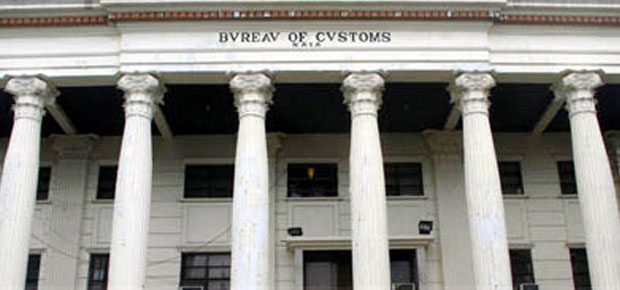

MANILA, Philippines—The Bureau of Customs (BOC) on Monday (Jan. 24) said it marked over 17 billion liters of tax-paid oil products and collected P165.96 billion in import duties and other taxes in 2021.

In a statement, the country’s second biggest tax-collection agency said that together with the Bureau of Internal Revenue (BIR), a total of 34.59 billion liters of diesel, gasoline and kerosene were injected with a chemical marker signifying payments of taxes amounting to P313.98 billion from September 2019 to December 2021, under the fuel marking program.

“In line with the program’s campaign to address fuel smuggling, the BOC and BIR apprehended a total of 86,888 liters of diesel and kerosene and seized two units of tank trucks carrying unmarked fuel with estimated value of P5.16 million and P7.4 million, respectively,” it said.

“Tanks of eight retail stations where these unmarked fuel were found were likewise sealed and recommended for filing of criminal cases,” it added.

Last week, the Department of Finance (DOF) said Finance Secretary Carlos Dominguez III allowed the BOC to turn over 6,357.8 liters of unmarked diesel fuel to the Philippine Coast Guard. In turn, the Coast Guard will use the oil to power its vessels during anti-smuggling operations.

During field testing last year, the BOC and the BIR seized these diesel oil in Pampanga as they did not contain the chemical marker.

The gas station in Arayat, Pampanga that owned the oil already abandoned its claims on the confiscated goods, hence forfeiting them in favor of the government.

But the DOF said the company would still face a criminal case for violation of fuel marking rules under the Tax Reform for Acceleration and Inclusion (TRAIN) Act.

The Customs Modernization and Tariff Act (CMTA), meanwhile, allows donation of products subjected to forfeiture proceedings, once approved by the finance secretary.

Fuel marking was aimed at curbing oil smuggling, which flourished in the past and deprived the government of foregone revenues estimated to have reached over half of actual duties and taxes generated by the BOC and the BIR yearly, or about P27-44 billion before the TRAIN law took effect in 2018.

Since April 2021, the BOC and the BIR conducted random field and confirmatory testing to ensure that all oil traders complied with fuel marking.

In 2020, the country’s two largest revenue agencies were granted deputization and police authority during field testing. If they find adulterated, diluted or unmarked petroleum, revenue officers can seize these products as well as arrest unscrupulous traders.

The BOC leads fuel marking in depots, tank trucks, vessels, warehouses, and other fuel-transporting vehicles. The BIR oversees testing in refineries, depots, gasoline stations, and other retail outlets.

TSB