Leaving on a jet plane: Travelers’ bags are packed–but is PH ready for them?

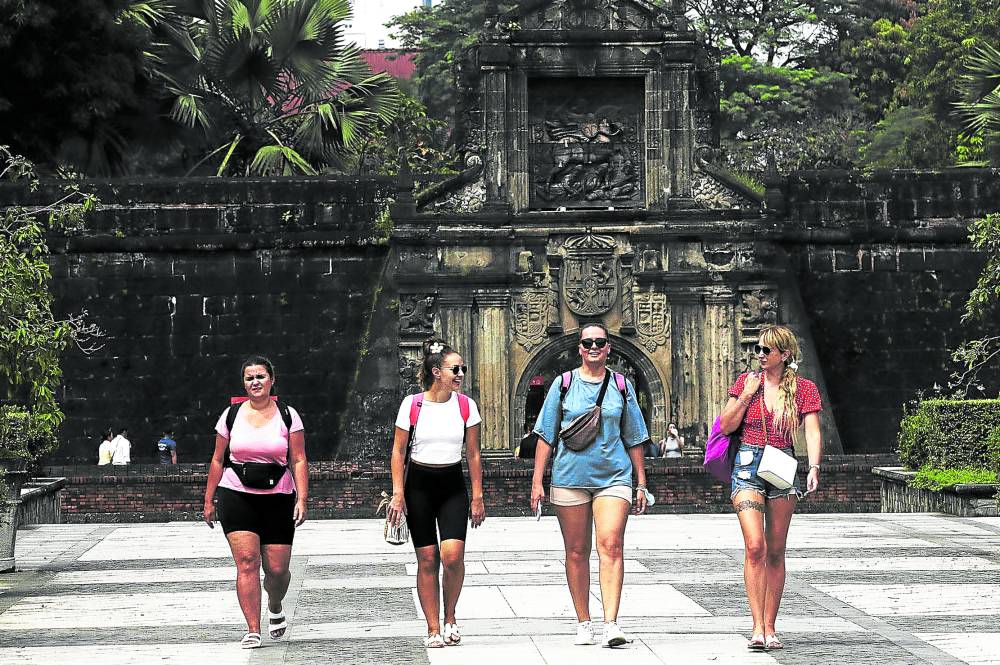

THEY’RE BACK! Russian tourists visit Fort Santiago in Intramuros, Manila, as international borders reopen in this photo taken last November 2022. —RICHARD A. REYES.

As travelers pack their luggage for their next trip, local airlines are also preparing to spread their wings. Hotels, meanwhile, are welcoming more guests as the tourism sector claws its way back to prepandemic vibrancy.

The runway has become busier now after years of mobility restrictions due to the COVID-19 pandemic. Passengers’ confidence toward travel has also returned—and heavier traffic is expected at airports moving forward as travelers take advantage of the further reopening of international borders.

“We carried close to 10 million passengers in 2022 and are expecting growth from market recovery and incremental capacity,” Cielo Villaluna, spokesperson for Philippine Airline (PAL), tells the Inquirer.

Steve Dailisan, head of communications and public affairs of AirAsia Philippines, says the budget carrier is looking at doubling the 4.178 million guests it flew in the past year.

“A big factor for this is the opening of international borders for leisure travel and the public’s positive sentiments on revenge travel,” he tells the Inquirer.

The increasing mobility is boding well for the tourism sector, including the hospitality industry.

“Aside from the domestic tourism push, we see the influx of more international tourists boosting tourism receipts, hotel rates, and occupancies,” says Joey Roi Bondoc, research director at property consultancy firm Colliers.

The Department of Tourism projects foreign tourist arrivals to reach 4.8 million this year with the return of travel confidence and easing of mobile restrictions. Last year, it reached 2.7 million, beating the government’s 1.7 million target.

Flight capacity restoration

To address the increasing demand for air travel, local carriers have been ramping up flight capacity since last year.

The flag carrier is heading toward its goal of fully restoring its network to prepandemic levels, banking on the momentum of the passenger traffic. Forward bookings, Villaluna says, have been on the resurgence—a “positive indicator” that recovery continues.

In January, PAL received an additional aircraft, an Airbus A330, as it gears up for the expected heightened demand for air travel for the upcoming summer season when people travel for vacation. It will service routes to Hawaii, Australia and several destinations in Asia.

