UnionBank big winner at The Asian Banker Financial Technology Innovation Awards 2021

Union Bank of the Philippines (UnionBank) won the most number of awards among all the participating institutions, raking in four international-scale awards at The Asian Banker Financial Technology Innovation Awards 2021 that took place last August 12 via Zoom, further proving the Bank’s status as one of the leading financial technology innovators in the Asian region. The prestigious awards program covers nominations from Asia Pacific, Middle East, and Africa.

UnionBank won “Best Data Management Initiative” for its comprehensive data management strategy that utilizes a big data ecosystem and a centralized platform to enable effective use of artificial intelligence (AI), machine learning, anti-money laundering reporting, and data governance applications. This provides a 360-degree and real-time monitoring of customer transactions and has resulted in a 25-percent reduction in development time and significant operational cost savings.

“I would like to personally offer this award to our clients and partners who have been the pillar and compass for why we made this initiative,” said UnionBank Chief Information Officer Dennis Omila. “Likewise, I’d like to dedicate the award also to the wonderful and amazing UnionBank family. Many thanks to all of you!”

The Bank also won “Best Mobile Banking Technology Implementation” for its business banking app designed for small and medium enterprises (SMEs), which offers innovative features including fully digital account opening, easier access to loans, and digital check deposits, among others. The app was downloaded 17,000 times on mobile and 23,000 via web, and 90 percent of transactions were done through mobile. It resulted in increased usage of digital loans and online check deposits for the Bank and has improved the overall experience for SMEs.

“We thank all our customers for trusting us. This award motivates us and helps us do more, do better, and do greater, to follow the customer experience and provide the best journeys to them,” said UnionBank’s SME Segment Head Jaypee Soliman.

UnionBank also won “Best Process Automation Implementation” for pioneering the digital account opening feature for businesses and for digitizing multiple know-your-customer processes in the country, which improved customer experience and scalability of acquisition. This resulted in reductions of 70 percent in manual processes and 90 percent in turn-around time, significant savings in operational and manpower costs, and the digital onboarding of over 10,000 businesses in just 10 months.

“I’m receiving this award on behalf of a team of Filipinos and UnionBankers who are determined to make a difference in our society and our business clients. On behalf of the team, we would like to thank Asian Banker for this award,” said Senior Product Manager for UnionBank Miguel Dans.

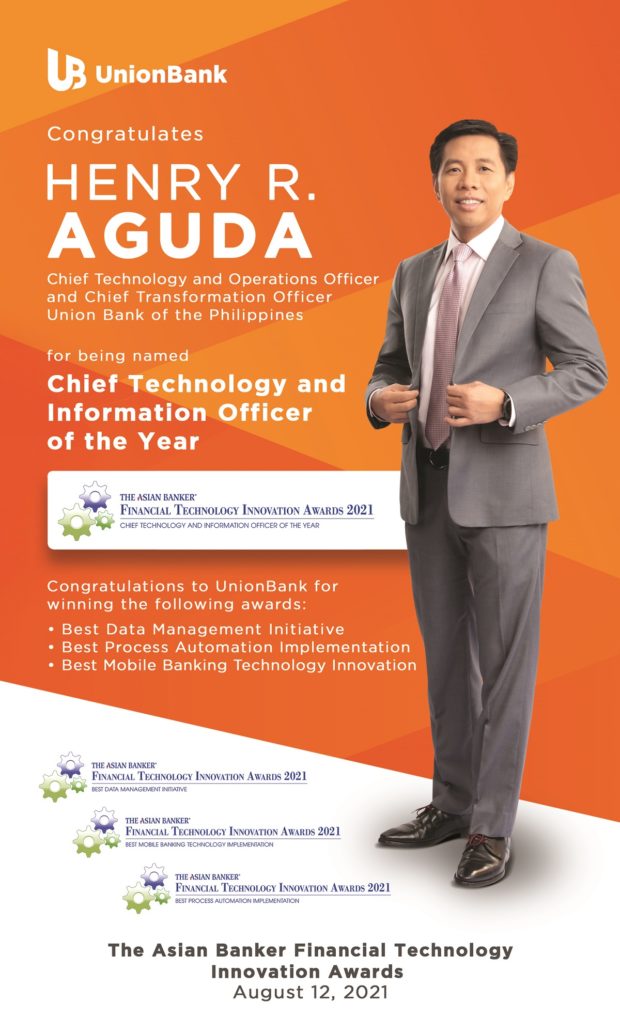

Meanwhile, honored with “The Chief Information and Technology Officer of the Year” award, the highest accolade given every year under the Financial Technology and Innovation Awards Programme, is Senior Executive Vice President Henry R. Aguda, UnionBank Chief Technology and Operations Officer, and Chief Transformation Officer.

David Gyori, CEO of Banking Reports London, and Advisor of the Financial Technology Awards Programme at The Asian Banker, read the award citation.

“Every year, we recognize one leader who represents the best of the skills, professionalism, instinct for technology transformation and innovation in financial services in the industry, both in the market that the person serves and globally. The awardee is an icon whom the rest of us can aspire to become because he represents all of us.”

The award is given to honour the significant achievements of the recipient over his or her entire career in inspiring change in their respective institution, industry, as well as their commitment and achievement in the development of their staff.

This special recognition has over the years been conferred on the most accomplished leaders in the financial services industry in the Asia Pacific, Middle East, and Africa regions.

Winners of this award undergo an exhaustive evaluation process involving a shortlist of outstanding candidates and confirmed by an international council of advisors. It takes stock of the achievements in technology innovation, leadership qualities, and resilience of executives to successfully respond to and overcome adversities and crisis during the period under review.

During this unprecedented year, the council of advisors gave importance to the ability to lead their institutions with vision, verve, and fortitude during periods of transformation and unprecedented challenges.

The council also considered the ability to build long-term and sustainable banking franchise, and how this translated to their institutions’ leadership in their respective market and region through robust performance, innovative products and services, enhanced customer relationships and an agile workforce.

“This year’s winner has shown broad experience and transformative leadership in building the bank as one of the top banks in the Philippines and Asia Pacific. The bank is one of the largest and most profitable business segments in the group, backed by exceptional financial performance and a clear business strategy,” said Gyori.

In his acceptance speech, Aguda thanked The Asian Banker and the esteemed international panel of advisors and congratulated all the awardees. “I am overwhelmed with gratitude, but everything that was accomplished, it cannot be done by one person. It was done by a great team, such that this award is proudly dedicated to all UnionBankers who, with immense courage and unyielding conviction, worked day in and day out to build a more financially inclusive digital future for customers and for the public we serve.”

The Asian Banker Financial Technology Innovation Awards Programme provides the undisputed benchmark of the technology innovation in an increasingly fierce marketplace. The Asian Banker awards are viewed by executives as the most prestigious, comprehensive, and transparent recognition programme of its kind in the world today. The programme is designed to identify emerging best practices in technology implementations and innovations as well as to identify implementation goals and challenges from which other financial institutions and technology companies can learn.

ADVT