Asian markets mostly down after Bernanke comments

HONG KONG—(UPDATE) Asian stocks were mostly down on Wednesday as worries over the state of the global economy hit confidence, but a late rally saw the Nikkei finish the day just in positive territory.

Tokyo edged up 0.07 percent, or 6.51 points, to 9,449.46 while Sydney lost 0.65 percent, or 29.5 points, to 4,536.8, a two-and-a-half-month low.

Seoul was 0.78 percent, or 16.36 points, lower at 2,083.35.

Hong Kong slipped 0.91 percent, or 207.04 points, to 22,661.63 but Shanghai rose 0.22 percent, or 5.99 points, to close at 2,750.29.

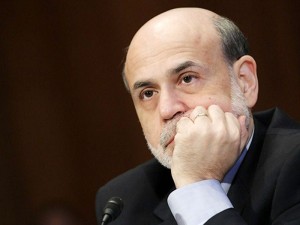

Demand took a hit after Federal Reserve chairman Ben Bernanke warned there had been a “loss of momentum” in the already tepid US jobs market.

Two years into a slow and largely jobless recovery, Bernanke predicted employment and growth would eventually pick up, but that a recent soft patch needed to be carefully monitored and that stimulative policies were still necessary.

“Until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established,” Bernanke told an audience in Atlanta, Georgia.

Reiterating a now all-too-familiar story of a recovery hobbled by a lack of new employment opportunities and a continued housing crisis, he told the audience that “the jobs situation remains far from normal.”

Bernanke’s comments came on top of a fifth straight day of losses on Wall Street, with the Dow Jones Industrial Average closing down 19.15 points, or 0.16 percent.

Recent data, particularly in the US, “have pointed to a substantial slowing in growth over the last two months,” said Dominic Wilson at Goldman Sachs in a note, according to Dow Jones Newswires.

“We are tilted a little negatively in equities for the first time this year, and we are not taking strong views on overall risk/cyclical direction yet,” he added.

In Tokyo worries over the lack of positive direction in the economy both locally and globally weighed on sentiment for most of the session but a late round of bargain hunting pushed the index into positive territory.

Figures released on Wednesday showed Japan’s current account surplus plunged 69.5 percent from a year earlier in April.

Although the drop was much smaller than falls of more than 80 percent forecast by economists, it was the smallest surplus for the month of April in 26 years.

The surplus in the current account – the broadest measure of trade with the rest of the world – fell to 405.6 billion yen ($5.0 billion) in April from 1.33 trillion yen a year earlier, official data showed.

“It is difficult to buy amid uncertainty over the outlook of the overseas economies and the yen’s direction,” said Cosmo Securities strategist Toshikazu Horiuchi.

The yen hit a one-month high against the US dollar in early Tokyo trade at 79.84 yen, before dropping back to 80.06 yen as the equities market shifted upwards. The dollar ended trade in New York in Tuesday at 80.05.

Meanwhile, the euro sagged to $1.4677 from $1.4688 and to 117.53 yen from 117.60 yen.

Although the dollar rose against the yen in the afternoon, the Japanese unit’s relative strength continues to hurt Japan’s exporters, a key sector of an economy struggling under the weight of the March 11 earthquake and tsunami.

Shares in embattled utility Tokyo Electric Power Co. (TEPCO) hit a new all-time closing low amid continued uncertainty over a government scheme to ensure it can meet compensation bills over the crisis at its nuclear plant.

TEPCO closed down 7.40 percent at 200 after hitting a new intraday low of 194 yen.

The shares have lost more than 90 percent of their value since the day before the earthquake and tsunami, which crippled cooling systems at the Fukushima Daiichi nuclear plant, triggering reactor meltdowns.

Oil was lower ahead of an OPEC ministerial meeting due to take place later in Vienna, analysts said.

New York’s main contract, light sweet crude for July delivery, dipped 54 cents to $98.55 a barrel and Brent North Sea crude for July lost 70 cents to $116.08 in the afternoon.

The 12-nation Organization of the Petroleum Exporting Countries (OPEC) is expected to discuss whether the oil cartel should raise production quotas to aid the struggling global economic recovery and compensate for hobbled Libyan output.

Gold finished at $1,537-$1,538 an ounce in Hong Kong, down from Tuesday’s close of $1,545-$1,546.50.

In other markets:

— Mumbai’s Sensex index fell 0.55 percent, or 101.33 points, to 18,394.29, ending two straight days of gains.

Car maker Maruti Suzuki India fell 1.18 percent or 14.65 rupeees to 1,226.05 while Mobile phone firm Reliance Communications rose 2.45 percent or 2.25 rupees to 94.25.

— Taipei dropped 0.55 percent, or 49.57 points, to 9,007.53.

HTC shed 2.72 percent to Tw$1,250.5 while Hon Hai rose 0.5 percent to Tw$100.5.

— Bangkok slid 1.95 percent, or 20.17 points, to 1,014.58.

Banpu lost 8 baht to 720, while PTT fell 9 baht to 330.

— Manila gained 0.45 percent, or 18.99 points, to 4,255.44.

Alliance Global rose 2.22 percent to 10.12 pesos and SM Investments added 0.18 percent to 566 pesos. San Miguel shed 0.52 percent to 115.50 pesos.

— Wellington ended 0.56 percent, or 19.78 points, higher at 3,525.39.

Contact Energy rose 3.6 percent to NZ$6.02, Telecom added 2.4 percent to NZ$2.36 but Fletcher Building slid 0.9 to to NZ$8.75.

— Kuala Lumpur ended flat at 1,551.79.

Petronas Chemicals slid 1.8 percent to 6.96 ringgit while budget carrier AirAsia climbed 6.2 percent to 3.24.

— Jakarta fell 17.13 points or 0.45 percent to 3,825.82.

— Singapore’s Straits Times Index closed up 12.97 points, or 0.42 percent, at 3,102.98.

DBS Bank lost 0.54 percent to Sg$14.72 and SingTel was down 0.32 percent at Sg$3.12.