PH heeds renewable energy imperative

The Philippines may have turned over a new leaf with the change in leadership but it still holds the same aspiration of harnessing—and increasing the utilization of—greener sources of energy.

A law was passed more than a decade ago to accelerate the development of renewable energy (RE) resources. However, the country is still heavily dependent on fossil fuels until now.

Government data show that coal-fired power plants remain the most heavily used source of energy, accounting for about half of the energy mix, while nonconventional energy sources come at a distant second.

Taking into account the country’s vulnerability to natural disasters due to its geographic circumstances, the government is giving it another shot by making RE the top climate action agenda.

“We must take advantage of all the best technology that is now available, especially in the areas of renewable energy,” says President Marcos in his first-ever State of the Nation Address.

“The technology on renewable energy is progressing rapidly. And many of these technologies are appropriate for the Philippines,” Marcos adds.

Call for liberalization

The Department of Energy (DOE) has taken its cue from the President’s pronouncement. It has realigned its list of priorities, among which is relaxing foreign ownership restriction to funnel more investments to the RE sector.

Energy Secretary Raphael Lotilla says at least two executive issuances need to be addressed: the foreign investment negative list (updated annually), which outlines foreign ownership cap in key economic activities; and the 60-40 percent provision favoring local control in the Constitution.

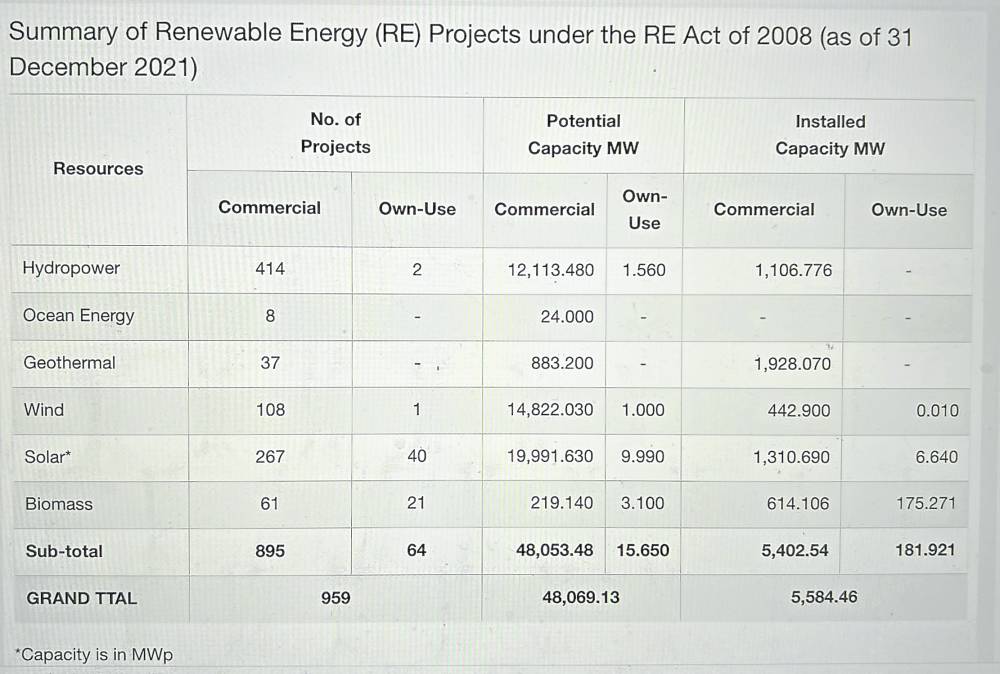

Under the implementing rules and regulations of Republic Act No. 9513, otherwise known as the Renewable Energy Act of 2008, “the exploration, development, production and utilization of natural resources shall be under the full control and supervision of the State.”

It states that foreign RE developers can undertake RE development through an RE service/operating contract with the government, as mandated by Article XII, Section 2 of the Philippine Constitution. Their ownership stake, however, is limited to 40 percent.

