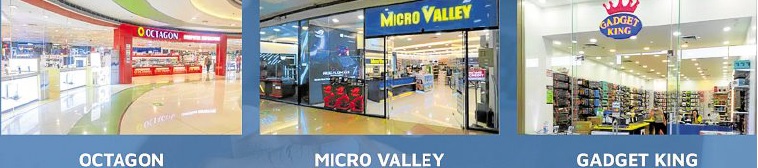

IPO REKINDLED Upson is the country’s biggest consumer electronics retailer based on store

count and revenue. —CONTRIBUTED PHOTO

The country’s biggest retailer of computers and IT equipment has scheduled its P5.4 billion initial public offering (IPO) this March after receiving the go-signal from the Philippine Stock Exchange (PSE).

Upson International Corp., among the companies that deferred listing in 2022 due to challenging market conditions, said in a statement on Monday it would push through with the IPO from March 6 to 10 this year.

Upson is best known today as the operator of mall-based electronics stores such as Octagon Computer Superstore and Gadget King. It was founded by entrepreneurs Ricardo Lee and William Lim as personal computers became an accessible consumer product in the 1990s.

The company is selling as much as 986.83 million stocks at up to P5.50 per share. The final IPO price will be set on Feb. 28, the statement showed.

It is targeting to make its PSE debut under the stock symbol “UPSON” on March 16 this year.

“We are both thrilled and grateful to have received the PSE’s approval for our planned initial public offering. This is a significant milestone as we look forward to sharing our growth prospects with everyone,” said Upson president and CEO Arlene Sy. Upson is raising money to finance the opening of 250 new outlets by 2027, more than doubling its store presence from 200 outlets in September last year.

Growth story

“The expansion includes adding warehouses and distribution facilities strategically located in nine other areas nationwide. The nationwide logistics infrastructure that supplements its retail network is to ensure uniform pricing of its products across all its branches,” Upson said.

The IPO consists of 789.47 million primary common shares and up to 98.68 million secondary common shares to be sold by Upson chair Lawrence Lee. The offer includes an overallotment option of up to 98.68 million common shares.

Data from third party research outlet Center for Research and Communication showed that Upson was the country’s biggest consumer electronics retailer in 2020 in terms of store count and revenue.

The company had begun as a distributor of Logitech and Canon products before the Asian Financial Crisis in 1997 forced it to revamp its business model and enter the retailing segment.

Its stores today have a nationwide footprint and are located in the country’s top shopping malls.

Upson earlier delayed the IPO that was originally set for October last year, saying it was waiting for the release of better financial data in the latter part of 2022.

It said in the prospectus that net income during the first nine months of 2022 had jumped over 68 percent to P400.23 million, while sales were up over 10 percent to P7.03 billion.

First Metro Investment Corp. is issue manager and bookrunner for the transaction, while RCBC Capital Corp. is joint lead underwriter. INQ