Pandemic spawns small businesses that are here to stay

ENTREPRENEURSHIP DRIVE Four in 10 Filipino respondents established new businesses during the lockdowns and half of them are thriving postpandemic. — Manulife Philippines

“I did not plan to put up a business during the pandemic because from my point of view, it was really very risky,” recalls Donatella Chua, a foodie whose brand and moniker as the “The Croissant Lady” came full circle during the pandemic.

Figuratively baked in the fire of the health crisis, Chua’s croissant business came about in April of 2021 as mere happenstance, beginning with her sweet craving for a Viennoiserie sweet roll she had tasted in prepandemic times.

“I was recalling the best pain au chocolat I’ve ever had in my life. It was in a hotel breakfast during my business travel in Ireland last 2019,” she reminisces of its taste. But because she could not find any local supplier that could measure up, she decided to dip her hands into making these delicious pastries.

Today, she bakes anywhere from 200 to 300 pieces of her artisanal pastries daily, including her widely sought-after “croissaymada”—a buttery, sugary and cheesy combination of a croissant and an ensaymada. Apart from selling baked products, she also supplies ready-to-bake croissants for those who would like to serve or eat them fresh from their own ovens.

While her goodies are mostly for delivery, her newfound success has allowed her to open a cozy private kitchen in Makati (a secret space at the back of the showroom of culinary and hospitality clothing supplier Chef Works, her older venture) where she also offers croissant-themed tasting menu for small groups. Among her unique creations are croissants with dinuguan as well as those with kimchi and cheese fillings.

She plans to open up her brand for franchising in the future.

This story of “The Croissant Lady” is among the multitude of people whose businesses were able to take form and take off during one of the most tumultuous times in history.

CROISSANT LADY Donatella Chua hosting a tasting menu —FILE PHOTO

Opportunity amid crisis

According to a research done by the Philippine unit of Canada-based insurance giant Manulife Financial Corp., about four in 10 Filipinos established new businesses at the height of the COVID-19 pandemic lockdowns.

The study, titled “Filipino entrepreneurship and the bayanihan spirit: The resurgence of micro and small businesses in the Philippines,” surveyed 500 people nationwide aged 18 to 55 in May of 2022. It offers insights into the inspiring world of how micro, small and medium enterprises (MSMEs) have flourished during the pandemic.

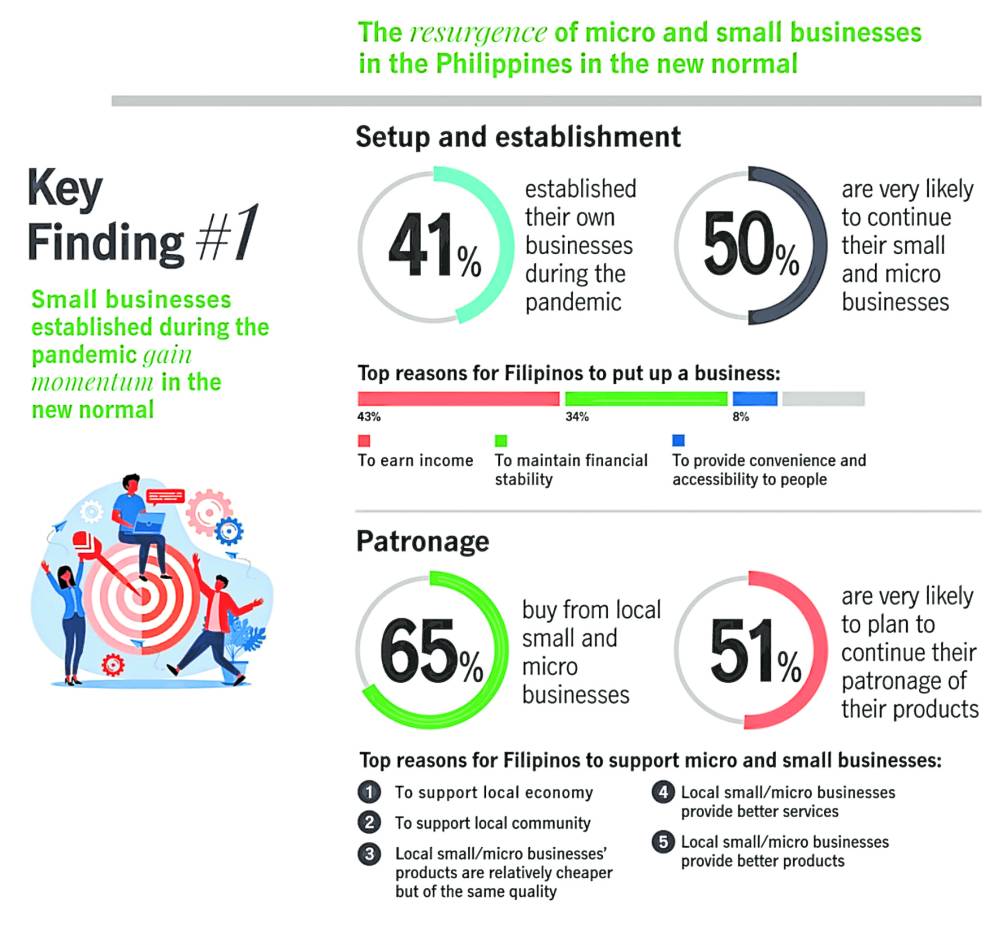

According to Manulife Philippines, 41 percent of respondents started businesses during the pandemic, with up to 50 percent of them saying they are very likely to continue their operations in the new normal.

For 43 percent of those people, the main reason for starting a business is to earn income; 34 percent, to maintain financial stability, and 8 percent, to provide convenience and accessibility to people.

The same study also looked at the kind of businesses started during the pandemic. Some 41 percent, or the biggest bulk, went into food processing, while 30 percent started retail businesses and 24 percent went into the delivery of essential goods and services.

The Manulife research also found that Filipino consumers have patronized these businesses, with 65 percent of respondents saying they have availed of products and services from these MSMEs. Bayanihan or community spirit is cited as a strong motivator.

Of this number, 51 percent say that they are very likely to continue their patronage.

Seeking security, protection

With the emergence of these new businesses and the dynamics that the pandemic has brought, Manulife Philippines says interest in insurance products among new business owners increased during the health crisis.

“This study’s findings coincide with our previous studies that show how the pandemic spurred significant behavioral shifts among Filipinos, including business owners, regarding their finances,” says Melissa Henson, chief marketing officer of Manulife Philippines.

“The socioeconomic disruptions Filipinos experienced in the past two years drove increased interest in purchasing life insurance as a financial safety net. Manulife aims to respond to this growing demand by offering relevant and affordable solutions that can give them the protection and financial security that they deserve,” she adds.

Manulife Philippines notes that life insurance has emerged as the top financial product, as cited by 40 percent of the respondents.

This is followed by medical, health, or accident insurance with 36 percent and nonlife insurance with 17 percent.

Moreover, 41 percent of respondents say they intend to buy life insurance in the next 12 months. INQ