Electric vehicles getting up to speed with the mainstream

CHARGE AND DRIVE Installation of EV charging and transport system at Ayala Malls Circuit Makati. —Contributed photo

With the growing concern about climate change and rising energy costs, more and more companies in the Philippines are racing to put electric vehicles (EVs) on the road.

Compared to traditional cars that use internal combustion engines, EVs are marketed to be one of the more efficient tools toward carbon neutrality and over the long-term, an escape route from skyrocketing oil prices.

These sustainability imperatives have driven big local corporate names like Manila Electric Co. (Meralco) and the Ayala Group to actively participate in the switch. Even the government is starting to dangle incentives to EV manufacturers to fast-track its adaptation in the country.

Meralco, under its Green Mobility program, vowed to electrify its vehicle fleet. DHL Express Philippines also announced the deployment of a new fleet of EVs to handle shipment in key cities in Metro Manila.Meanwhile, the Ayala group, through industrial arm Integrated Micro-Electronics Inc., has been rolling more charging stations into the mainstream using Ayala shopping malls as springboard.

For ordinary Filipinos, however, the transition can be daunting. The reluctance primarily comes from the higher upfront costs when buying electric cars as well as the lack of charging infrastructure available.

Stephen Castillo, a financial analyst who works in Makati City, has been mulling to purchase an electric vehicle for himself but he has his reservations.

“At this point, I don’t think it’s a feasible investment,” he says in an interview with Inquirer. “I think it’s still too expensive and there are limited options. What if you need to buy spare parts? Where can you go for maintenance visits? I don’t think there are already places for that. If there are, I’m sure there are only a few.”

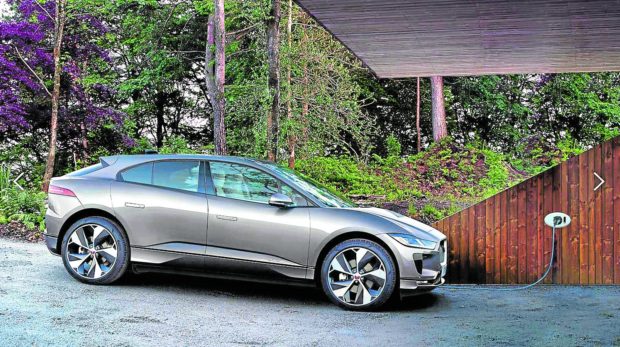

LUXURY EV Jaguar I-Pace —PHOTO FROM JAGUAR WEBSITE

Pricing issue

According to ZigWheels, an international brand of India-based auto portal CarDekho, there are 11 electric car brands that are available in the Philippines versus 58 for cars that use diesel or gasoline.

The cheapest unit available is Clima Mobility’s Genius EV priced at half a million while the most expensive is Porsche’s Taycan—the luxury brand’s take on an electric car currently being sold at P9 million.

Clima Mobility is not only the cheapest but the first Filipino-made electric car brand in the Philippines. Its first model, the Genius EV, is primarily designed to replace the government’s fleet of patrol cars and service vehicles. With just one single charge of the battery, it can travel up to 72 kilometers and can be fully charged in four to five hours.

“High upfront costs are regarded as the main barrier in acquiring EVs. The initial cost, however, does not provide the full picture,” says Raymond Ravelo, Meralco chief sustainability officer and eSakay president and CEO. “While EVs today are generally more expensive than internal combustion engine (ICE) vehicles on an upfront cost basis, over the life of the EVs, owners actually enjoy significant operating expense savings on a per kilometer basis, electric costs less than gasoline/diesel, and EVs are less costly to maintain than an ICE vehicle.”

He adds that some of the most pervasive reasons that are holding back car owners to switch to EVs are actually myths, including the lack of readily available charging stations, difficulty to maintain and poor performance compared to ICEs in terms of power.

According to Ravelo, over 90 percent of EV charging happens at home or in the office, as electric cars can be filled up anywhere where there is a socket. EVs also have fewer moving parts that can break down and need maintenance compared with ICEs—98 percent fewer moving parts on average, in fact. Lastly, Ravelo says EVs have better torque that translates to almost instantaneous power delivery, even when climbing steep slopes.

Playing the long game

It may take years before consumers are convinced to switch to cleaner forms of transport, but investors remain upbeat that as technologies improve and with more players entering the electric vehicle space, EVs will eventually dominate roads.

Tesla leads the pack, but several automotive companies also seem to believe that EV is the future of transportation as they continue to invest billions of dollars into developing their own lines of electric cars.

In Wall Street, the market capitalization of Tesla—which delivered nearly a million EVs in 2021—breached $1 trillion last year (now at $934 billion), while General Motors, valued at just $73 billion, is now investing heavily in the EV space.

In 2020, even as global car sales slumped by 16 percent due to the COVID-19 crisis, the EV industry was able to sell a record 3 million cars, up by 40 percent from 2019. In 2021, sales skyrocketed by 108 percent, according to the International Energy Agency (IAE). Some analysts predict this 2022 may just be the EV industry’s “breakout” year.

For the Chamber of Automotive Manufacturers of the Philippines Inc., significant fiscal incentives are needed to bring down the cost of EVs, including policies that will boost consumer demand.

The proposed Electric Vehicle Industry Development Act seeks to create a road map to grow the local EV market but has yet to be enacted. But under the government’s third tranche of tax reform, perks are already set to be given to industry players.

Still, several factors have yet to be threshed out. Batteries are the most essential part of an electric car, and the raw materials for its manufacturing come from mining—another activity that environmentalists frown upon.

There is also the expected surge in the demand for electricity that comes with the transition, that may slow down attempts of countries like the Philippines to turn its back from coal, the cheapest and most dominant power source.

Some analysts have also pointed out that the rise of electric cars may trigger another oil crisis, depending on how much oil demand it would displace over the years.

For the IAE, the electric car market will continue to be dynamic. Consumers, in turn, will benefit from having more options that can take them from point A to point B.

“As manufacturers sharpen their electrification strategies to compete for market share rather than considering EVs mostly as policy compliance vehicles, we will see more resources devoted to advertising, increasingly aggressive pricing and the development of ever more attractive electric models,” IEA says.

“Government policies remain the key driving force for global electric car markets, but their dynamism in 2021 also reflects a very active year on the part of the automotive industry,” it adds.