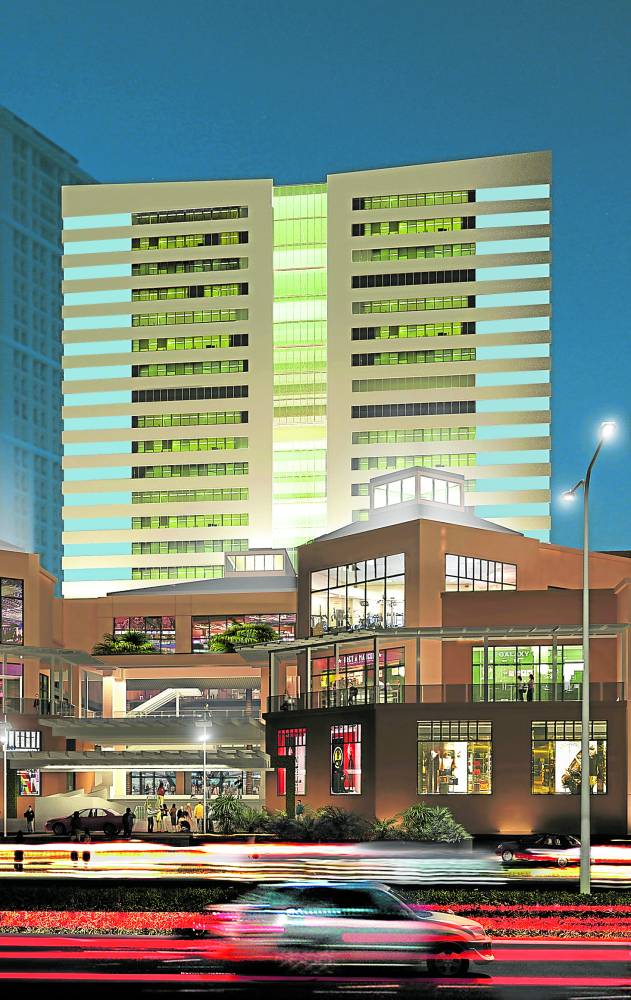

Ayala Land’s The 30th mall is one of the original assets in AREIT’s portfolio, which is set to grow further this year. —CONTRIBUTED PHOTO

Real estate investment trust (REIT) pioneer AREIT Inc. is set to acquire six additional office buildings in Cebu valued at about P11.26 billion from its sponsor, Ayala Land Inc. (ALI), outperforming its goal of doubling its portfolio within two years from its stock market debut.

AREIT unveiled a second property-for-share swap with ALI that will further boost to P64 billion its assets under management (AUM), marking a 213 percent increase since this REIT went public in August 2020.

In exchange for the assets, AREIT will issue 252.14 million new common shares to ALI, as validated by a third-party fairness opinion. This is seen to ultimately maintain ALI’s stake in AREIT at 60-67 percent, in line with the minimum public ownership of 33 percent required by the REIT regulations.

“We are focused on delivering our commitment to grow our assets, diversify our geographic and tenant base and create more shareholder value with increasing dividends and price appreciation. With this new asset infusion, we foresee AREIT’s dividend per share to increase, in addition to the recently concluded asset infusions last year,” AREIT president and CEO Carol Mills said in a press statement on Friday.

BPO-oriented buildings

The six buildings are eBloc Towers 1 to 4 located at the Cebu IT Park as well as ACC Tower and Tech Tower located at Ayala Center Cebu. The office buildings have a total gross leasable area of 124,299 square meters with an overall occupancy rate of 97 percent, leased by major business process outsourcing (BPO) firms.

The new batch of asset infusions are subject to the approval of AREIT shareholders at the annual meeting this April 21. It will also be subject to clearance by pertinent regulatory bodies.

ALI and AREIT are targeting to complete the new asset swap within the year.

Since its initial public offering (IPO), AREIT has delivered a sum of 92 percent total shareholder return from dividend yield and price appreciation.

Growing footprint

In terms of footprint, AREIT started with 153,000 square meters of property assets valued at P30 billion in 2020. By end-2021, this has expanded to 549,000 square meters, equivalent to P53 billion in AUM. With this P64-billion new asset infusion, AREIT will further scale up its portfolio to 673,000 square meters.

On Feb. 24, AREIT’s board approved the declaration of dividends of P0.47 per share for the fourth quarter of 2021, to be distributed on March 25 to stockholders on record as of March 11 this year.

AREIT’s dividend per share increased from P0.44 in the third quarter to P0.47 in the fourth quarter after concluding its first asset-share swap of P15 billion last October 2021.

AREIT’s full-year dividends from its 2021 income summed up to P1.77 per share, up by 34 percent from 2020 and 12 percent higher than its REIT plan projection during the IPO.

With this prospective infusion of Cebu assets, AREIT expects its dividend per share to increase further.