger rate hikes now considering everything that’s happened this past couple of weeks,” said Craig Erlam, senior market analyst at OANDA.

Brent prices hit their lowest last week since 2021 on concern that the rout in bank shares could trigger a global recession and cut fuel demand.

An emergency rescue of Credit Suisse over the weekend helped revive oil prices.

READ MORE:

Oil prices hit lowest levels since 2021 on banking fears

Oil prices stabilize as banking deal eases some worries about crude appetite