Market misery deals sovereign wealth funds historic setback in 2022 -study

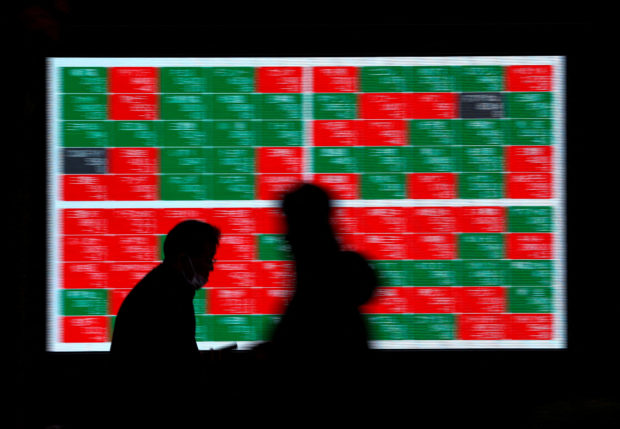

Passersby walk past an electric stock quotation board outside a brokerage in Tokyo, Japan, Dec 30, 2022. REUTERS/Issei Kato/File photo

LONDON – Heavy falls in stock and bond markets over the last year have cut the combined value of the world’s sovereign wealth and public pension funds for the first time ever – and to the tune of $2.2 trillion, an annual study of the sector has estimated.

The report on state-owned investment vehicles by industry specialist Global SWF found that the value of assets managed by sovereign wealth funds fell to $10.6 trillion from $11.5 trillion, while those of public pension funds dropped to $20.8 trillion from $22.1 trillion.

Global SWF’s Diego López said the main driver had been the “simultaneous and significant” 10 percent-plus corrections suffered by major bond and stock markets, a combination that had not happened in 50 years.

It came as Russia’s invasion of Ukraine boosted commodity prices and drove already-rising inflation rates to 40-year highs. In response, the U.S. Federal reserve and other major central banks jacked up their interest rates causing a global market sell-off.

“These are paper losses and some of the funds will not see them realized in their role as long-term investors,” López said. “But it is quite telling of the moment we are living.”

Article continues after this advertisementThe report, which analyzed 455 state-owned investors with a combined $32 trillion in assets, found that Denmark’s ATP had had the toughest year anywhere with an estimated 45-percent plunge that lost $34 billion for Danish pensioners.

Article continues after this advertisementDespite all the turbulence though, the money funds spent buying up companies, property or infrastructure still jumped 12 percent compared with 2021.

A record $257.5 billion was deployed across 743 deals, with sovereign wealth funds also sealing a record number of $1 billion-plus “mega-deals”.

Singapore’s supersized $690 billion GIC fund topped the table, spending just over $39 billion in 72 deals. Over half of that was piled into real estate with a clear bias towards logistics properties.

In fact, five of the 10 largest investments ever by state-owned investors took place in 2022, starting in January when another Singapore vehicle, Temasek, spent $7 billion buying testing, inspection and certification firm Element Materials from private equity fund Bridgepoint.

In March, Canada’s BCI then agreed to acquire 60 percent of Britain’s National Grid Gas Transmission and Metering arm with Macquarie. Two months later, Italy’s CDP Equity wealth fund spent $4.4 billion on Autostrade per l’Italia alongside Blackstone and Macquarie.

“If financial markets continue to fall in 2023, it is likely that sovereign funds will keep ‘chasing elephants’ as an effective way of meeting their capital allocation requirements,” the report said.

It tipped SWFs from the Gulf such as ADIA, Mubadala, ADQ, PIF, QIA to become much more active in buying up Western firms having received large injections of oil revenue money over the past year.