Asialink eyes bigger share of consumer financing mart

In June 1997, a group of friends led by bank executive Robert Jordan Jr., entrepreneur Ruben Lugtu II and finance executive Wilfredo Anastacio pooled P3 million in capital and ventured into consumer financing, inspired by the idea that there was a large and untapped group of Filipinos who needed funds but were “underserved” by the large banks.

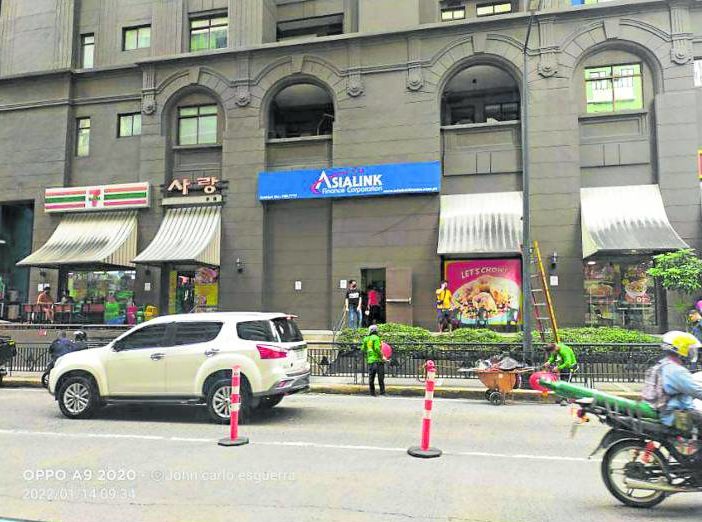

Their faith in that idea has certainly paid off as 25 years later, Asialink Finance Corp. has emerged as one of the country’s largest consumer financing companies, with its services proving to be even more vital during the COVID-19 pandemic when it provided qualified borrowers the financial lifeline that they needed to stay afloat and recover from its worst effects.

Asialink indeed was one of the fortunate Filipino companies that managed to post stellar numbers even amid the resulting twin public health and economic crises, with its net income surging by 142 percent to P520 million in 2021 from P215 million in 2020, on the back of some P10 billion in assets and P2.15 billion in revenues.

Not to say, however, that the company was spared from the pandemic. Far from it.

In 2020, it was forced to drastically reduce its manpower from 700 to just 80 as its 76 branches across the country were not allowed to operate at the height of the lockdowns. It gradually reopened branches as restrictions were loosened but even then, its net income in 2020 was reduced to P215 million from P352 million in 2019.

Article continues after this advertisementAsialink took it all in stride as it is no stranger to crisis, after all, having started out extending clean group appliance loans during the Asian financial crisis and expanding during the 2008 global financial crisis.

Article continues after this advertisementThe COVID-19 pandemic was the worst, says Apples Mangubat, president and CEO of Asialink, but it gave the consumer finance company even greater motivation to hold fast to its mission, taking the time to reach out to its existing customers and see how they can meet halfway. It restructured loans when it could so that these individual borrowers would still be able to meet their obligations while keeping their own businesses afloat.

Lending to entrepreneurs

It was also in 2020 when Asialink recalibrated its business loans offering, allowing borrowers to take out loans worth up to 70 percent of the market value of their cars or trucks. These loans carried an interest rate of between 1.375 and 1.75 percent a month depending on the terms and the value of the collateral. The loans proved a godsend to entrepreneurs who needed to restart businesses that had been hit hard by the pandemic.

“We wanted to help the business people recover, so they can start their businesses again,” Mangubat explains.

Financing gap

Mangubat shares that the need for quick loans has always been high and the banks could not service all of the requirements. Asialink fills that gap.

“Most of our customers won’t qualify for bank loans while banks are not designed for this business. So we bridge that gap, partnering with banks in effect and lending to the end borrowers,” says Mangubat.

Demand became even higher at the height of the pandemic and it has shown no signs of slowing down. This is why Asialink has been expanding its financing sources to meet the needs of its growing consumer base, serviced by its 800 employees and thousands of independent loan consultants across the country.

So far, it has raised P1.8 billion from various banks and it is set to borrow more as it reaches out to more customers across the country, helped along by its strict adherence to financial standards and market insights that have allowed Asialink to keep its past-due loans at just 2 percent of the total loan portfolio even during the pandemic.

It also helped that over the past 25 years, it was able to finetune its credit investigation process, employing a variety of tools to get to know the borrowers—mostly between 40 and 60 years old—to minimize the risk of loan defaults.

Asialink’s solid numbers won for it a “PRS A plus” with stable outlook credit rating from the Philippine Rating Services Corp., indicating its “above average capacity” to meet its financial commitments. The banking community has also rewarded Asialink’s enviable track record with financial support, providing it credit lines to rapidly expand its operations.

With that under its belt, Mangubat says Asialink is flexing its muscles to build up to be an even bigger consumer finance company, encouraged by the fact that the economy is recovering and there is renewed appetite among entrepreneurs and micro, small and medium enterprises to revive or expand their operations.

As they do, she says Asialink wants to be there for them, for as they grow, then Asialink grows, too.

“We focus on providing inclusive financial access. We want to grow with our customers and help them achieve their dreams. We fill an unmet market demand, and this way, we become part of their journey to growth and success,” says Mangubat.