Stocks jilted as central banks promise tough love

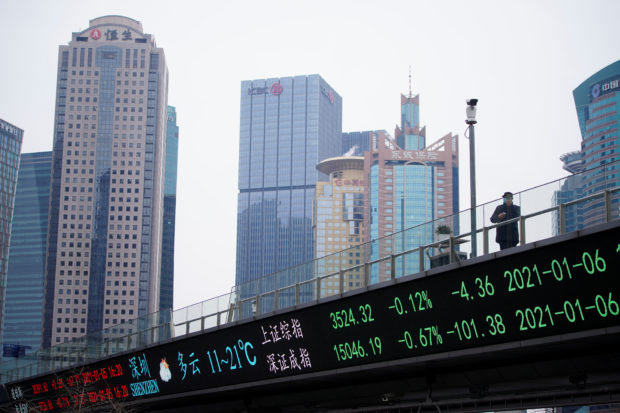

A man wearing a face mask, following the coronavirus disease (COVID-19) outbreak, stands on an overpass with an electronic board showing Shanghai and Shenzhen stock indexes, at the Lujiazui financial district in Shanghai, China. REUTERS/Aly Song/File photo

SYDNEY – Asian shares slid on Monday as the mounting risk of more aggressive rate hikes in the United States and Europe shoved bond yields higher and tested equity and earnings valuations.

Federal Reserve Chair Jerome Powell’s promise of policy “pain” to contain inflation quashed hopes that the central bank would ride to the rescue of markets as so often in the past.

The tough love message was driven home by European Central Bank board member Isabel Schnabel who warned over the weekend that central banks must now act forcefully to combat inflation, even if that drags their economies into recession.

“The main takeaways are taming inflation is job number one for the Fed and the Funds Rate needs to get to a restrictive level of 3.5 percent to 4 percent ,” said Jason England, global bonds portfolio manager at Janus Henderson Investors.

“The rate will need to stay higher until inflation is brought down to their 2 percent target, thus rate cuts priced into the market for next year are premature.”

Futures are now pricing in around a 60 percent chance the Fed will hike by 75 basis points in September, and see rates peaking in the 3.75-4 percent range.

Much might depend on what the August payrolls figures show this Friday when analysts are looking for a moderate rise of 285,000 following July’s blockbuster 528,000 gain.

The hawkish message was not what Wall Street wanted to hear and S&P 500 futures were down a further 1.1 percent , having shed almost 3.4 percent on Friday. Nasdaq futures lost 1.5 percent with tech stocks pressured by the outlook for slower economic growth.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.7 percent . Japan’s Nikkei dropped 2.3 percent , while South Korea shed 2.3 percent .

Euro struggles

The aggressive chorus from central banks lifted short-term yields globally, while further inverting the Treasury curve as investors priced in an eventual economic downturn.

Two-year U.S. yields were up at 3.44 percent , far above the ten-year at 3.08 percent . Yields climbed across Europe with double digit gains in Italy, Spain and Portugal.

All of which benefited the safe-haven U.S. dollar as it climbed to 109.15 and just a whisker from a 20-year high of 109.29 reached in July.

The dollar scored a five-week high on the yen at 138.21, with bulls looking to re-test its July top of 139.38.

The euro was struggling at $0.9937, not far from last week’s two-decade trough of $0.99005, while sterling slipped to a one-month low of $1.1686.

“EUR/USD can remain below parity this week,” said Joseph Capurso, head of international economics at CBA.

“Energy security fears will remain front and center this week as Gazprom will shut its mainline pipeline to deliver gas to Western Europe for three days from 31 August to 2 September,” he added. “There are fears gas supply may not be turned back on following the shut-down.”

Those fears saw natural gas futures in Europe surge 38 percent last week, adding further fuel to the inflation bonfire.

The rise of the dollar and yields has been a drag for gold, which was hovering at $1,735 an ounce. [GOL/]

Oil prices were little changed in early trading, and have been generally underpinned by speculation OPEC+ could cut output at a meeting on Sept 5.

Brent dipped 9 cents to $100.90, while U.S. crude firmed 6 cents to $93.12 per barrel.

(