The next era of Digital Banking: A winning case

It has always been this way – banks have to keep up with the newest technology in order to reinforce their position on the market. The latest, health-driven digital revolution has touched every sector of the global economy, including corporate banking. Business customers expect systems tailored to meet their demanding needs. The new era of digital banking is right here and now. To keep up, banks have to be open to flexible solutions, and the one implemented by TMBThanachart Bank together with Comarch has already won the prestigious Asian Banker Award.

Update needed

The banking sector is constantly exposed to increasing operational costs and cyber threats due to a higher than ever demand for financing. During this critical time, banks around the world require solid measures to increase sales and expand. They must show true awareness and flexibility in their day-to-day decisions. If platforms that they work on are no longer compliant with the changing landscape of their sector, they will inevitably fall behind with their offer, and, by extension, lose customers.

Comarch Corporate Banking – One-stop shop for corporations and SMEs

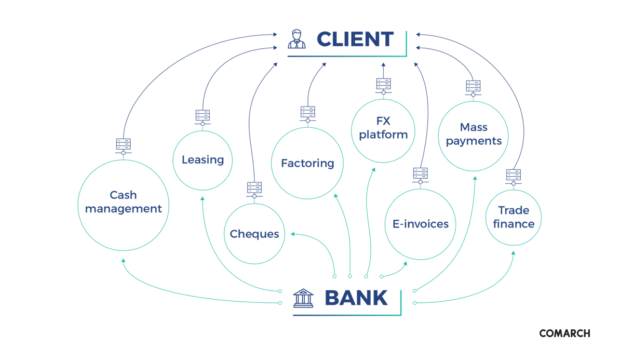

Enter Comarch Corporate Banking (CCB) – a solution whose mission is to streamline and optimize banking processes by allowing customers to access a number of products and functionalities within a single platform, while keeping cyber criminals at bay through advanced security measures. The system’s implementation at TMBThanachart Bank triumphed at this year’s The Asian Banker Awards under the brand TTB Business ONE. CCB was designed to reduce traditional branch banking costs and fraud risks, while providing smooth user experience. The system is shielded with advanced security mechanisms and approval workflows.

Comarch team with The Asian Banker Award

The new standard

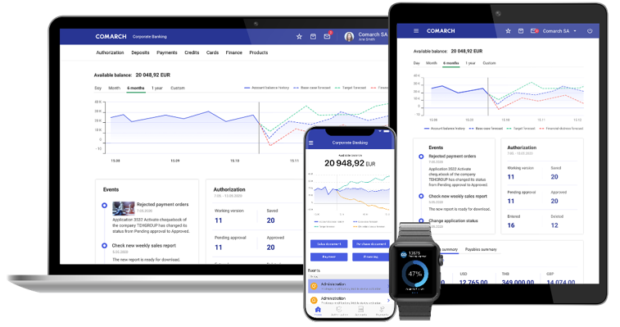

The banking industry is rapidly modernizing and new digital standards are coming. One such standard is creating an ecosystem that makes all data, services and offers accessible through one platform with a single login. The challenge given to Comarch was to build an easy-to-navigate portal, complex enough to encompass a plethora of diverse information retrieved from multiple backend systems. Modern corporate customers expect the possibility to operate via various channels at the same time — mobile, desktop, ERP connector, and more. With an omnichannel approach, catering to individual customer needs is much easier.

Comarch Corporate Banking – online platform in any channel you need

Roman Bobrowski, a CCB Project Manager at Comarch, recounts that “the bank was following the idea: the customer is the focus, and expected the system to be simple and convenient to use.” Comarch’s answer was to create a transparent network of separate yet seamlessly connected modules. The division into intertwined sections simplifies the whole platform and at the same time allows seamless navigation through every service or product available. This was made possible by following the newest technological trends.

Radical change

At the extreme pace of development that we witness today, small modifications of the UX or adding a bonus functionality to the system might not be enough. If a platform’s software engine is obsolete, no cosmetic changes will fix that. To put this into context: at first, Comarch’s role at TTB was to simply improve the existing system, which had been in constant development for the past 10 years. After some consideration, though, the project expanded and TMB-Thanachart asked Comarch to deploy a replacement solution that would include all the bank’s existing data.

“It was necessary to adapt many CCB product processes to those already existing in the bank”, says Jakub Cieślewicz, a CCB Project Manager at Comarch. “Developing the solution required full involvement of teams on both sides.” As a result of effective cooperation, the completed platform launched after less than 9 months of adaptation, implementation, and deployment. The project’s creators overcame such obstacles as the COVID-19 pandemic outbreak and TMB’s merger with Thanachart, which additionally limited the amount of time available for the whole process.

By implementing a platform as innovative as Comarch Corporate Banking, TMBThanachart Bank proved to be a financial institution that has digital transformation under control. TTB’s new corporate digital banking system is a cutting-edge platform with open architecture, easily integrable with fintechs and additional banking solutions. To learn more about Comarch’s award-winning platform, visit the CCB website: Corporate Banking services and financial IT solutions (comarch.com). Further information about the implementation process at TTB may be found on the business case page: Comarch at ttb business case.

ADVT.