Next-gen tycoon upholds Ayala legacy of steward leadership

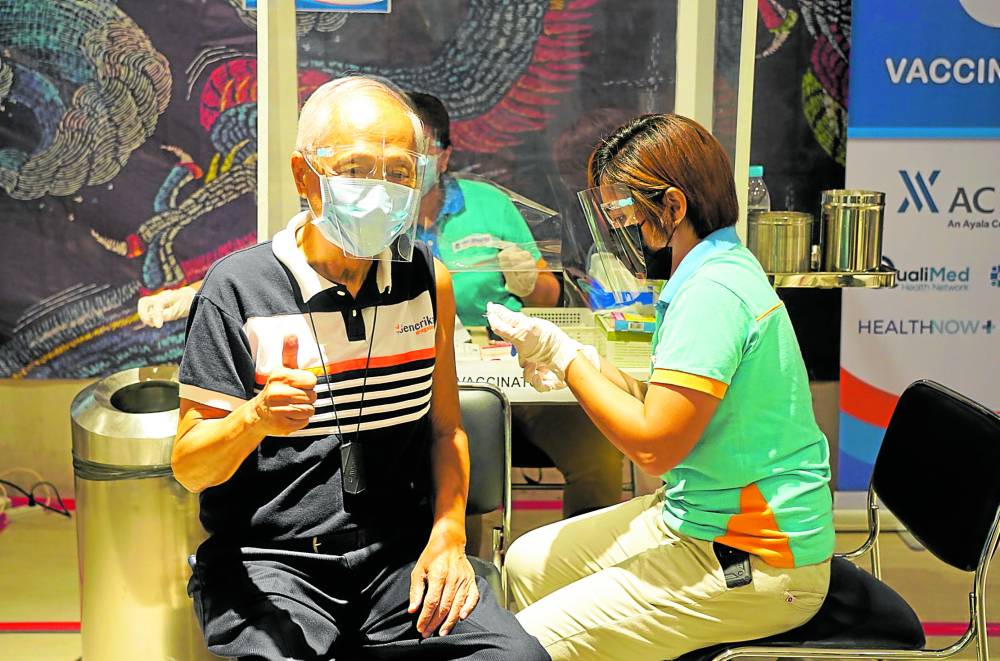

FRONTLINER AC Health helped administer more than 770,000 doses of COVID-19 vaccines.

For demonstrating “notable efforts to create a collective better future for stakeholders, society, future generations and the environment,” Ayala Corp., one of the country’s oldest conglomerates, was deemed worthy to be added to the inaugural Steward Leadership (SL) 25.

SL 25 is an annual listing of initiatives from 25 for-profit organizations that have shown “steward leadership excellence” within Asia-Pacific.

It is presented by Stewardship Asia Centre, INSEAD Hoffmann Global Institute for Business and Society, Willis Towers Watson and The Straits Times.

Ayala Corp. was the sole Philippine company under the conglomerate category to make it to the list—whittled down from 95 submissions—specifically for helping the country withstand the worst of the effects of the devastating COVID-19 pandemic.

In all, the conglomerate that turns 189 years old in March, with interests in banking, infrastructure development, telecommunications and property development, deployed over P24 billion for its holistic COVID-19 response.

Jaime Alfonso Zobel de Ayala, head of business development and digital innovation of Ayala Corp., received the award for the group in Singapore, representing how the eighth generation of the Zobel family at the helm of the conglomerate intends to maintain the commitment to stewardship that has been cited as one of the primary reasons behind Ayala Corp.’s enviable longevity.

In this discussion with the Inquirer, the 32-year-old Zobel, the only son of Ayala chair Jaime Augusto Zobel de Ayala, talks about the value of stewardship and how it is translated into action across the group so it could remain relevant in the years to come.

FETED Jaime Alfonso Zobel de Ayala receiving in Singapore the award for Ayala Corp.’s inclusion in the Steward Leadership 25. —Contributed photos

Q: Considering that Ayala was recognized in part due to its approach to stewardship, of which sustainability is an element, can you describe how Ayala’s approach to sustainability complements its larger commitment to stewardship?

