Silver heads for biggest deficit in decades, Silver Institute says

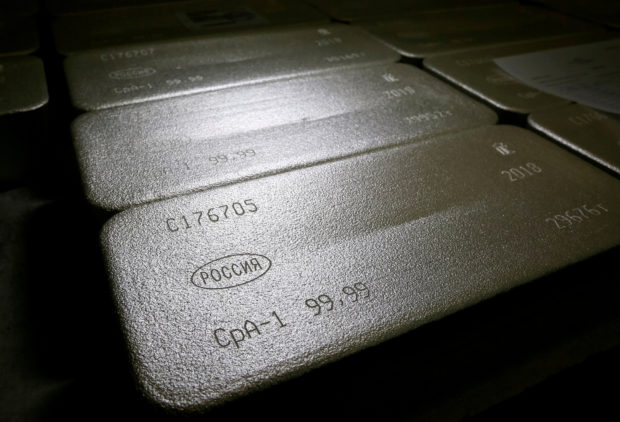

Ingots of 99.99 percent pure silver are seen at the Krastsvetmet non-ferrous metals plant, one of the world’s largest producers in the precious metals industry, in the Siberian city of Krasnoyarsk, Russia. REUTERS/Ilya Naymushin/File photo

LONDON – Global demand for silver is expected to rise 16 percent this year to 1.21 billion ounces, creating the biggest deficit in decades, according to the Silver Institute.

Use of silver by industry, for jewellery and silverware and for bars and coins for retail investors were all forecast to reach record levels, the institute said.

Automakers are using more silver as the amount of electronics in vehicles increases, but the sector accounts for only around 5 percent of total demand. Solar panels account for around 10 percent of silver demand.

Demand in India almost doubled in 2022 as buyers took advantage of low prices to replenish stockpiles drawn down in 2020 and 2021.

Exchange traded funds (ETFs) storing silver for investors shrank, however, returning metal to the market, but the Silver Institute does not count ETFs as physical demand because they only store wholesale silver bars and do not rework them.

Article continues after this advertisementThe Silver Institute predicted a deficit of 194 million ounces this year, up from 48 million ounces in 2021.

Article continues after this advertisementDemand is likely to fall next year, said Philip Newman at consultants Metals Focus, which prepared the Silver Institute’s numbers.

“India’s restocking is likely to trip over into 2023 but at some point will dissipate,” he said. “By extension, you could see some decent figures in 2023 but it may not match 2022.”

Newman said he expected strong demand from industries such as solar panel and auto makers and more silver supply deficits in the coming years, but not as large as in 2022.

The amount of silver stored in vaults in London and New York monitored by the COMEX exchange and the London Bullion Market Association has fallen by around 370 million ounces – or 25 percent — this year.

But Newman said there was plenty of silver left. “You do have still sizeable stocks,” he said. “I don’t think that’s a concern.”

Silver prices have fallen around 10 percent this year to $21 an ounce, mostly due to financial investors selling silver in response to rising U.S. bond yields and a strengthening dollar.