After surviving COVID, PH economy grapples with inflation next

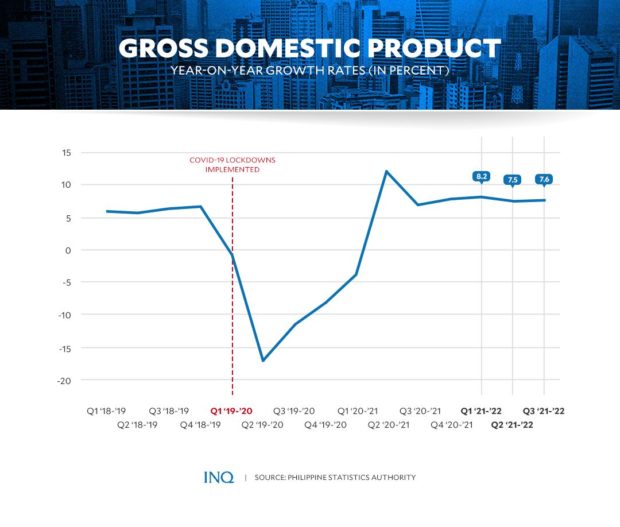

With the surprising 7.6-percent growth in the third quarter, the economy needs to grow only by 3.3 percent to 6.9 percent in the last quarter to hit the full-year goal, according to Socioeconomic Planning Secretary Arsenio Balisacan.

Another piece of welcome news was the sharp drop in the country’s unemployment rate last October to 4.5 percent, said to be the lowest since records began in 1986. It was a big improvement from the 7.4 percent jobless rate posted in the same month last year.

The bad news, however, is that the biggest threat to the sustainability of economic growth is still lurking in the corner—soaring inflation.

Soaring prices

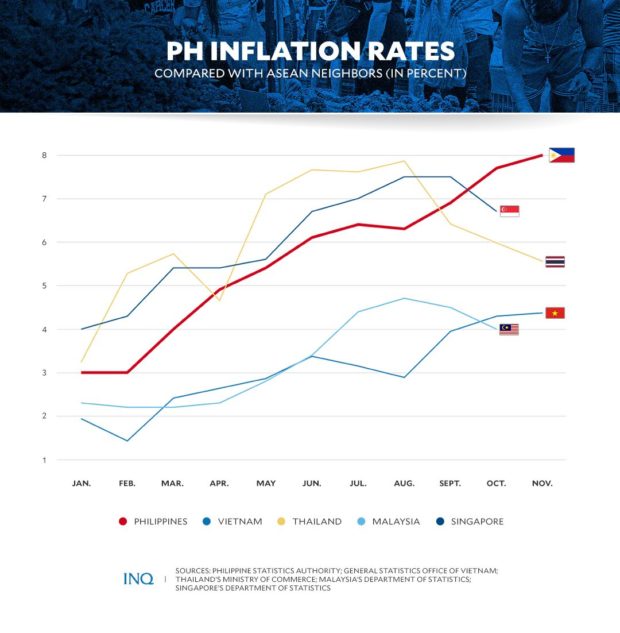

Last November, the inflation rate sizzled to 8 percent, the highest in 14 years and it has yet to peak.

Article continues after this advertisementEconomists see inflation rate hitting about 9 percent in December for an average of 5.9 percent for the full year of 2022. It is seen to remain elevated particularly in the first quarter of 2023 before it starts easing in the succeeding quarters for a full-year 2023 average of 4.4 percent.

Article continues after this advertisementIt will only be in 2024 when inflation is expected to settle within the BSP’s target range of 2 percent to 4 percent, at 3.1 percent.

Given this scenario and the expected reversal of revenge spending that fueled the economy in 2022, economists and multilateral institutions are projecting Philippine economic growth to decelerate to 5 percent to 6 percent in 2023.

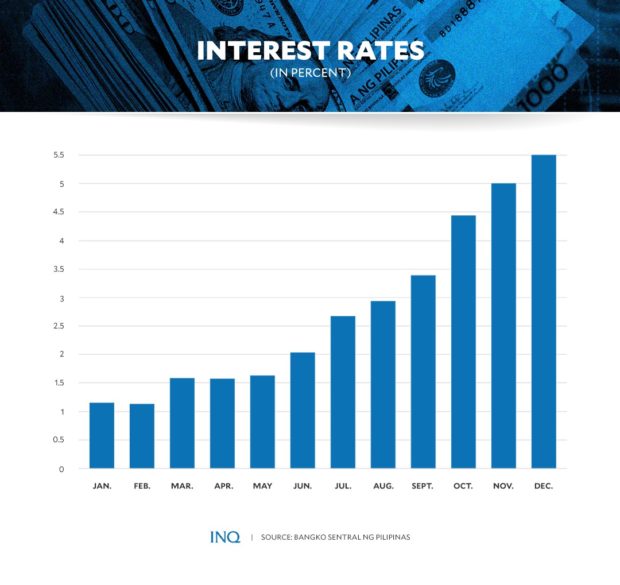

To rein in inflation, the Bangko Sentral ng Pilipinas (BSP) had raised key interest rates for seven consecutive months since May and by a total of 350 basis points. Its key rate is now 5.5 percent, up from just 2 percent before May.

And it is not done yet. The BSP is widely expected to continue raising rates next year until inflation slows down to at least near the government’s target range of 2 percent to 4 percent.

Supply chain disruptions

What brought these inflation woes? The COVID-19 pandemic and the Russia-Ukraine war. Add to that the weakness of the country’s agricultural sector, as shown by low farm productivity, and natural calamities like typhoons and the African Swine Fever that further eroded the country’s food production.

Recall that a long and comfortable period of benign inflation in the country ended abruptly when COVID -19 struck in early 2020.

The economy virtually ground to a halt as the entire country was placed under very stringent lockdowns. It sent the economy into a long recession that ended in the second quarter of 2021.

But just when the country was starting to regain its footing as lockdown restrictions were beginning to ease, the Russia-Ukraine war broke out last February, dousing hopes of a more robust recovery.

The war zone is thousands of miles away from the Philippines. However, the disruptions it caused to the global supply chain and the resulting increases in world market prices of oil and other commodities hit the country hard.

This is because the Philippines is a net importer of oil, raw materials for industries and agriculture, and even of food. TSB