Succession for family businesses made easy

As a result of the global pandemic, our world is changing in profound ways that we have never seen before. One of the most important success factors for the longevity of any business, but especially family businesses, is proper succession.

It is estimated that 80 percent of the businesses in the Philippines are family-owned or family-controlled. Research shows that often, 70 percent of wealthy families lose their wealth by the second generation, and 90 percent lose it by the third generation. Only one in three businesses makes it to the next generation. And only about 10 percent of family businesses pass to the grandchildren’s generation.

Why does this happen and how can we stop it?

Succession—the ugly truth

Even some of the world’s most famous business owners and CEOs have blind spots. Too often, we see only what we want to see but we do not face the facts. This is also the reason why every prominent business leader, from the CEO of Google to Bill Gates, has a coach.

Because of the blind spot, owners and top management often put successors in place they like but who are inadequate for the job.

A negative example: a family business in the Philippines where the potential successor just did not have the motivation to do the job. The owner could not accept this fact. Instead, he forced his child into the role, and the entire business suffered.

A positive example: a German multinational family business whose owner approached us. The first of the children clearly had talent and desire for the role. The second did not. Solution: the first became an active member of the board but had the foresight to know that he was not fit to lead the entire organization. So a non-family member became the CEO. The second child who had no desire or skills to take an active leadership position went instead into philanthropy and took over the corporate social responsibility (CSR) activities of the group. Today, the business makes revenues in excess of $20 billion and is still privately owned. That is proper succession planning in action.

Are your children fit to lead?

A business should be governed by meritocracy: people should be selected on the basis of their ability. If you own a family business, and your son or daughter is not fit to lead, they should not be running your businesses. At least, not yet!

How do you know if and when they are fit to lead? Ideally, an external committee of experts should determine if an individual has the ability to occupy a top spot in your organization—not you and not the people from within your organization.

I remember sitting down with the patriarch of a well-respected family business empire in the Philippines for our first meeting, which ran for several hours. In the end he told me: “Now I finally have someone who is telling me the bare facts.”

In the Philippines, you face an added challenge as an owner: Filipinos naturally respect wealth and higher authority more than in many other countries. It is always good to be respectful. But if that means no one tells you the truth when you are in power, you are in trouble.

Great executives are made, not born

That’s good news for you if you are a business owner. It means: if your children are not ready, they can become ready with the proper coaching.

Do not make the mistake of forcing any of them to fit into a role before they become the best people for the job. This is bad for many reasons.

The most obvious one is that the business suffers immediately. If any unqualified person is put into a top position, it directly impacts profit and growth negatively.

The family member in question loses respect with the other executives who talk behind his or her back that the only reason why they got the job is because they are family. This brings down the morale in the leadership and further decreases the overall productivity in the entire business.

We have seen many cases of unproductive family businesses where an additional ring of executives had been put in place around the incompetent family member just to shield him or her from losing face and from bringing down the business because of their inadequacy.

Remember this rule: the leadership’s productivity directly determines the productivity of all the ranks below. If employees see a family member in a top position who is coasting along, why should they, in turn, give their best every single day and outperform themselves and the competition?

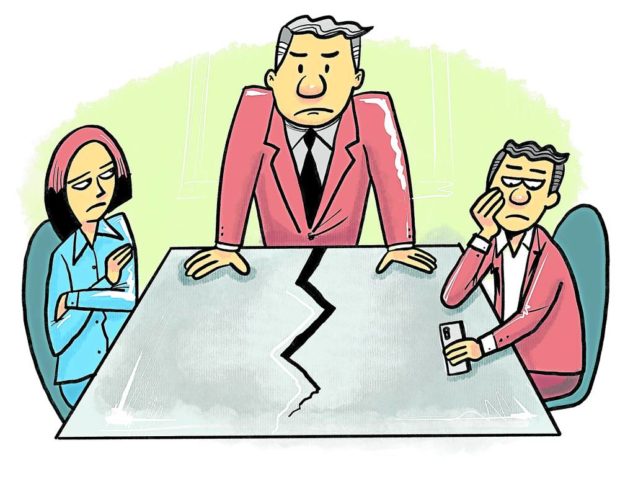

Sugarcoating— the boardroom disease

In the Philippines there is another challenge that stands in the way of proper succession: “boardroom sugarcoating.” Top leaders in the organization are afraid to speak the truth because they are afraid of conflict, of weakening their own position or of exposing the weaknesses and mistakes of others.

If you go for a checkup, do you want the doctor to tell you the truth or lie? Of course, you want to know the truth because only then can you cure your illness. It is the same in any business: If you do not face the facts in all brutal honesty, you cannot win.

When a family approached us with the request to boost the profits in their group of companies, we found out that in one of their businesses, the CEO had assembled a board of “yes men” who would not oppose anything he brought up. The results? The company missed many important opportunities, profits stagnated and top talent left because they could not freely express their opinion.

Another example from one of our clients in the Philippines, a family business conglomerate: the board had so much respect for the CEO, who was also the owner, that no board member ever told him the truth. Constant sugarcoating. Everybody talked behind the owner’s back. There were no open and honest conversations about failures, who was to blame for them and what needed to be done.

When the owner’s family asked us to make their business future-proof, we first had to have one-on-one conversations with all board members and the top management so they could finally open up and tell us the real facts in confidence.

Practical solutions

If you are a business owner or CEO, and you need to make the tough decision on whom to put into a top position, or who might even replace you, here are the practical steps you can take.

Face the facts. Because we all have blind spots, ask an external expert to support you in evaluating if the person is right for the job.

If not, get them the proper coaching they need.

To avoid “boardroom sugarcoating,” here are two solutions that should run in parallel: first, you need to encourage a culture of more open communication. Second, while your culture is changing, have external advisors guide you who will give you a view of the bare facts and reality as it is, not as you want to hear it.

Despite the natural respect people have for higher authority, encourage open but uncomfortable conversations, motivate people to voice their opinion freely and even disagree with you. And constantly reassure them they will not be reprimanded for this.

See you next week!

* * *

Tom Oliver, “the mentor of the giants” (Fortune), is the chairman of The Tom Oliver Group, the trusted advisor to many of the world’s most influential family businesses, high potential medium-sized enterprises, market leaders and global conglomerates.