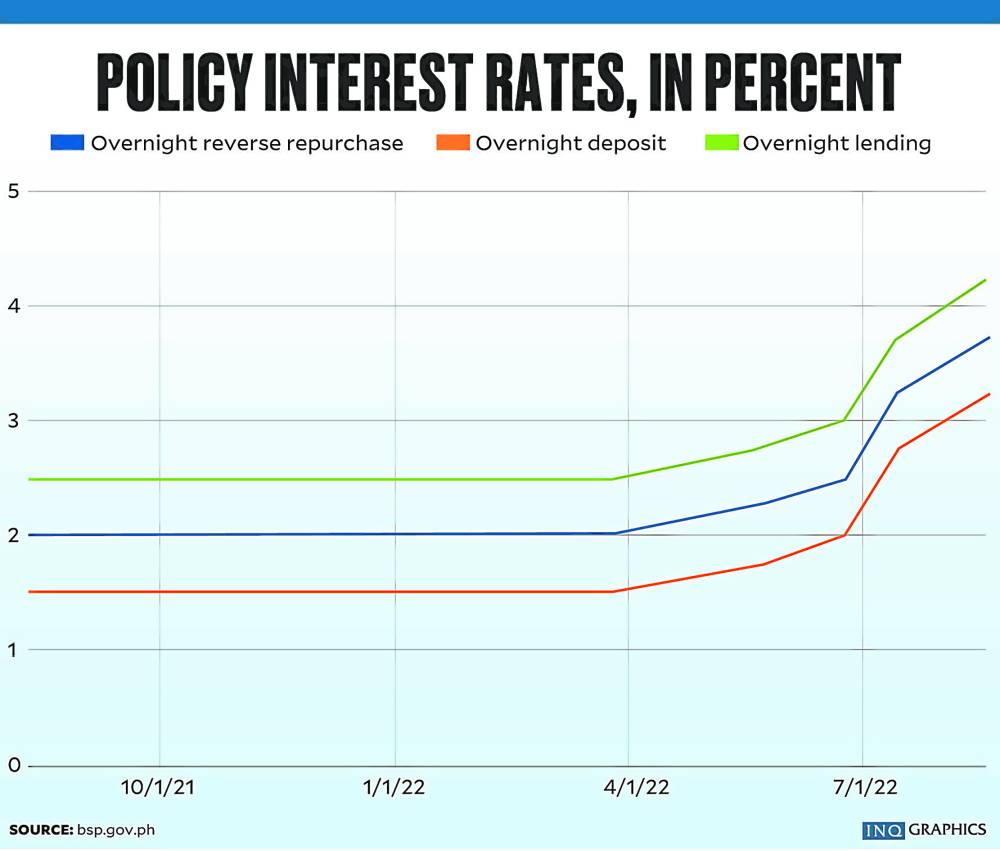

As expected, the Monetary Board (MB) again raised the Bangko Sentral ng Pilipinas (BSP) key policy rate or the interest rate on money that the central bank borrows from banks, by 0.5 percentage point (ppt) to 3.75 percent.

With the rise in the BSP’s overnight borrowing rate that takes effect on Aug. 19, the interest rates on the overnight deposit and lending facilities were also raised by as much to 3.25 percent and 4.25 percent, respectively.

Since starting the normalization of its policy stance last May, the MB has raised the policy rate four times by a total of 1.75 ppts from an all-time low of 2 percent.

MB chair and BSP Governor Felipe Medalla said in a briefing the latest average inflation projections had shifted even higher, to an average of 5.4 percent in 2022, further removed from the government’s target range of 2 percent to 4 percent, prompting the increase in the rates.

At two previous regular MB policy meetings, the forecast average inflation for this year was 4.6 percent (May) and 5 percent (June).

“While the forecasts for 2023 and 2024 have declined to 4 percent and 3.2 percent, respectively, the inflation target remains at risk over the policy horizon owing to broadening price pressures,” Medalla said.

He said the latest forecasts show that inflation “would probably peak in the tenth or eleventh month of the year (October or November).”

“Inflation would probably remain high in the first semester of next year,” Medalla said.

Last June, the forecast for average inflation in 2023 was 4.2 percent, and for 2024 was 3.3 percent.

He added that higher inflation expectations also highlight the risk of further second-round effects, referring to rising prices of other items like wages and transport fares.

Medalla said the risks that the inflation expectations for next year would shift higher also continued to dominate the outlook, due to the potential impact of higher global non-oil prices, the continued shortage in domestic fish supply, the sharp increase in the price of sugar, as well as pending petitions for transport fare increases.

On the other hand, the impact of a weaker-than-expected global economic recovery as well as the resurgence of local COVID-19 infections continue to pose the possibility that inflation expectations could go downward.

“At the same time, despite some moderation in [Philippine] economic activity in recent months, overall domestic demand conditions have generally held firm, supported by improved employment outturns and by ample liquidity and credit,” the BSP chief said.

Medalla reiterated that the Philippine economy was strong enough to absorb any additional policy rate hikes in the coming months, if such are needed.