Real estate sector sees more speed bumps ahead

It may take the Philippine property sector two to three years to return to prepandemic vibrancy, based on a survey by global commercial real estate consulting firm Cushman & Wakefield.

Based on the second edition of Cushman & Wakefield’s COVID-19 real estate developer sentiment survey, property firms had become less optimistic in the short-term as they expected the market to remain vulnerable amid weak sentiment and lower supply and demand, as well as declining property values and rental rates.

The latest survey sought to gauge the changes in real estate developers’ viewpoint on the recovery prospects of the economy and the real estate sector as uncertainties remained more than a year since the pandemic erupted, when the first issue of the survey was released.

Respondents expressed optimism in the next 12 months, with 31 percent of them expecting the real estate market to show early signs of recovery—with both supply and demand strengthening, alongside moderate growth in property values and rental rates. Nonetheless, respondents saw the market remaining vulnerable in the next 12 months.

Over the long-term—or a period of two to three years —62 percent anticipated the real estate market to build up momentum. During that timeframe, 31 percent believed that property values and rental rates would revert to prepandemic level while the other 31 percent projected moderate growth in property values and rental rates.

Demand prospects for the industrial sub-sector were seen promising, with 83 percent of industrial developers expecting an increase in new lease volume, while 50 percent were seeing an increase in sales in the next 12 months.

But prospects for retail and hotel sub-sectors remained sluggish, with 75 percent of hotel and retail developers expecting that the decline in occupancy would persist in the next 12 months.

Within the office sub-sector, 54 percent of office developers were expecting a decline in new lease volume.

Meanwhile, the majority of residential developers (38 percent) were projecting a decline in sales in the next 12 months.

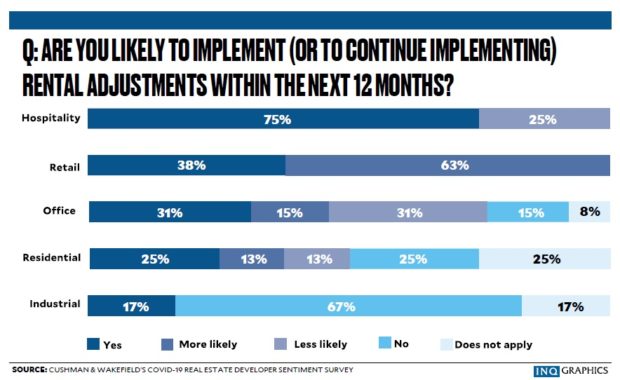

In the hospitality space, 75 percent of hotel developers were inclined to implement rental adjustments in the next 12 months, while 63 percent of shopping mall developers said they would more likely do the same. While 31 percent of office developers projected rental adjustments in the next 12 months, another 31 percent believed that they were less likely to do so.

Sixty-seven percent of industrial developers believed that rental adjustments would not be necessary within the next 12 months.

“Market recovery will be uneven across the real estate sub-sectors, as the respective demand sources have been affected by varying degrees. The COVID-19 pandemic has disrupted the various sources and growth of demand for the different real estate sub-sectors, influenced by a similar uneven economic recovery across the global market,” said Claro Cordero, director and head of research, consulting and advisory services at Cushman & Wakefield.

Cordero suggested that the success of recent real estate investment trust (REIT) listings indicated the strong potential of this new asset class to contribute to the sector’s growth.

“Given the kind of market environment and challenges posed by the COVID-19 pandemic, real estate developers should offer well-diversified assets across different sub-sectors and locations—i.e., those within key commercial business districts in Metro Manila and other asset classes and growth areas outside Metro Manila. A well-diversified REIT vehicle provides downside protection and creates value for its unit holders,” he said. INQ