Most Filipino consumers are hopeful that their financial situation will recover from the prolonged COVID-19 pandemic, and they are more optimistic than consumers in other emerging markets, based on the latest quarterly survey by multinational credit reporting firm TransUnion.

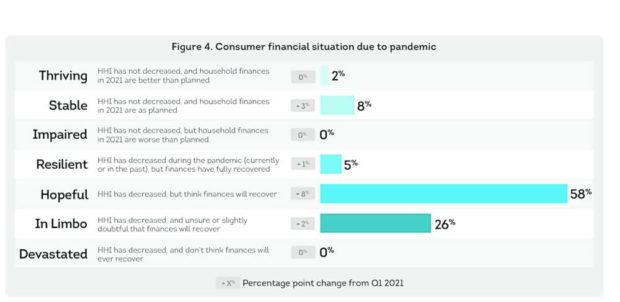

About 58 percent of Filipino respondents surveyed by TransUnion in the fourth quarter of 2021 said while their household income had declined, their finances would likely turn for the better. This number improved from 55 percent who had expressed optimism in the third quarter survey although it was still lower than the 74 percent “hopeful” respondents during the first quarter of 2021 survey.

“I think that’s very positive statistics,” TransUnion Philippines president and CEO Pia Arellano said in an interview with Inquirer. “I think it really just shows how resilient and how optimistic we Filipinos are, in the midst of adversity.”

Comparing this with similar surveys conducted by TransUnion in other key markets where it was operating for the same period, the percentage of “hopeful” consumers was much higher in the Philippines than in other emerging markets like Hong Kong (38 percent), South Africa (47 percent), Colombia (50 percent) and Brazil (53 percent).

Across the board, she noted that Filipinos were turning out to be more hopeful when compared with other jurisdictions covered by TransUnion.

Better than planned

About 26 percent of Filipino respondents said their household income had declined and they were doubtful that their finances would recover. Another 5 percent said their finances had already fully recovered from the decline in household income earlier in the pandemic.

Only 10 percent of the respondents said their household income had not declined during the pandemic. Some of them (2 percent) said their finances even turned out to be better than planned while for others (8 percent), finances were just in line with their plans.

The TransUnion Philippines Consumer Pulse Study surveyed 1,089 adults in the Philippines to discover findings on the financial impact of COVID-19 on consumers. The study was conducted from Nov. 1 to Nov. 8, 2021, with respondents ranging from different Philippine resident demographics from Gen Z (born 1995-2003), millennials (born 1980-1994), Gen X (born 1965-1979) and Baby Boomers (born 1944-1964).

The research showed that that fewer Filipino households (59 percent) reported a current decrease in income due to the pandemic compared with the previous quarter’s 64 percent. However, more than half (52 percent) of respondents surveyed said they had cut back on discretionary spending in the last three months.

The research also showed an increase in the restructuring of loans during the pandemic. TransUnion members with restructured loans increased to 33 percent in 2021 from 29 percent in the previous year. Before the pandemic (2019), the percentage was just at 27 percent.

Arellano noted that while the pandemic had adversely affected the younger demographics the most, it was interesting to note that it was the older and more financially stable generations – Gen X and Baby Boomers- who were keen on tightening their belt to boost savings. INQ