In the Philippine tourism sector, optimism is definitely trouncing pessimism.

The rise in foreign and local tourists indicates that Philippine tourism is well on its way to recovery. Actual arrivals and receipts are breaching the Department of Tourism’s targets, while average daily rates (ADR) and occupancies are picking up.

In our view, the reopening of China, construction and modernization of more airports, and development of new hotels within and outside Metro Manila should further boost the sector. The Philippine Senate’s proposal to amend the Holiday Economics Law, the executive department’s plan to provide value added tax (VAT) refunds to tourists, and the DOT’s continuing initiatives should also give domestic tourism a much needed boost.

Colliers Philippines is optimistic that this recovery story should entice more developers to bring in more foreign hotel brands and expand homegrown ones.

Popularity of key destinations outside MM

Colliers Philippines believes that key tourist destinations outside Metro Manila will benefit from the surge in local and international tourists.

In our view, now is an opportune time for hotel developers to expand footprint in key locations including Cebu, Davao, Iloilo and Clark in Pampanga. Resort-oriented developments as well as business hotels are likely to thrive now that occupancies and average daily rates are increasing.

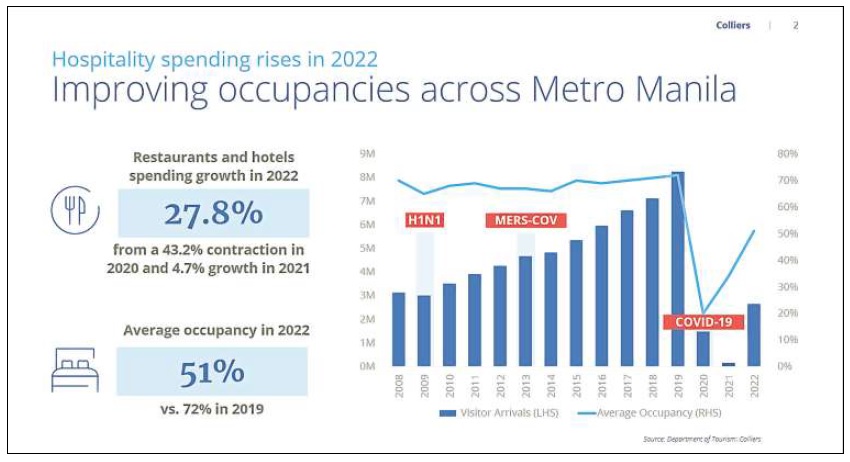

Filipinos’ propensity to spend on leisure is also improving. Latest data from the Philippine Statistics Authority (PSA) indicate that Filipinos are now willing to spend again on restaurants, hotels, and related establishments. The restaurants and hotel segment expanded by 27.8 percent in 2022 after contracting by 43.2 percent in 2020.

Explore REITs to expand leisure presence

Colliers believes that hotel real estate investment trusts (REITs) will likely be an attractive option for developers on expansion mode especially now that the tourism sector is slowly recovering.

In our view, REIT proceeds from hotel assets can be used by developers to acquire foreign brands or establish/expand homegrown ones.

The development and modernization of more international airports across the Philippines should further raise the attractiveness of hotel REITs. Modern, expansive airports should attract more tourists and boost the capacities of air transport facilities.

More hotels outside Metro Manila

Developers have been building new hotels in key locations outside the metro as they capitalize on pent-up travel demand from local and foreign tourists.

Some of the new hotels in the pipeline include those in Mactan, Bacolod, Boracay, Davao, Bohol, Palawan, and Clark in Pampanga. In our opinion, hotel operators should also monitor the construction and upgrade of airports across the country. These projects should provide impetus for developers to expand leisure presence.

Arrivals exceed target

Data from DOT showed that tourist arrivals reached 2.65 million in 2022, up 1,519 percent from the 163,879 visitors recoded in 2021. This also breached the DOT’s projection of 1.7 million arrivals for the year. Among the top source markets in 2022 include the United States, South Korea and Australia.

In 2023, DOT projects foreign arrivals to reach 4.8 million–still lower than the record-high 8.2 million arrivals in 2019, but indicative of optimism in the market.

The DOT reported that about 5.23 million tourism-related jobs were generated in 2022, while revenues reached P209 billion, up 2,465 percent year-on-year. This year, the DOT expects tourism revenues to reach P319 billion.

Colliers sees these gains accelerating tourism’s contribution to the Philippine economy, which peaked at 12.8 percent in 2019 before plunging to 5.1 percent in 2020.

Improving occupancy

In H2 2022, average hotel occupancies in the capital region reached 55 percent, higher than the 47 percent recorded in H1 2022 and 44 percent in H2 2021. Colliers attributed the rise in occupancies to the holiday season and return of more Filipinos working abroad.

Recovery in foreign arrivals and surge in meetings, incentives, conferences and exhibitions (MICE) activities also helped drive the demand for hotels during the period.

For this year, Colliers expects average hotel occupancy in the capital region to breach 60 percent, driven by the influx of more foreign visitors and continued growth from the local staycation market.

The resurgence of in-person events should also lift the demand for MICE facilities. Business hotels are likely to see better occupancies in 2023 due to the return of face-to-face conferences.