PAL has also been beefing up its flight capacity at Clark International Airport, relaunching flights from the Pampanga gateway to Caticlan and Busuanga by April.

“Since the reopening of local borders for leisure travel, beach and island destinations, and other domestic attractions with activities have become the most visited destinations among our guests,” Dailisan says.

AirAsia, as such, is anticipating delivery of additional 10 aircraft this year as it is on the quest to reopen more international routes.

Tony Fernandes, CEO of AirAsia parent firm Capital A, says they are seeing the full restoration of flight capacity this year, driven by the further reopening of the economy, especially the tourism sector.

By March, budget carrier Cebu Pacific is set to operate all routes that had been suspended due to the pandemic-induced restrictions.

The Gokongwei-led airline currently accommodates about 350 flights per day on average, which is nearing the 380 to 420 daily flights prior to the pandemic. Last year, it flew nearly 15 million passengers, a marked growth from just 3.3 million passengers in 2021.

Cebu Pacific will also receive 10 more new aircraft this year: three A320neo, three A321neo and four A330neo.

Meanwhile, all the airlines have restarted their flights to China, one of the most popular destinations in the world, as the Asian country welcomes back guests again after years of lockdown.

International aircraft leasing company Avolon says global aviation traffic is expected to keep its momentum with Asia driving the growth for air travel demand with the reopening of China. It sees passenger movement recovering to prepandemic levels by June given the further mobility.

Hotel occupancy

Of course, hotel rooms are being booked by the travelers, apart from their flights.

Hotel occupancy rate is projected to grow to 60 percent this year from 55 percent in 2022 due to the anticipated surge in domestic and foreign travelers, Colliers says. This figure is estimated to reach 70 percent on average until 2025.

The property expert notes that occupancy has gone up in the second half of last year, thanks to holiday spending and more Filipinos arriving from abroad.

“The recovery in foreign arrivals and surge in meetings, incentives, conferences and exhibitions (MICE) activities also helped drive the demand for hotels during the period,” it explains.

In its study, Colliers shares that property developers have been looking outside Metro Manila to build their hotels as they maximize opportunities arising from pent-up travel demand.

Among the hotels to be built are located in Mactan, Bacolod, Boracay, Davao, Bohol, Palawan and Pampanga.

Opening more doors

The property consulting firm expects construction of 4,140 rooms this year. Last year, 1,449 new rooms were completed, which were higher compared with 720 recorded in 2021. “From 2023 to 2025, foreign brands are likely to account for 42 percent of the new hotel supply in Metro Manila,” it adds.

Colliers advises hotel operators to monitor the progress of the airport constructions as well in the country.

“These projects should provide impetus for developers to expand leisure presence.”

The Department of Transportation is targeting to complete several regional airport projects worth P1 trillion this year.

These include the construction and enhancement of Tuguegarao Airport, San Vicente Airport, Tacloban Airport, Antique Airport, Bacolod-Silay Airport, Catbalogan Airport, Davao International Airport, M’Lang Airport, Sanga-Sanga Airport and Ozamis Airport.

Currently, major airport projects in Cavite and Bulacan are under development. These are envisioned to become alternative gateways to the congested Ninoy Aquino International Airport.

Price tags

Booking a flight and staying at hotels come with a cost—and these are expected to go up along with the increase in consumer demand.

The Civil Aeronautics Board raised fuel surcharge in March to level 7 from level 6. Under level 7, passengers will pay fuel surcharge amounting to P219 to P739 for domestic flights and P722.71 to P5,373.69 for international flights.

These rates are higher compared with level 6 pricing: P185 to P665 for passengers flying locally and P610.37 to P4,538.40 for those boarding international flights.

Fuel surcharges are additional fees collected by airlines to help them recover fuel costs. These are separate from the base fare, the actual amount paid by the passenger for each seat.

The average daily rates (ADRs) for hotels, meanwhile, are estimated to increase by 6 percent due to greater demand this year, according to Colliers.

Last year, the rates grew by 14.1 percent on average, exceeding the 8-percent improvement projected by the property expert. This showed a turnaround from a cumulative drop of 20 percent in 2020 to 2021.

“Five-star hotels recorded the fastest growth in ADRs, indicating strong demand for top-tier hotels in key business hubs and the gradual return of business travelers and in-person corporate events,” Colliers explains.