The DOE is looking into the possibility of allowing 100 percent foreign ownership of RE projects.

“We need to address the industry’s needs and definitely one way of doing that is to open up renewable, for example, to 100 percent foreign ownership so that foreign locators can actually also develop their own sources of power,” says Lotilla.

All these and more will be brought to the DOE’s newly formed Law and Energy Advisory Panel, which will guide the agency on various reform initiatives and legal matters, including the promotion of indigenous and low-carbon sources.

Target mix

The government’s ambition is to increase the share of RE in the country’s power generation mix from 29.4 percent to at least 35 percent by 2030 and 50 percent by 2040. The updated target, encapsulated in the National Renewable Energy Program (NREP) 2020-2040, aims to achieve energy security, sustainable development and inclusive growth and mitigate the impact of climate change.

To attain its goal, NREP calls for new RE capacity totaling 52,826 megawatts, broken down as follows: solar (27,162 MW); wind (16,650 MW); hydro (6,150 MW); geothermal (2,500 MW) and biomass (364 MW). It also calls for the development of new gas plants – deemed as a cleaner energy source that will still be critical during the transition to RE – with a total capacity of 18,859 MW.

The Marcos administration has maintained the moratorium on greenfield or new coal-fired power plants, a policy first instituted by the DOE under the Duterte administration.

It also allowed full foreign ownership of large-scale geothermal projects through the Financial and Technical Assistance Agreements, as long as the minimum investment is $50 million.

Green is in

Many companies have joined the RE bandwagon amid the uncertain investment environment and challenges of constructing new power plants.

So far, First Gen Corp. is the largest clean and RE independent power producer with a total installed capacity of 3,495 MW as of end-2021. It owns power plants that utilize natural gas, geothermal, wind, hydro and solar power.

ACEN Corp., the listed energy platform of the Ayala Group, has a “bold ambition” of building 20 gigawatts (GW) of attributable RE capacity by 2030. It has lined up 18 GW of projects across the region.

Aboitiz Power Corp. is targeting to significantly expand its “cleanergy” portfolio by building an additional 3,700 MW of RE assets, resulting in a 50:50 balance between RE and thermal capacities by 2030.

The country’s largest power distributor, Manila Electric Co., through its power generation arm Meralco PowerGen Corp., intends to build 1,500 MW of RE projects in the next seven years.

It has also committed to securing 1,500 MW of its power requirements from RE sources in the next five years.

Solar Philippines of businessman Leandro Leviste plans to develop 10 GW of solar projects in various parts of the country by 2025.

SMC Global Power Holdings Corp. of Ramon Ang-led San Miguel Corp. is actively identifying and pursuing RE investments.

Alsons Consolidated Resources Inc. of the Alcantara Group is hopping on the trend by scaling up its RE presence in the next few years.

Vivant Corp., the listed company of the Garcia-Escaño Family of Cebu, also wants to play its part by bolstering the RE share in its power portfolio to 20 percent by 2023 and further to 30 percent by 2030.

Emerging Power Inc., the RE unit of listed mining company Nickel Asia Corp. and Shell Overseas Investments B.V. of the Shell Group committed to work on 1 GW of RE projects by 2028.

Cebu-based SPC Power Corp. sought regulatory approval to venture into the RE space as it wants to acquire over develop about 300 megawatts of RE projects.

For its part, Alternergy Holdings Corp. is pushing for 1,245 MW of RE capacity in the next five years.

Key hurdles

Various studies have shown the Philippines is lagging behind the global push for green energy and the government itself admitted this reality.

The NREP identified certain factors that hampered the country’s RE push, including the delayed implementation of policy mechanisms, complex permitting process, grid interconnection issues, RE resource development, and limited access to financing and exposure to climate-related risks.

At this rate, only time can tell whether or not the government will finally be able to transition from fossil fuels to RE resources and subsequently pitch in global efforts to reach “net-zero” emissions by 2050.

Meanwhile, Mr. Marcos has reiterated his administration’s intention to adopt nuclear energy, which could significantly change the energy mix moving forward.