Zobel: Our friends and partners at the Stewardship Asia Centre defined stewardship as “creating value by integrating the needs of stakeholders, future generations and the environment.”

This definition of stewardship carries several elements that are also important components of sustainability—having a long-term orientation; a recognition of how stakeholders are interconnected; being creative and resilient amid challenges; and taking ownership for one’s actions.

This definition is also quite holistic—it not only considers institutions and people here in the present as stakeholders, but also the environment and future generations.

Sustainability and stewardship are both about stakeholder accountability. It is the philosophy that institutions should strive to incorporate the interests of all their stakeholders into their strategic decisions. At the same time, organizations should accurately and properly report the impact that was created by those strategic decisions.

I think that this model of integrating diverse stakeholder interests into strategic decisions is the most effective way for an institution to remain trusted, relevant and enduring. For us at Ayala, we understand that we still have more to do, but we hope to continue executing these principles.

We are honored that the company’s efforts and the impact that these had to our stakeholders were recognized internationally.

CONSUMER DIGITALIZATION GCash has 71 million users as of November 2022

Q: Given that definition, where in the Ayala group do you see stewardship best expressed?

Zobel: I think that stewardship and sustainability are best expressed in initiatives that focus on resolving significant, long-standing problems that people face. I believe that tremendous value can be created for several stakeholders when there is a deliberate effort to genuinely resolve these problems. Let me illustrate some examples in the Ayala Group on how we expressed these principles: Mynt and GCash were established to improve access to financial services, which is a problem plaguing so many Filipinos for several years already. People may not remember this, but GCash started all the way back in 2004 to make financial transactions easier, particularly for the large number of Filipinos who were either unbanked or underbanked at the time. GCash operated at a loss for multiple years, which was, to some extent, concerning. However, despite challenges in the business, we focused on generating high levels of awareness on how the GCash platform can be a lifestyle enabler, aside from being a financial services platform. It took many years, but we are seeing the fruits of these efforts today.

Second, AC Health was established in 2015 to harness private sector resources to provide affordable and accessible primary health care. When AC Health was established, we wanted to be a meaningful help in the persistent challenge of manpower and infrastructure capacity issues in the health care space. I understand that with our 100 million population, we only have 40,000 practicing doctors, 89,000 nurses and 110,000 hospital beds.

When COVID-19 exacerbated these deficiencies, AC Health chose to deploy its resources of clinics and hospitals, pharmacies and telemedicine to a larger national effort led by the government and other institutions. Several of the strategic decisions AC Health made during this national emergency were in the interest of not only resolving an unprecedented global health crisis, but also developing a long-term, trusting relationship with stakeholders, rather than immediate gains.

As a last example, ACEN and the Asian Development Bank collaborated to structure the world’s first Energy Transition Mechanism transaction (ETM). The ETM allows for the early retirement of a 246-MW coal-fired power plant, while recovering P7.2 billion that can be reinvested in renewable energy facilities, while also resulting in up to 50 million metric tons of avoided carbon dioxide emissions.

The ETM is unique in that it helps achieve a just energy transition, not by simply trading away the polluting asset, but by extracting and delivering value to stakeholders over time, as we replace the coal power plant with renewable energy. For Ayala, this brings us closer to our ambition of achieving net zero greenhouse gas emission by 2050.

Banks and investors also had their existing coal exposure converted into an ESG (environment, social and governance)-driven investment that can generate healthy returns. The coal plant’s employees will be guaranteed a just transition through the provision of skills retraining. And lastly, for the community-at-large, the ETM contributes to creating a cleaner and healthier environment.

Jaime Alfonso Zobel de Ayala

Q: There have been critics of ESG standards, raising issues of credibility in sustainability reports, and that these issues are not really prioritized by investors and consumers. Would you agree or disagree? Why or why not?

