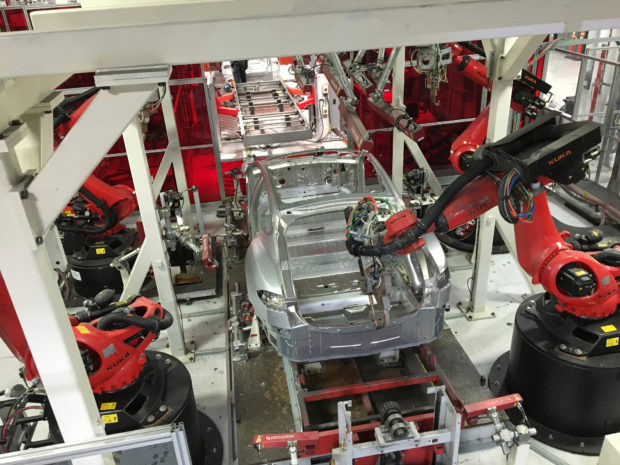

Tesla vehicles are being assembled by robots at Tesla Motors Inc factory in Fremont, California, U.S. REUTERS/Joseph White/File Photo

North American companies snapped up a record number of robots in the first half of this year as they struggled to keep factories and warehouses humming in the face of an extremely tight labor market and soaring compensation costs.

Companies ordered a record 12,305 machines in the second quarter valued at $585 million, 25 percent more units than during the same period a year ago, according to data compiled by industry group Association for Advancing Automation. Combined with a strong first quarter, the North American robotics market notched its best first half ever, the group said.

“Companies need to get product out the door — and so they need” new automation, said Jeff Burnstein, president of the Association for Advancing Automation, known as A3.

Eaton Corp. PLC, for example, is working on 150 different robot installations over the next year and a half in its electrical equipment factories in North America.

The incentives for companies to pursue a robot-enhanced workforce are obvious in the current tight labor market. With nearly two open jobs for every unemployed worker, employers are bidding up wages: Total U.S. labor costs – covering wages and benefits – surged 5.1 percent year over year in the second quarter, the most since the Labor Department began tracking it in 2001.

People are seen next to robotic arms for a second battery tray assembly line at the opening of a Mercedes-Benz electric vehicle Battery Factory, one of only seven locations producing batteries for their fully electric Mercedes-EQ models, in Woodstock, Alabama, U.S. REUTERS/Elijah Nouvelage/File Photo

Yet if robots are designed to make workers more productive, that is not evident so far: Those thick order books come as U.S. productivity fell in the second quarter at its steepest pace on an annualized basis since the government began reporting it in 1948.

One possible explanation is the distortions caused by the COVID-19 pandemic. The crisis saw huge shifts in the workforce, including an exodus of workers during the darkest days of the crisis who are only slowly filtering back into jobs. It is normal for workers to be less productive if they are moving into new careers or changing jobs in their existing fields.

Moreover, much of the latest employment gains have come in lower-productivity service sectors like leisure and hospitality, which also may mask the improvements robots may be making elsewhere.

A3’s Burnstein said it also takes time for companies to fully implement new machinery to maximize its potential. “There’s a learning curve,” he said.

This is especially true in sectors adopting entirely new technologies, such as the auto industry’s turn toward electric vehicles. A3 found nearly 60 percent of the robots ordered in the second quarter went to automotive companies.

Mike Cicco, CEO of FANUC America, the U.S. division of the Japanese robotics manufacturer, estimates half of his industry’s sales to carmakers are currently earmarked for new electric-vehicle factories.

“This is all investment for plants that won’t be up and running for several years now,” he said, so it is not surprising that those robots are not yet contributing to higher productivity.

The rush to add robots is part of a larger upswing in investment as companies seek to keep up with strong demand, which remains elevated even as the Federal Reserve has raised interest rates to rein in inflation.

Knapheide Manufacturing Co is among companies investing in new robots — including a new production line for flatbed truck bodies slated to go into its Quincy, Illinois, factory this year. The new line will use robots to feed steel parts through an automated welding process.

Mike Bovee, the engineer overseeing the installation, said the new robots should help ease a chronic shortage of welders. Knapheide currently recruits those workers from as far away as Texas.

“We’ll always need as many welders as we can find,” he said, but they can be redeployed to other parts of production at the 1,500-worker plant.