Inflation movements to set policy rates, says BSP

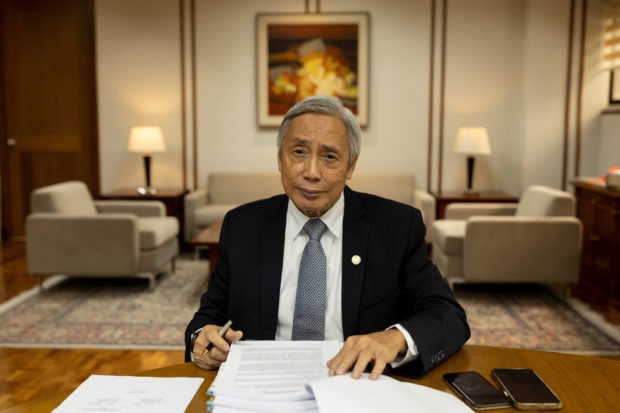

FILE PHOTO-Bangko Sentral ng Pilipinas Governor Felipe Medalla poses for a photograph in his office at Manila, Philippines, November 18, 2022. REUTERS/Eloisa Lopez

Amid expectations that inflation in the Philippines slowed in January albeit still high, Monetary Board Chair Felipe Medalla said policymakers’ decision on interest rates would continue to be determined by the domestic situation instead of events abroad.

“The next meeting will focus on inflationary expectations in the Philippines, not the United States Federal Reserve’s 25-basis-point rate increase [that was announced last week],” Medalla told reporters over the weekend.

Varying forecasts from private-sector analysts for the January print range from 7.2 percent to 8 percent, slower than the 8.1 percent that the Philippine Statistics Authority (PSA) reported for December. The Bangko Sentral ng Pilipinas itself expects January inflation at 7.9 percent, with a forecast margin of 0.4 percentage point either way (higher and lower).

This translates to a forecast range of 7.5 percent to 8.3 percent, which acknowledges the possibility that the January readout might have outpaced inflation in December. The PSA will announce official inflation numbers on Feb. 7.

The economic research team at United States-based Goldman Sachs expects headline inflation to ease very slightly down to 8 percent in January.

Article continues after this advertisementHigher food prices

This means that, comparing month on month price increases, the rate went faster to 0.4 percent in January over December, from 0.3 percent in December over November.

Article continues after this advertisementThe sequential rev-up is “mainly due to higher food prices, especially onions, an increase in electricity and water rates and higher domestic fuel prices,” Goldman Sachs said.

Dutch group ING Bank expects the January print to slide to 7.8 percent and to remain high because supply shortages persist.

“Low domestic production resulted in surging prices for basic food commodities,” ING Bank said. “Meanwhile, still-elevated global energy prices have resulted in high utility costs and rising gasoline prices.”