Why bleeding PH firms won’t go green

Still steeped in the mires of the COVID-19 pandemic, most businesses are setting aside going green to focus on recovery. Sustainability, after all, can not yet be sustained.

According to the 2022 edition of a joint survey published by the PricewaterhouseCoopers (PwC) Philippines and the Management Association of the Philippines (MAP), only 30 percent of the chief executive officers (CEOs) surveyed have incorporated environmental, social and governance (ESG) into their business plans.

ESG offers a framework for businesses to manage risks and opportunities. It is a broad term that ranges from health and safety issues to pollution reduction and other philanthropic programs.

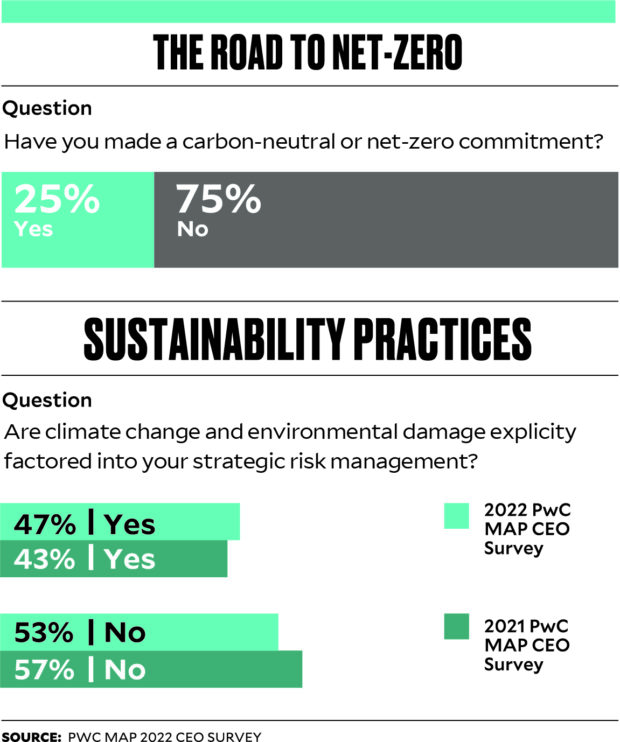

Of the 119 CEOs surveyed from mid-July to August, only 47 percent said climate and environmental damage were factors they consider in strategic risk management

It is a slight improvement from last year’s 43 percent, but both figures showed that majority of top business leaders—whose decisions dictate and influence company policies and directions—are still not onboard with the idea.

STILL WANTING While their tribe is increasing, PH companies

that embrace environment, social and governance standards

form just the minority. —PWC MAP 2022 CEO SURVEY

In addition, only a fourth said they have made commitments to making their businesses carbon-neutral or adhering to a “net zero” emission principle.

Survival

“Many MSMEs (micro, small and medium companies) are still of the mind that they need to be viable before they can be sustainable,” PwC Philippines chair emeritus Alex Cabrera explains.

Mary Jade Roxas-Divinagracia, a managing partner at the firm, is of the same mind, adding that priorities have been “distorted” since the COVID-19 outbreak, illustrating the deep cuts suffered by multiple industries.

“In the last two years, most of the companies have been focused on merely surviving … trying to be feasible and viable first before thinking of sustainability,” she says.

In the same report, 35 percent stated their companies have yet to recover from the pandemic. Only 21 percent said they were back to prepandemic levels.

Still, 38 percent said they were significantly higher than where they were when the pandemic hit in 2020.

Cabrera says this scenario can be viewed with a ‘glass half-full’ point of view, noting that a third of the surveyed CEOs reflects just the beginning of an ongoing “journey” to incorporate ESG into business plans.

“The 30 percent to me is not such a bad start. I really believe that the 70 percent will soon catch up, not because of legal compulsion but because of necessity,” he says.

But there is more to the survey than meets the eye, according to Roxas-Divinagracia.

Not polluters?

“A significant part of those who said that they did not have (such policies) claim that they did not produce meaningful amounts of greenhouse gas emissions; that’s why there’s no need for them to do so,” she says.

A third of the CEOs who said they do have any ESG commitment reasoned that their respective sectors do not have any established and well-defined decarbonization approach, she adds.

She says the other third mentioned they do not have the capabilities to measure their emissions, highlighting the need to consult sustainability specialists—but which can still prove costly to some.

“Even at the firm level, we’ve noticed the lack of experience and capable resources in that area. So hopefully we are able to build that capacity as well,” she says.

According to the same study, only 43 percent of surveyed CEOs said “yes” when asked if they are measuring and reporting the financial impact of their sustainable practices.

Climate change laws

The Philippines has at least eight national laws related to mitigating climate change, each offering guidelines in varying degrees. Five of these are industry-specific, but could still be considered as broad enough.

The most notable is Republic Act No. 9729, also known as the “Climate Change Act of 2009,” which incorporates climate change strategies into government policy formulations.

Pursuant to the law, the commission is headed by the president of the country as well as three appointed commissioners.

Depending on who you ask, the broadness of the laws can either be good or bad, resting on the prevailing culture of the mainstream businesses in the country.

The more sector-specific laws include the Philippine Clean Air Act of 1999 (RA 8749), the Ecological Solid Waste Management Act of 2000 (RA 9003), the Clean Water Act of 2004 (RA 9275), the Renewable Energy Act of 2008 (RA 9513), and the Extended Producer Responsibility Act of 2022 (RA 11898).

ATR Asset Management head of macro and sustainability research Jose Mari Lacson says the Philippines currently lacks a comprehensive data collection and measurement system that can gauge the effectiveness of local laws and track the progress of local businesses objectively.

“Data [gathering] is the first step toward building sustainability into business. Nobody really collects the data so it can be understood properly,” Lacson says.

“The simplest one would be on emissions, which is one of the primary indicators for greenhouse gas and climate change. If we want to effect change in the way we do things, then you need to understand how emissions are coming from the electric (sector) or from transport and logistics,” he adds.

Snapshot

The Philippine automotive market can offer a glimpse of the green movement in the country.

Rommel Gutierrez, president of the Chamber of Automotive Manufacturers of the Philippines, Inc., says the market for “cleaner” vehicles is expanding, albeit at a slow pace.

Data from the auto industry association shows that electric vehicles, including hybrid electric vehicles, plug-in hybrid electric vehicles and battery electric vehicles are gaining a lot of ground in terms of sales.

“Over the past years, we have seen increasing numbers of buyers of hybrid vehicles. Some buy pure electric (vehicles). But right now, it’s really more of the hybrid (vehicles) that are being sold on the market,” Gutierrez tells the Inquirer.

Electric vehicles went from having a 0.02-percent (86 vehicle units) share to total sales in 2019 to a 0.31-percent (810 units) share in 2021.

Sales are projected to reach a 1.68-percent (2,246 units) share by the end of 2022, displaying the potentially exponential growth in patronage of more environment-friendly automobiles.

“There’s a growing number of people who are more environmentally conscious. Pero hindi pa lahat (But it’s not 100 percent yet),” Gutierrez said.

MAP conference committee vice chair Alma Jimenez says the market will be the “biggest push-pull factor” in the adoption of these sustainable practices, highlighting the driving power of ordinary consumers.

“Once the market is affected, surely, I think, businesses will react,” she says. INQ