Philippine stocks enter bull market territory

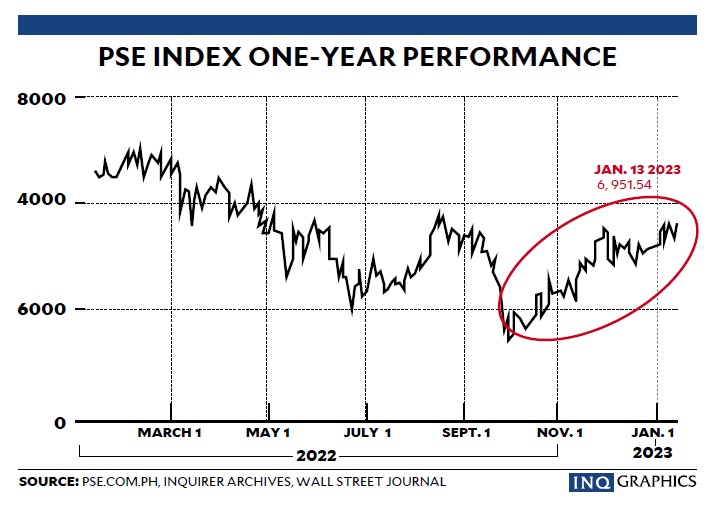

Philippine stocks entered a bull market on Friday as investors bet on fading inflationary pressures and China’s reopening, pushing up the country’s benchmark index—Philippine Stock Exchange index (PSEi) to its highest level in nine months.

The PSEi charged higher during the session, gaining 1.73 percent, or 118.01 points, to end at 6,961.54. The broader All Shares index also rose 1.38 percent, or 49.58 points, to 3,637.62.

A bull market is typically called after stocks rise 20 percent from the recent low. On Friday, the PSEi was up nearly 22 percent since the Oct. 3, 2022 low of 5,699.30.

“The market is pricing in a scenario where inflation may have already peaked,” Jonathan Ravelas, a veteran stock market analyst and financial strategy consultant at e-Methods for Business Management Corp., told the Inquirer in an interview on Friday.

Worries over soaring consumer prices and a downgrade in corporate earnings pulled down by the PSEi by 7.8 percent in 2022.

Meanwhile, the strong breakout on Friday might be a prelude to further stock market gains but Ravelas said investors should stay cautious due to threat of a global recession.

“The real breakout level should be above 7,500,” which Ravelas said was a level that acted a ceiling for the PSEi during the pandemic.

“We can call it the COVID-19 ceiling,” he added.

Trading volume was moderately higher on Friday as 1.63 billion shares valued at P9.24 billion changed hands. Foreigners were also net buyers amounting to P707 million.

While bulls appeared in control of the market, many investors remain hesitant to jump back in since many stocks remain below their prepandemic levels.

“Lots of investors are still underwater right now,” a trader told the Inquirer.

Despite recent gains, the PSEi is still trading about 11 percent below the end-2019 level of 7,815.26, stock exchange data showed.

Notable movers on Friday include the Aboitiz family’s Union Bank of the Philippines and Consunji-led conglomerate DMCI Holdings Inc.

Stockbrokerage house First Metro Securities said on Friday the two companies have a “high probability” of being included in the 30-member PSEi in the next review in February this year.

UnionBank jumped 4.29 percent to P87.50 per share while DMCI rose 0.33 percent to P12.22 per share.

Investors also weighed rosy comments from Bangko Sentral ng Pilipinas Governor Felipe Medalla on their outlook for inflation.

Medalla said the worst of the consumer price surge was potentially over and inflation could drop below 4 percent in the third quarter of 2023, which was within the government’s target range of 2-4 percent.

The latest US inflation reading for December also came in at 6.5 percent, within expectations and below the November print of 7.1 percent.

“While prices rose at a 6.5 percent pace compared to the previous year, the results heightened hopes that the Federal Reserve may soon slow its [interest rate hikes],” Luis Gerardo Limlingan, head of sales at stock brokerage house Regina Capital Development, said in a note to investors on Friday.