Zobel: In his annual letters to CEOs, Larry Fink, chair and CEO of BlackRock, often talks about the power of stakeholder capitalism and a strong adherence to ESG principles to advance social progress and environmental conservation. As the head of one of the largest investment firms in the world, I think that is a strong expression of support from the investing community on the value of ESG and stakeholder centricity.

Furthermore, we have seen increasing interest, most especially in the younger generation, to see how the products they consume are produced and how companies are making a meaningful impact to society and the environment. Today, businesses seem to not only exist just for the purpose of profit alone, but for so much more.

ESG standards and stakeholder centricity present a good path toward making companies more inclusive, and socially and environmentally responsible. However, this should be accompanied by transparent and accurate measurement and reporting. Again, this is all part of this principle of stakeholder accountability that sustainability and stewardship espouse.

I agree that the many global measurement standards and even the capitalist system are never without criticism. Greenwashing is a prominent criticism and a healthy argument in the ongoing dialogue about stakeholder accountability. This is especially valid as there have been instances where companies have distorted their reporting to be in line with the green movement.

However, I am encouraged that several international organizations are creating a more robust system of sustainability standards to help investors in decision-making. For instance, there is the International Sustainability Standards Board (ISSB) that is working hard to address the demand for transparent, high quality, reliable and comparable ESG data. Ayala was fortunate to have had the chance to participate in the ISSB’s consultations through our membership in the World Business Council for Sustainable Development.

There is also an exciting development emerging in Europe through the European Union Taxonomy for Sustainable Activities, which was established to determine which investments or activities are environmentally sustainable. There may be iterations moving forward, but it is encouraging to see a healthy dialogue progress toward more globally accepted standards on accountability.

As a last point, I think it is healthy for organizations to have a diverse set of perspectives from investors on corporate accountability. Investors who want companies to clearly define their impact to stakeholders may value the prevailing ESG standards more than others. I believe that this diversity in thought within a company’s investor base helps in ensuring that a corporation remains trusted and relevant to a broader set of stakeholders, whether they are investors, customers, or the community.

EMBRACING RENEWABLES ACEN’s 120-MW GigaSol Alaminos solar farm provides clean energy to the grid. —Contributed photo

Q: The group has said that stewardship and sustainability have been followed throughout the years; how so in previous generations and then now with yours?

Zobel: I mentioned in other engagements that stewardship and generating shared value for all stakeholders are principles defined by Ayala’s founders. And then, these were exemplified by the professional leaders throughout the corporation’s history. The values, purpose and principles are consistent, while the application evolves according to the needs of the times. I believe that this is what has made the company so uniquely innovative—Ayala, anchored on firm foundational principles, constantly adapts to the developing needs of stakeholders over time, while generating shared value for a broad set of interests.

In a developing economy like the Philippines, fundamental services, such as utilities, infrastructure and urban development continue to be sectors that need reinvestment. While we have historically invested in these sectors that contribute to national development, I see now that market conditions are rapidly changing. Addressing the interests of all our stakeholders now require more sophisticated solutions.

To illustrate, not only are we moving away from a low interest rate environment; there are also several social and environmental circumstances that have exacerbated the economic challenges of our generation. These challenges have elevated pain points with lucrative solutions, including digital solutions, renewable energy and social investments.

With such a volatile market and demanding stakeholder expectations, stakeholder capitalism is certainly becoming more complex to execute. There are more rigorous reporting standards to adhere to, more impact-minded investors and customers to serve and more unforeseen external challenges to adapt to.

Now that we are being measured along these lines, we have to be more accurate in assessing and reporting our contributions to these complex issues. But more importantly, we now have to ensure that our initiatives are generating genuine stakeholder impact. It is an honor that our efforts are being acknowledged here and abroad—and we credit the many generations of Ayala executives and employees that made this happen.

For the present generation of family members and employees, we hope to follow in our forebears’ footsteps. We hope to continue along this path of impact and shared value creation, while making sure that the projects and businesses we launch are relevant and meaningful to the many people that we touch.