Makati City padlocks Smart head office over P3.2B in unpaid taxes, lack of business permit

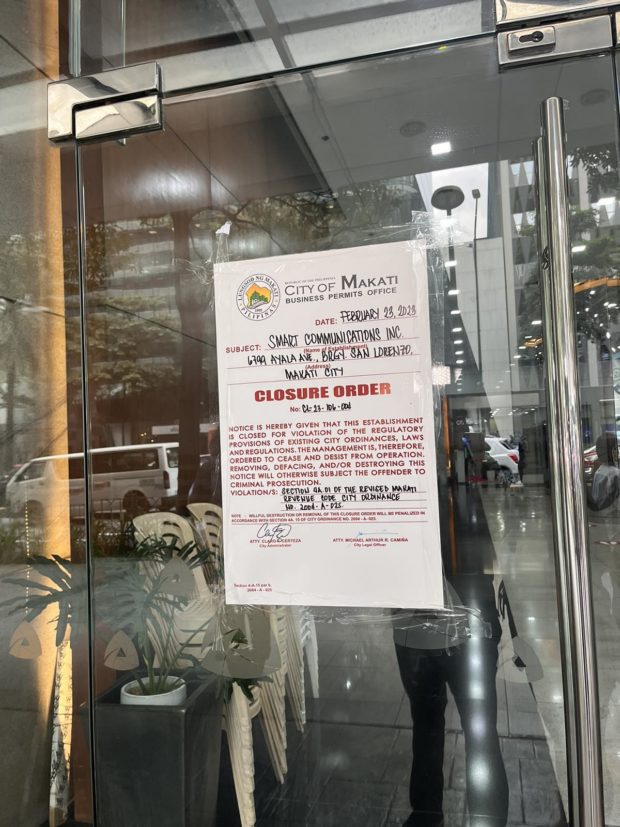

Makati City personnel post closure order on glass door at Smart office entrance. -Contributed photo

The local government of Makati City on Monday morning padlocked the headquarters of PLDT’s mobile phone service unit Smart Communications Inc. for allegedly having billions of pesos worth of unpaid taxes and for operating without a business permit over the last four years.

In a statement, Makati officials said Smart has, to date, “failed to settle or obtain any relief from the courts over its franchise tax deficiency worth over P3.2 billion covering the period January 2012 to December 2015.”

“When businesses in Makati choose to operate without a valid business permit, they are essentially operating outside the law,” City Administrator Claro Certeza said. “This is unacceptable, and I want to make it clear that we will not tolerate this kind of behavior, whether you are a big or small company.”

“You are hereby commanded to cease and desist from further operating your business establishment until such time compliance with the said ordinance is made,” read the the closure order issued last week and posted this morning at the entrance of Smart’s Ayala Ave. headquarters.

Closure order posted — Contributed photo

The case stemmed from an examination launched by the Office of the City Treasurer in 2016, which concluded that Smart owed the city government over P3.2 billion in franchise tax over the four-year period.

Certeza said the city had requested Smart to submit a breakdown of revenues and business taxes paid in all branches nationwide, but the telecommunications giant refused to present the documents.

In 2018, Smart filed a petition for review before a Makati Regional Trial Court seeking to nullify of the Office of City Treasurer’s Notice of Assessment, which states that the telecommunications giant did not pay the franchise tax.

During the trial, Makati City filed a motion for production and inspection of documents, which the court granted. However, in 2019, Smart filed an opposition against Makati’s motion and challenged the court’s decision before the Court of Tax Appeals (CTA).

In 2022, CTA denied Smart’s petition and affirmed the decision of the Makati RTC.

Smart argued that the city has no jurisdiction to audit the company’s financial statements and operations in other branches nationwide, adding that it had submitted all records related to its operations within the city and paid the necessary taxes.

The CTA, however, said Makati has the authority to investigate Smart’s entire operations under the Local Government Code.

RELATED STORY: