The benchmark Philippine Stock Exchange index (PSEi) fell over 3 percent last week as risk aversion roared back over worries the fast-spreading Omicron variant might derail the economy’s recovery.

BDO Unibank Inc. chief strategist Jonathan Ravelas said the close at 7,055.19 “continues to reflect the market’s nervous stance.”

“Expect the market to [move] within the 7,000-7,200 levels in the near-term,” he said in a note to investors over the weekend.

Ravelas also warned that a sustained fall below 6,950 for the PSEi would see bearish investors target the 6,500 to 6,800 levels next.

April Lynn Tan, vice president for corporate strategy at COL Financial Group Inc., said investors remained cautious amid the trickle of updates on Omicron.

“We are now flat compared to end-2020, so I don’t think the market is really pricing in a recovery,” she said.

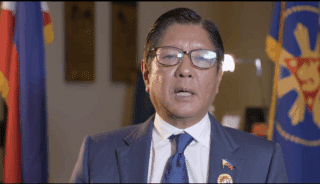

Astro del Castillo, managing director of First Grade Finance Inc., said the uncertainty surrounding the spread of the new variant will continue to weigh on market sentiments.

“It seems like the Philippines is just bracing for it. The question is really when it arrives,” he said.

Del Castillo expects the PSEi to consolidate within the current level, although technical indicators are pointing to near-term relief.

“Technically, the markets are due for a bounce if you look at the charts,” he said.

Investors would also be positioning ahead of the release of November inflation data on Dec. 7, he said.