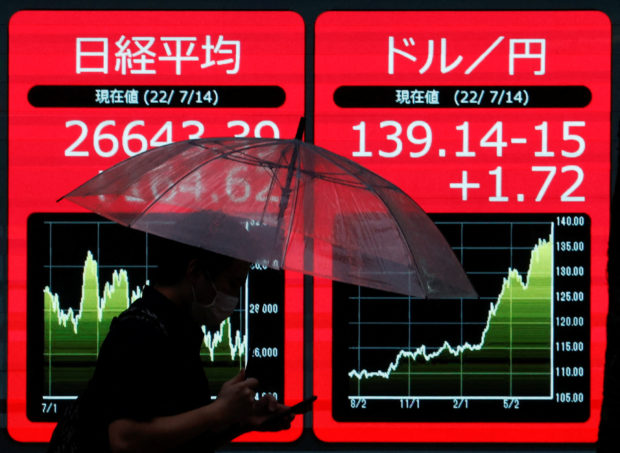

A man holding an umbrella is silhouetted as he walks in front of an electric monitor displaying the Japanese yen exchange rate against the U.S. dollar and Nikkei share average in Tokyo, Japan. REUTERS/Issei Kato

SYDNEY – Asian shares were down for a sixth straight session on Tuesday after a renewed spike in European energy prices stoked fears of recession and pushed bond yields higher, while tipping the euro to 20-year lows.

Benchmark gas prices in the European Union surged 13 percent overnight to a record peak, having doubled in just a month to be 14 times higher than the average of the past decade.

Analysts at Citi warned inflation in Britain could top 18 percent if energy prices were not restrained.

European and British manufacturing surveys due later on Tuesday were expected to highlight the damage being done to activity, with Germany seen deeper in contractionary territory.

“Europe’s dire energy situation suggests the peak of inflation is not here yet and the risk remains that high inflation is sticky for longer without further aggressive central bank action,” said Tapas Strickland, a director of economics at NAB.

“No surprise then to see the USD at near multi-decade highs against a falling EUR and GBP.”

The single currency was struggling at $0.9937, having dropped 1 percent to a 20-year trough of $0.99265. The break of the July low at $0.9952 was taken as a bearish sign for a further push lower, with little in the way of chart support left.

Sterling was down at $1.1766, after diving as deep as $1.1743 and levels last seen in March 2020 at the start of the pandemic. That saw the dollar index up to 108.870 and within a whisker of its July peak.

In Asia, unease over China’s economy continued to percolate as a cut in lending rates and talk of a fresh round of official loans to property developers underlined stresses in the sector.

“It would be bad enough for Chinese equities if the economy’s struggles were confined to the property sector,” said Oliver Allen a market economist at Capital Economics.

“But growth in the services sector seems unlikely to accelerate by much so long as China’s zero-COVID policies remain in place; the pandemic-linked export boom is coming to an end; and power shortages due to droughts in parts of the country look set to hobble industry in the near term.”

Chinese blue chips were off 0.2 percent having received only a fleeting lift from the latest policy easing.

Fed hawks rule

MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.4 percent, and has fallen every day in the past week.

The Nikkei lost 1.2 percent after a PMI survey showed factory activity in Japan slowed to a 19-month low in August amid persistent rises in raw material and energy costs.

EUROSTOXX 50 futures and FTSE futures were both off a fraction after sliding overnight.

S&P 500 futures and Nasdaq futures both edged up 0.1 percent, but that followed sharp falls on Monday when rising bond yields undermined tech shares.

The benchmark U.S. 10-year yield hit a five-week high of 3.04 percent on Monday, while the 30-year yield climbed to a seven-week peak of 3.268 percent.

Ten-year yields were last trading at 3.029 percent, up 50 basis points from the lows of early August.

The move in part reflects hawkish commentary from Federal Reserve officials which has led the market to price in a 55 percent chance of a 75 basis-point hike to 3.0-3.25 percent in September, and a peak for rates around 3.75 percent.

The ascent of the dollar and yields has been a drag for gold, which was hovering at $1,740 an ounce after hitting a three-week low overnight.

After a whipsaw session overnight, oil prices were bouncing as Saudi Arabia warned that the OPEC+ producer alliance could cut output.

Prices have been weighed by demand concerns and the chance of a nuclear deal that could return sanctioned Iranian oil to the market.

Brent was up 78 cents at $97.26, while U.S. crude rose 78 cents to $91.14 per barrel.