Batting for a stable economic environment

The ongoing COVID-19 pandemic and the Russian invasion of Ukraine have ushered in a lot of uncertainty in the last two years. It has resulted in crashing stock markets in the US and China, disruption in oil and commodities supply in Europe, rising interest rates and inflation and possible lockdowns due to new COVID-19 variants.

All these are likely to trigger a looming economic depression worldwide.

Outsourcing to thrive

There is a sector in our economy that will thrive and grow in this situation, and this is the offshoring/outsourcing sector or the IT and business process management (IT-BPM) segment.

In 2021, approximately 120,000 employees were hired by the BPO sector and this hiring trend is likely to continue in 2022. New employees will need workspaces, especially for high security data sensitive work, and we see them migrating back to offices.

We see employers demanding that workers spend time in the office. Thus, employees will have to decide whether they will go back to the office, find a different employer with an office much nearer to home, or find work-from-home (WFH) jobs.

Article continues after this advertisementRising leasing volumes

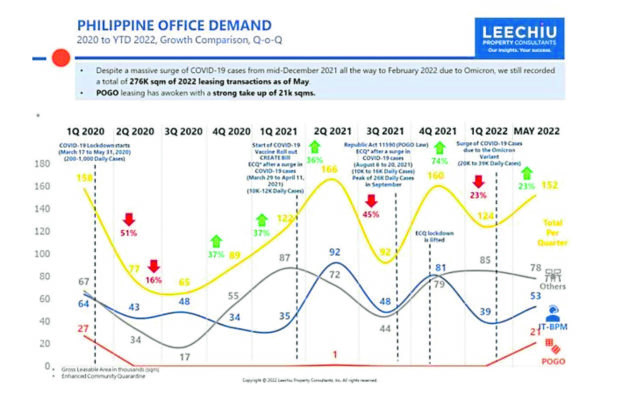

With the lockdowns behind us, office leasing volumes have risen. The first five months saw office leasing transactions reaching 276,000 sqm, equivalent to 51 percent of last year’s absorption of 540,000 sqm.

Article continues after this advertisementThese numbers are highly encouraging when we see the IT-BPM uptick coupled with the strong movement in the Pogo sector, which recorded a take-up of 21,000 sqm in May alone.

Live requirements are also rising. As of May 2022, there are 375,000 sqm of live office requirements which will likely conclude in the next six months. About 40 percent or 151,000 sqm are from the IT-BPM sector. We expect more office space inquiries from June onwards.

We see high recovery by 2023 with the resolution of the multiple headwinds we are experiencing today.

Residential supply

On the Metro Manila residential supply, we are still seeing low inventory introduced in the market. The pipeline supply of 179,000 units for the next seven years is already 74.3 percent sold.

Developers have been hesitant to push new projects and inventory in the market. Total inventory in the market now stands at 58,000 units, composed of 12,100 ready-for-occupancy (RFO) units and 46,000 preselling units.

With the opening up of markets and the low COVID-19 cases, we anticipate multiple launches of new condominiums. We will see improved sales by the third quarter 2022.

Capital values recovering

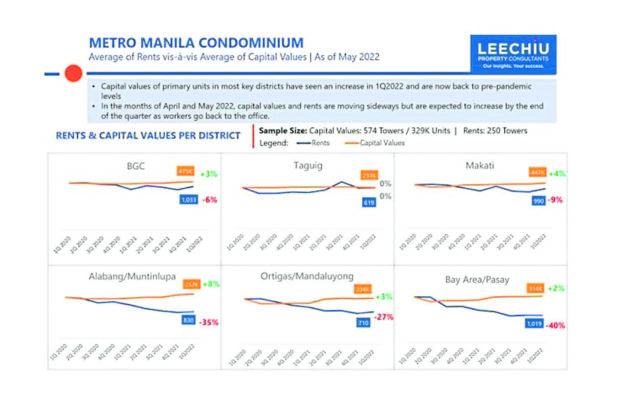

Capital values in certain Metro Manila business districts have recovered. These price levels are already back to pre-pandemic levels.

While capital values have flattened in the Taguig area, other areas have registered 2 percent to 8 percent increases in condominium prices. Rents, however, are still down by as much as 35 percent to 40 percent compared to pre-pandemic levels in the former POGO hotspots including Alabang and the Bay Area. Rents in the main financial districts of Bonifacio Global City and Makati are still down but only from 6 percent to 9 percent.

Improving mall traffic

As the alert levels moved downwards and with families (and children) now allowed to enter malls, the mall traffic has improved to 80 percent versus pre-pandemic foot traffic. On weekends, malls are already experiencing pre-pandemic visitor numbers.

In the case of large mall developer SM, as early as the fourth quarter, some of its malls have already exceeded pre-pandemic levels like SM Mall of Asia (in Pasay) and SM Southmall (in Las Piñas). These two malls have hit 120 percent surpassing pre-pandemic levels. This scenario also played out in other SM malls in the provinces with Alert Level 1 restrictions or areas with more lenient quarantine restrictions are observed.

Wish list

It is hoped that the new administration will look more into in-city, medium- to high-rise housing as a solution to informal settler families (ISF) and urban blight. The way to help alleviate the ISF problem of Metro Manila is for the government to proactively develop subsidized housing within each local government unit, and keep the homes within the city where there is employment.

Stronger protection of property rights is also needed. The wish is for the government to strictly enforce property rights to ensure that the right of the owner is above any ISFs.

Allowing foreigners to lease for 99 to 100 years will bring us at par with our neighbors in Asia. That length of lease is already highly acceptable among investors, given especially that our law only allows Filipinos to own land.

It is also crucial for the new administration to manage national debt, improve tax collection efficiency, as well as protect and improve credit ratings—all of which of are related to the prudent fiscal management by our economic managers.

The highly skilled economic team under Finance Secretary Carlos G. Dominguez III had been successful in handling the worst economic crash in recent years. Investments and businesses thrive in a stable economic environment.

The author is the co-founder and CEO of Leechiu Property Consultants Inc.